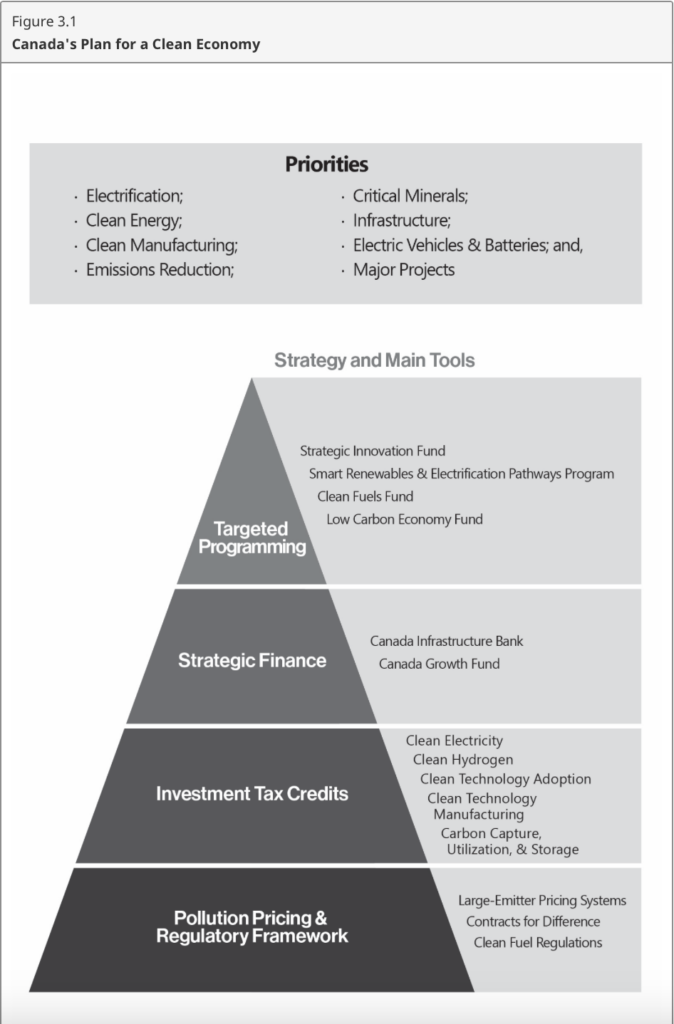

Nothing says green more than the recently released federal budget, which clearly prioritizes the push for a “clean economy” with all the investment tax credits it is showering on the green energy sector.

Labeled the “made-in-Canada plan,” the budget–chiefly assembled by Finance Minister Chrystia Freeland–hedges big bets on the green economy to create “an anchor regime of clear and predictable investment tax credits.”

“Building on the foundation the government has been laying since 2015, Budget 2023 delivers a series of major investments to ensure Canada’s clean economy can deliver prosperity, middle class jobs, and more vibrant communities across Canada,” the Department of Finance said in its budget.

15% refundable tax credit for clean electricity

At the top of the clean economy plan for investment tax credits is the clean electricity technologies and proponents, under the Clean Electricity Investment Tax Credit. The budget proposes a 15% refundable tax credit for eligible clean electricity investments. These include:

- Non-emitting electricity generation systems

- wind

- concentrated solar and solar photovoltaic

- hydro (including large-scale), wave, and tidal

- nuclear (including large-scale and small modular reactors)

The Clean Electricity Investment Tax Credit will cost $6.3 billion over four years beginning in 2024-25, with an extra $19.4 billion from 2028-29 through 2034-35.

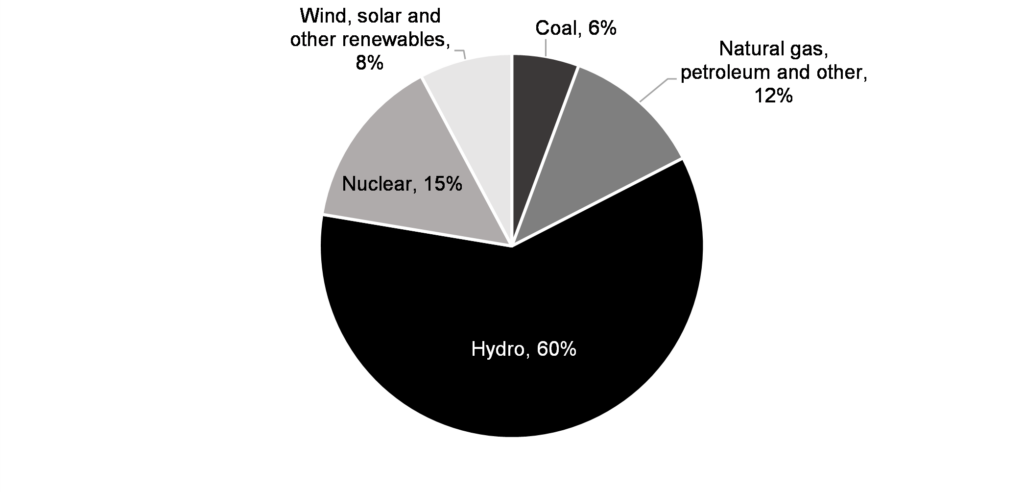

According to its own tally, the government says roughly 83% of Canada’s electricity comes from non-emitting sources–with hydro sources taking the lion share.

Proponents of nuclear energy lauded the inclusion of the sector in eligibility for tax credits.

“Today’s budget represents a significant change in how the Federal government is approaching nuclear power in Canada,” said John Gorman, President and CEO of the Canadian Nuclear Association. “No longer are we simply ‘on the table’ as Prime Minister Trudeau put it one year ago; nuclear is now recognized as a fundamental and necessary component of Canada’s low carbon energy system.”

