After the brouhaha brought about by Elon Musk’s new $8 per month subscription to Twitter’s (NYSE: TWTR) blue check, the new CEO is reportedly considering adding a paywall to the social media platform.

According to The Verge’s Platformer, Musk has been discovered to have explored placing the entire site behind a paywall.

Paywalls are usual gate tools for pay-for-content websites, most notably news outfits. While social media platforms have tiered pricing for additional features, paywalls are not common, if not present, in them.

Twitter is the worst!

— Elon Musk (@elonmusk) November 8, 2022

But also the best.

The rumored move is one of the new “chief Twit’s” latest efforts in revamping the platform to “maximize revenue potential.” Earlier on, Twitter laid off around 3,700 employees in one of tech world’s massive job cuts.

READ: Elon Musk’s Massive 3,700-Job Layoffs To Face Lawsuit From Fired Twitter Employees

The pay-for-blue-check scheme is also another stride to increase revenue streams for the platform. Musk responded to writer Stephen King’s grievances with the rumoured $20 per month blue check subscription fee, clarifying that the service would only cost $8 each month, which amounts to $96 annually.

The billionaire is ramping up revenue streams for Twitter after his acquisition of the platform, for which he has said more than once that he overpaid. Most recently, Musk had to sell 19.5 million Tesla shares over the last three market days, generating cumulative gross proceeds of $3.9 billion.

In financing the $44-billion takeover, Musk paid slightly more than $27 billion of his own cash in the acquisition.

Around $5.2 billion comes from bank loans including from Morgan Stanley, Bank of America, Japanese banks Mitsubishi UFJ Financial Group and Mizuho, Barclays and the French banks Societe Generale and BNP Paribas. Morgan Stanley alone has contributed $3.5 billion.

These loans are guaranteed by Twitter, and it is the firm, not Musk himself, which will carry the financial burden to pay them back.

But the other part of the financing involves $5.2 billion from investment organizations and other significant entities, including $1 billion from Larry Ellison, co-founder of software company Oracle.

Other members of this consortium include foreign investors like Prince Alwaleed bin Talal of Saudi Arabia, Chinese native-run Binance Holdings Ltd., and Qatar’s sovereign wealth fund. The presence of these non-American investors is causing a stir in the White House for fear of foreign intervention and surveillance.

READ: Foreign Investors In Elon Musk’s Twitter Buyout Can Potentially Access User Data

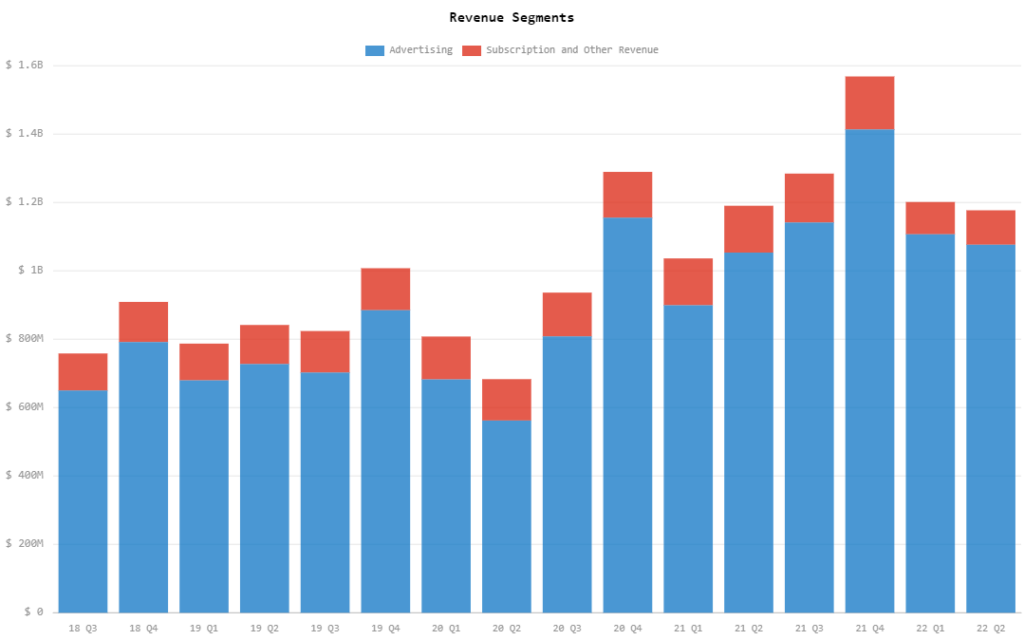

In its Q2 2022 financials, Twitter recorded $1.18 billion in quarterly revenue, a decline from both Q1 2022’s $1.20 billion and Q2 2021’s $1.19 billion. The firm also ended the quarter with a net loss of $270.0 million, a huge drop from the net income of $513.3 million in the previous quarter and $65.6 million from the previous year.

The reason for the decline? Twitter’s new owner: Musk.

“[The year-on-year decrease reflected] advertising industry headwinds associated with the macroenvironment as well as uncertainty related to the pending acquisition of Twitter by an affiliate of Elon Musk,” the company said in its statement.

Of the revenue mix, advertising revenue contributed the lion’s share with $1.08 billion. Musk has said multiple times that the platform shouldn’t just depend on its revenue stream from advertisers and that there is potential to create other revenue streams.

We need to pay the bills somehow! Twitter cannot rely entirely on advertisers. How about $8?

— Elon Musk (@elonmusk) November 1, 2022

And oh, Musk plans to pay for his blue check mark, too. So, there’s that.

💯

— Elon Musk (@elonmusk) November 8, 2022

Information for this briefing was found via The Verge and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.