On January 17th, First Quantum Minerals (TSX: FM) announced its 2021 preliminary production and 2022 to 2024 guidance. For the fourth quarter, the company produced 201,000 tonnes of copper, 74,000 ounces of gold, and 3,000 tonnes of nickel. This brings the yearly production to 816,000 tonnes of copper, 312,000 ounces of gold, and 17,000 tonnes of nickel.

For the 3 year guidance, the company expects to produce 810,000 to 880,000 tonnes of copper, 285,000 to 310,000 ounces of gold, and 25,000 to 30,000 tonnes of nickel for the full year 2022. This will grow to 850,000 to 910,000 tonnes of copper, 295,000 to 320,000 ounces of gold, and 40,000 to 50,000 tonnes of nickel in 2024.

First Quantum Minerals currently has 24 analysts covering the stock with an average 12-month price target of C$35.82, or a 4% upside to the current stock price. Out of the 24 analysts, 5 have strong buy ratings, 15 have buys and 4 have hold ratings. The street high sits at C$45 or a 32% upside to the current stock price, while the lowest price target comes in at C$23.

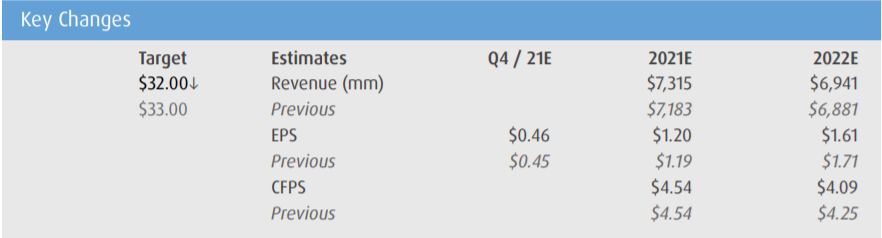

In BMO Capital Markets’ note, they reiterate their market perform rating but lowered their 12-month price target to C$32 from C$33 on slightly lower estimates.

For the production results, BMO says that they generally came in line with their expectations. Copper production came in 1,000 tonnes lower than BMO’s estimate while gold production came in 4,000 ounces higher than their estimate.

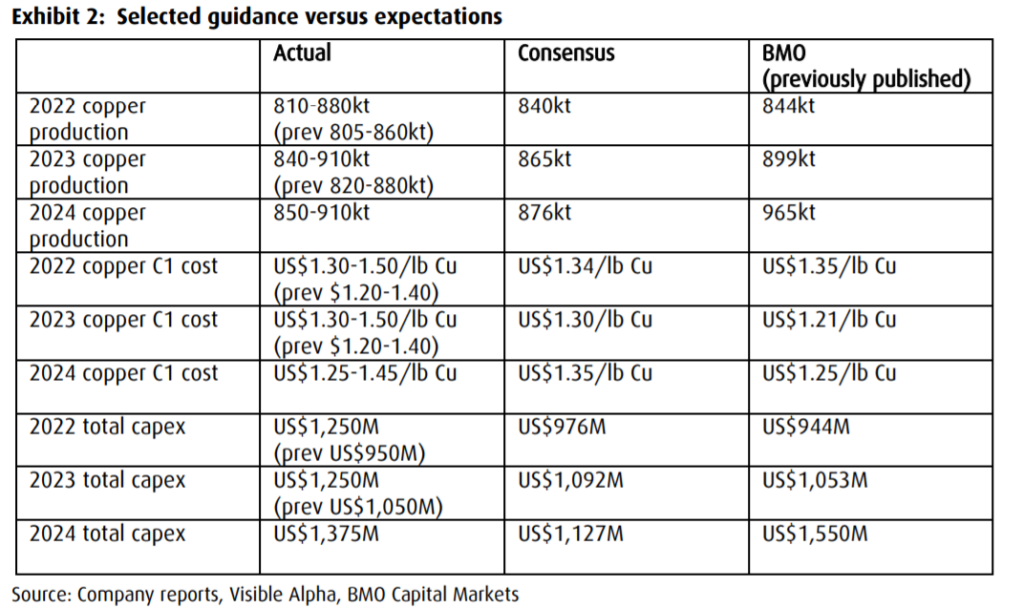

As for the companies three-year guidance, it also came generally in line with their estimates. You can see their estimates below.

Lastly, BMO says that the company’s new dividend framework, in-which 15% of available cash flows are allocated to shareholder returns or a minimum annual dividend of C$0.10 per share. They believe that 2022’s dividend will be C$0.42 per share or a roughly 1.7% yield.

Below you can see BMO’s updated fourth quarter, full year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.