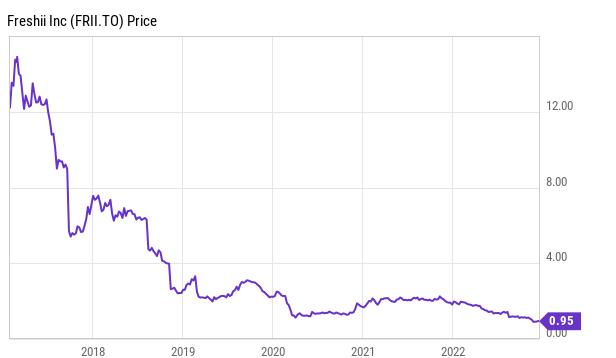

This morning Freshii Inc. (TSX: FRII) announced they have entered into an agreement to be purchased by Foodtastic Inc. for approximately $74.4M in cash or approximately $2.30 per share for all the shares issued.

The takeout represents a 142% premium to the closing price on Friday.

On a trailing 12-month basis, the company had generated $39.5M in top-line revenue, producing a $7.5M operating loss, and also losing $2.9M in operating cash flow. The company was founded in 2005, and today operates 331 stores with 125 more in the pipeline based on recent guidance. Their third quarter proved to be challenging with same-store sales down 11%, and overall revenue down 7% on the quarter.

Foodtastic is a Quebec-based franchisor of multiple restaurant brands including Pita Pit, Milestones, Shoeless Joes, La Belle & La Boeuf, amongst many others. Headquartered in Montreal, they made headlines in small-cap circles in 2021 when they purchased Second Cup from Aegis Brands for approximately $14M. At the time of purchase CEO, Peter Mammas told Yahoo Finance he planned to expand the coffee brand to 300 locations by 2025, from the existing store count of 190. One would assume he has similar plans for Freshii.

In a company news release, CEO of Freshii, Daniel Haroun said “We believe that this transaction recognizes the tremendous value of the Freshii brand. For almost 20 years, our incredibly passionate franchisee and other business partners and team members have been delivering on the mission of making healthy food accessible and building a leading Canadian health food brand.”

Shares of Freshii last traded at 95c on the TSX.

Information for this briefing was found via Sedar and Seekign Alpha. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.