CANADIAN BUDGET ADDS BIG NUCLEAR SUPPORT

— Mark Nelson (@energybants) March 29, 2023

Hard to keep up with how fast nuclear energy is crashing what was a renewables-only financing party.

This is big: Canada's a leading supplier of uranium and one of the top nuclear electricity producers, with its own vibrant reactor tech. https://t.co/uwJrgEuJKH

The fresh 15% investment tax credit follows the 30% tax credit provided for non-emitting electricity generation technologies specified by Freeland’s 2022 federal budget.

The investment tax credit is also applicable to firms that are into abated natural gas-fired electricity generation, stationary electricity storage systems that do not use fossil fuels in operation, and equipment for the transmission of electricity between provinces and territories.

Both new projects and refurbishment of existing facilities will be part of the credit. Taxable and non-taxable institutions such as Crown corporations and publicly owned utilities, Indigenous community-owned corporations, and pension funds would all be eligible.

The 2023 budget also plans to earmark in Canada Infrastructure Bank investments at least $10 billion each in Clean Power and Green Infrastructure areas, while it proposes to provide $3 billion over 13 years to Natural Resources Canada.

30% refundable tax credit for critical minerals

Taking a big share of federal spending in the budget proposal is the Clean Technology Manufacturing Investment Tax Credit, aimed at Canadian companies that are manufacturing or processing clean technologies and their precursors.

Budget 2023 eyes a refundable tax credit equal to 30% of the cost of investments in new machinery and equipment used to manufacture or process key clean technologies, and extract, process, or recycle key critical minerals. These include:

- Extraction, processing, or recycling of critical minerals essential for clean technology supply chains, specifically:

- lithium,

- cobalt,

- nickel,

- graphite,

- copper, and

- rare earth elements;

- Manufacturing of renewable or nuclear energy equipment;

- Processing or recycling of nuclear fuels and heavy water;

- Manufacturing of grid-scale electrical energy storage equipment;

- Manufacturing of zero-emission vehicles; and,

- Manufacturing or processing of certain upstream components and materials for the above activities, such as cathode materials and batteries used in electric vehicles.

The investment tax credit will cost $4.5 billion over five years, beginning in 2023-24, with an additional $6.6 billion from 2028-29 to 2034-35. This proposed tax credit complements the Clean Technology Investment Tax Credit announced in Budget 2022 to provide support to Canadian companies adopting clean technologies.

In the 2022 cycle of the budget, the government committed $3.8 billion for Canada’s Critical Minerals Strategy to provide foundational support to Canada’s mining sector.

The budget also cited the recent announcement that automaker Volkswagen’s subsidiary, PowerCo, will build its first overseas ‘gigafactory’ in St. Thomas, Ontario.

The department said that projected costs of this agreement have been fully accounted for in Budget 2023. However, both the federal government and Volkswagen have been mum about the sum paid to the carmaker in terms of public money to support the construction of its battery plant.

According to Greig Mordue, a former Canadian Toyota executive now studying automotive manufacturing policy at McMaster University, Volkswagen obtained between $1 and $10 billion in federal and provincial funding to establish its EV battery plant in Ontario.

“The price of entry is at least a billion dollars,” he said, referring to the sum granted to Stellantis last year by the Ontario and federal governments to develop its $5 billion EV battery plant in Windsor, Ontario.

Up to 40% refundable tax credit for clean hydrogen

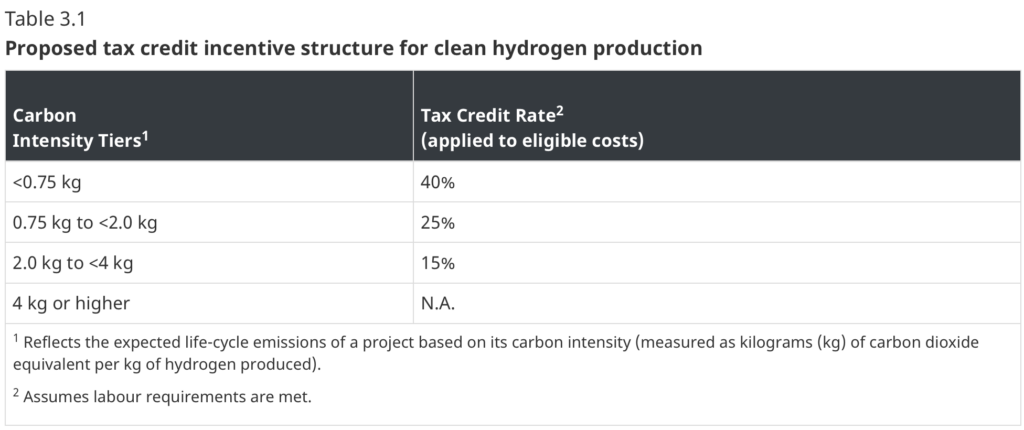

Budget 2023 also announced the details of the Clean Hydrogen Investment Tax Credit, incentivizing investments made in clean hydrogen production.

The proposed Clean Hydrogen Investment Tax Credit will cost $5.6 billion over five years, starting in 2023-24. The Clean Hydrogen Investment Tax Credit is anticipated to cost an additional $12.1 billion between 2028-29 and 2034-35.

The levels of tax credits will range from 15% to 40% of qualified project expenses, with the projects that produce the cleanest hydrogen receiving the most support. It also proposes to provide a 15% tax credit for the equipment required to convert hydrogen into ammonia.

Information for this briefing was found via CBC, Financial Times, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.