On May 14, Fisker Inc. (NYSE: FSR) announced it has partnered with Taiwan-based Hon Hai Technology Group — better known as Foxconn, the main assembler of Apple’s iPhones — to develop and manufacture Project PEAR (Personal Electric Automotive Revolution). According to Fisker, Project PEAR will be a new “breakthrough electric vehicle.” The PEAR will be Fisker’s second production model, after the Ocean SUV.

The first PEARs will be manufactured in the United States; other sites may be chosen to supplement that, particularly if the Fisker/Hon Hai venture were to approach projected PEAR unit sales volumes of 250,000 per year. Production of the PEAR, which is contemplated to carry a base sticker price of less than US$30,000, is scheduled to begin in 4Q 2023.

Released Quarterly Earnings on May 17

Fisker released its earnings for the quarter ended March 2021 on May 17. Key aspects of the release are as follows:

Reservations for Fisker’s Ocean SUV now total more than 16,000 units, up from 14,600 as of March 31, 2021. This increase reflects two significant fleet deals signed in the first six weeks of the second quarter. A reservation costs US$250 and is fully refundable. Fisker will unveil a protype of the vehicle at the Los Angeles Auto Show in November and plans to commence commercial production in 4Q 2022.

The Fisker SUV is expected to have a sales price range of US$37,499 to US$69,900 depending on the options selected in the vehicle. This range is before the effect of any electric vehicle (EV) credits in the United States (currently US$7,500 per vehicle).

As of March 31, 2021, Fisker’s cash balance was US$985 million, down slightly from US$991 million on December 31, 2020. The company has negligible debt. Fisker’s cash position equals about 30% of its stock market capitalization.

Fisker’s operating expenses are projected to range from US$240-US$270 million in 2021, up US$30 million from prior estimates. The company states that the entirety of the increase is due to Project PEAR, which was not reflected in prior guidance. Management estimates that 2021 capital spending will continue to range from US$210 to US$240 million.

Fisker’s 1Q 2021 operating cash flow shortfall and 1Q 2021 capital expenditures totaled US$28.8 million and US$65.7 million, respectively.

| (in thousands of US $, except for shares outstanding) | Quarter Ended March 31, 2021 | Quarter Ended December 31, 2020 |

| Operating Income | ($33,098) | ($31,306) |

| Operating Cash Flow | ($28,810) | ($30,064) |

| Cash – Period End | $985,422 | $991,158 |

| Debt – Period End | $2,448 | $2,567 |

| Shares Outstanding (Millions) | 293.6 | 277.3 |

Relative Performance of Fisker Stock

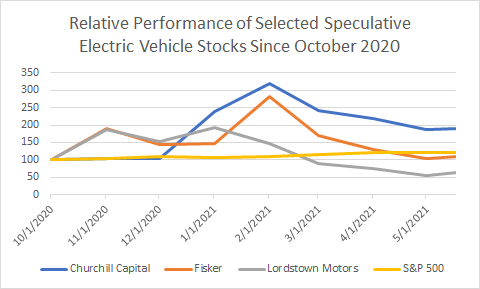

In the figure below, the relative performance of Fisker’s stock since October 2020 is shown versus that of Churchill Capital Corp IV (NYSE: CCIV), the SPAC partner of Lucid Motors; Lordstown Motors Corp. (NASDAQ: RIDE), another popular (and currently struggling) EV player; and the S&P 500. The S&P 500 and each of the stock prices are presented in index form where 100 is the uniform starting point.

Fisker shares are up 11% since October 2020 and has nearly matched the S&P 500’s performance. Churchill Capital has shown the strongest returns by far, and Lordstown Motors the weakest.

While a start-up, Fisker is well capitalized and is led by a well-known and well-respected auto designer. Its Ocean SUV model has received a significant number of reservations, and Fisker has agreed to develop and manufacture the attractively priced PEAR vehicle with a well-known and trusted partner (Foxconn). If Fisker can begin production of the Ocean at around the time frame it has announced (fall of 2022) and realize its target gross margins, the company could generate significant cash flow in a few years.

Fisker Inc. last traded on the NYSE at US$11.22.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.