Trump Media & Technology Group is leaning on the US Securities and Exchange Commission to wrap up its investigation on the pending SPAC merger deal with Digital World Acquisition Corp (Nasdaq: DWAC).

Former US President Donald Trump’s media firm said that while it will “continue cooperating with all stakeholders in connection with its planned merger,” it hopes that “the SEC staff will expeditiously conclude its review free from political interference.”

The deal, first announced in October 2021, is facing regulatory hurdles: the SEC is scrutinizing the merger, particularly the SPAC sponsor ARC Capital and the possible dealings between DWAC and TMTG before the merger. FINRA also sent the blank check firm “preliminary fact-find inquiries” related to trading in the company that occurred prior to the transaction with TMTG being announced.

Fast forward to almost one year later, the merger deal is yet to receive approvals from the regulators. DWAC announced recently that it is proposing to extend the business combination deadline until September 8, 2023; however, sources familiar with the matter say that the SPAC isn’t likely to get the shareholders’ support on this.

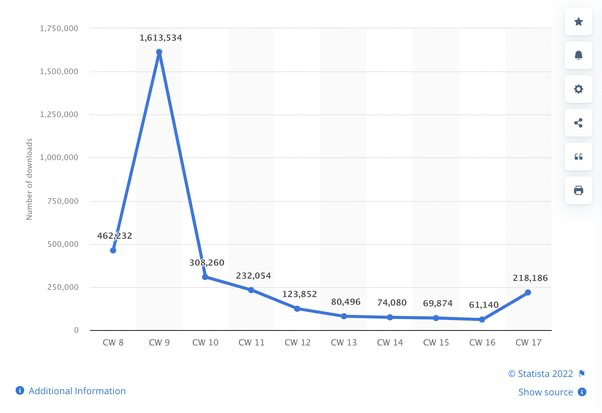

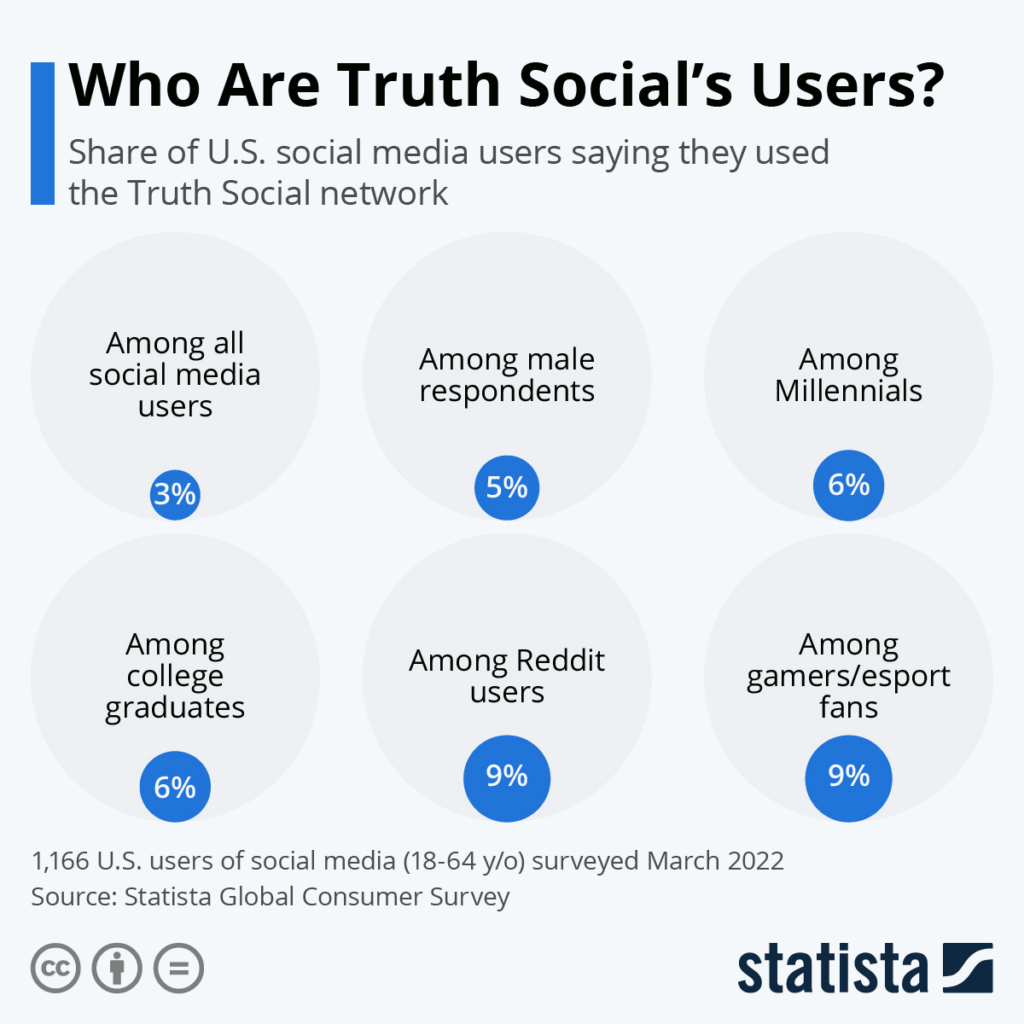

TMTG, which manages the social networking site Truth Social, touted the platform’s success.

“Truth Social is continuing to grow rapidly, driven by extraordinary user engagement and the recent launch of ads on the platform,” Trump Media & Technology Group told Just the News.

Trump himself posted on Truth Social that the platform is doing so well, he might not need to take it public for additional funds.

“SEC trying to hurt company doing financing (SPAC). Who knows? In any event, I don’t need financing, “I’m really rich!” Private company anyone???” Trump said.

Based on Forbes’s data, Truth Social has around 2.0 million monthly active users.

DWAC last traded at US$23.07 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.