A federal grand jury in the District of Maryland produced an indictment that was unsealed Tuesday, charging two men with participating in conspiracies to defraud Cytodyn Inc. (OTCQB: CYDY) investors. The defendants allegedly “deceived investors” about the timeline and status of the firm’s regulatory submissions to the US Food and Drug Administration (FDA) for the clinical trials of its drug candidate leronlimab.

“According to court documents, Nader Pourhassan, 59, of Lake Oswego, Oregon, and Kazem Kazempour, 69, of Potomac, Maryland, allegedly engaged in a conspiracy to defraud investors through false and misleading representations and material omissions relating to Cytodyn’s development of leronlimab,” the Justice Department statement read.

At the time of the alleged fraud, Pourhassan was the firm’s president and CEO while Kazempour is the co-founder, president, and CEO of Amarex Clinical Research–the firm that handled the clinical trials and was Cytodyn’s agent to the FDA. Kazempour was also a member of Cytodyn’s Disclosure Committee, which was in charge of examining and approving the company’s periodic filings with the the Securities and Exchange Commission.

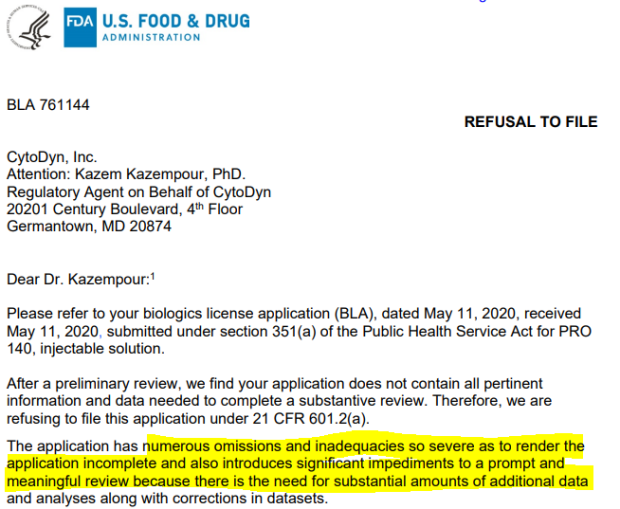

Specifically, the indictment alleges that Pourhassan and Kazempour misrepresented the timelines by which the biotech firms would complete and submit Cytodyn’s biologics license application (BLA) for leronlimab’s treatment of HIV to the FDA. The former Cytodyn chief reportedly directed Kazempour and Amarex to submit the BLA even if it was incomplete so they can announced such feat to investors.

“Pourhassan then allegedly sold millions of dollars’ worth of CytoDyn stock based on material non-public information, including information about the fact that the BLA was, in truth and in fact, incomplete when submitted,” the statement added.

The two defendants also allegedly made materially false and misleading representations on the firm’s progress on developing leronlimab as a potential treatment for COVID-19. Pourhassan allegedly knew that the clinical studies failed to achieve the results necessary to obtain any form of FDA approval for use as a treatment for the pandemic disease.

Part of the SEC charges against the former $CYDY CEO include how the company misled the market on its COVID drug by failing to report that it missed its primary and secondary endpoints and instead used selective subgroup analysis to falsely claim positive results. pic.twitter.com/vDtjQTytQF

— Nate Anderson (@ClarityToast) December 20, 2022

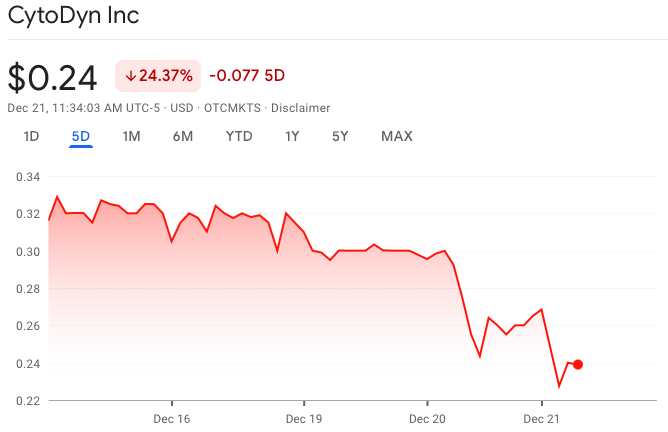

Shares fell as much as nearly 24% following the news. Year-to-date, the firm’s valuation has fallen around 77%.

Online blog Buyers Strike disclosed of a copy of an email sent in April 2020 seemingly showing Pourhassan directing Amarex to submit the BLA “even if we are short in no matter what portion.” The direction seems to be stemming from the succession of declines in share price.

A month later after the email was sent, the firm put out a statement clarifying their BLA, saying it “will not be considered completed until the company submits to the FDA clinical datasets required to address FDA comments.” The notes by the regulatory agency centered on the firm’s exclusivity claim, inadequate method of verification for sterility testing, and typographical errors in the prescribing information.

The timeline misrepresentation also seems to be a similar pattern for the firm. In an earnings call in July 2020, CFO Michael Mulholland touted that the firm would get its Nasdaq listing application finalized by the third week of August. The firm is yet to be listed to the exchange.

— CoronaTurd (@CoronaTurd) December 17, 2022

In December of that year, Mulholland sold around $5 million of his shares in the company.

Let’s see how Michael Mulholland here, who sold $5M in $CYDY shares while knowing his statements were false, enjoys his holidays as his pal NaDDer is ratting him out, hoping for a lighter sentence. https://t.co/N3QOi2OuQP pic.twitter.com/xQ3Xneyv1k

— MiMedx = Fraud (@MimedxGroupie) December 20, 2022

The indictment follows the development back in March where Cytodyn reported that its trials for leronlimab will be put on partial hold for its HIV program and full hold on its COVID-19 program. While the firm did not disclose then the reason behind the pause, it said it is “committed to FDA compliance.”

Leronlimab is a humanized monoclonal antibody targeted against a specific receptor in a human’s T-cell to trigger an immune system response. The FDA previously granted the firm a fast track designation to use the candidate drug as a possible treatment for HIV-related diseases and metastatic cancer.

The drug is also being studied by the biotech firm as an antibody treatment for critically ill COVID-19 patients.

Pourhassan and Kazempour face one count of conspiracy to commit securities fraud and wire fraud, three counts of securities fraud, and two charges of wire fraud in connection with the HIV BLA scheme. Pourhassan is also charged with another crime of securities fraud, another count of wire fraud relating to the COVID-19 conspiracy, and three counts of insider trading while Kazempour is also accused with giving false statements to federal law enforcement agents.

CytoDyn last traded at $0.24 on the OTCQB.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.