Last week First Majestic Silver Corp (TSX: FR) announced its second quarter production results. The company announced that it produced 7.7 million silver equivalent ounces, comprised of 2.775 million ounces of silver and 59,391 ounces of gold. Production is up -15% and 28% year over year, respectively, which equates to total production is up 20% on a year-over-year basis.

The company said that during the quarter, they saw record production at their Santa Elena mine, which produced 2.2 million silver equivalent ounces. They note that they are expecting even higher production rates from Ermitaño during the second half of the year to the tune of 8.7 to 9.2 million silver equivalent ounces.

Lastly, the company said it is revising its second half and full year 2022 guidance, “to reflect changes due to increased production from the Ermitaño mine and improved milling efficiencies at Santa Elena, improved production tonnages and grades at Jerritt Canyon as well as incorporating changes to metal price assumptions and production impacts from the first half of 2022.” The company is now expecting total 2022 production to come in at 32.5 to 34.6 million silver equivalent ounces, slightly down from the 32.2 to 35.8 million range.

There are currently six analysts covering First Majestic Silver with an average 12-month price target of C$14.31, or an upside of 70%. Out of the six analysts, two analysts have buy ratings, while the other four analysts have hold ratings on the stock. The street high price target sits at C$22, which represents an upside of 162%.

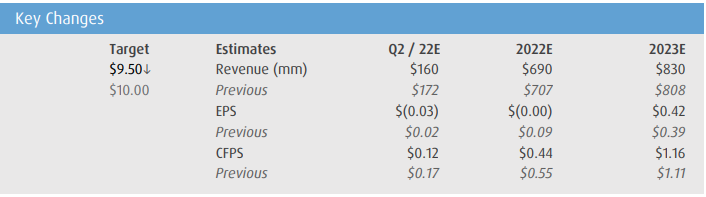

In BMO Capital Markets’ note on the results, they reiterate their market perform rating while cutting their 12-month price target from C$10 to C$9.50, saying the price target change comes as they update their estimates to reflect the new guidance from management.

On the results, BMO says that both silver and gold production came up short, with BMO expecting silver production to be 3.18 million ounces and gold production to come in at 62,800 ounces.

On a more bullish note, Santa Elena and Encantada saw better than expected results. With ore production increasing 14% at Santa Elena, gold production at the mine beat BMO’s estimate of 15,700 ounces. However, silver production did come up short as their estimate was 553,000 ounces versus the 384,953 ounces produced.

First Majestic’s Encantada mine produced 864,000 ounces of silver, 34% better than BMO’s forecasted 645,000 ounces. BMO writes, “The production beat was due to ore sourced from the Cuerpo 660 and La Prieta areas, which had an average grade of 141g/t (BMO 110g/t).”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.