Details on the recent bankruptcy filing of Sam Bankman-Fried’s FTX Group continue to come out, and quite frankly, the more details that are released, the more confusing the entire situation appears to get.

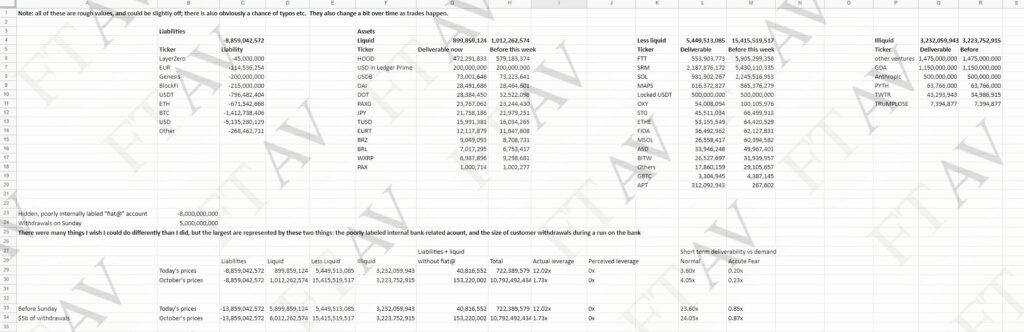

The Financial Times late Saturday released a copy of the FTX balance sheet, which is said to be current as of Thursday, November 10. While crude in nature, the spreadsheet effectively outlines the firms current assets in terms of liquidity, as well as current liabilities.

When it comes to assets, the company has broken down its holdings into three categories – liquid, less liquid, and illiquid. Each category is then further split into two categories, deliverable, and before this week. In terms of deliverable assets, they amount to $899.9 million, $5,449.5 million, and $3,232.1 million, respectively, for a combined total of $9,581.1 million.

Before this week, those values are meanwhile pegged at $1,012.3 million, $15,415.5 million, and $3,223.8 million, respectively, for a combined total of $19,651.5 million. This implies that within the last week, FTX has seen its assets decline by over $10.0 billion – which jives with recent reports that the company has seen significant outflows within the last seven days, which ultimately culminated in a Chapter 11 filing.

Liabilities meanwhile were simply reported as being $8,859.0 million, which was not further broken down into categories.

READ: The Rise and Fall of FTX Explained

There is, however, at least one glaring problem with the report. The first listed item under liquid assets is shares in Robinhood Markets (NASDAQ: HOOD) – which is not owned by FTX, or any of the firms included within the bankruptcy filing.

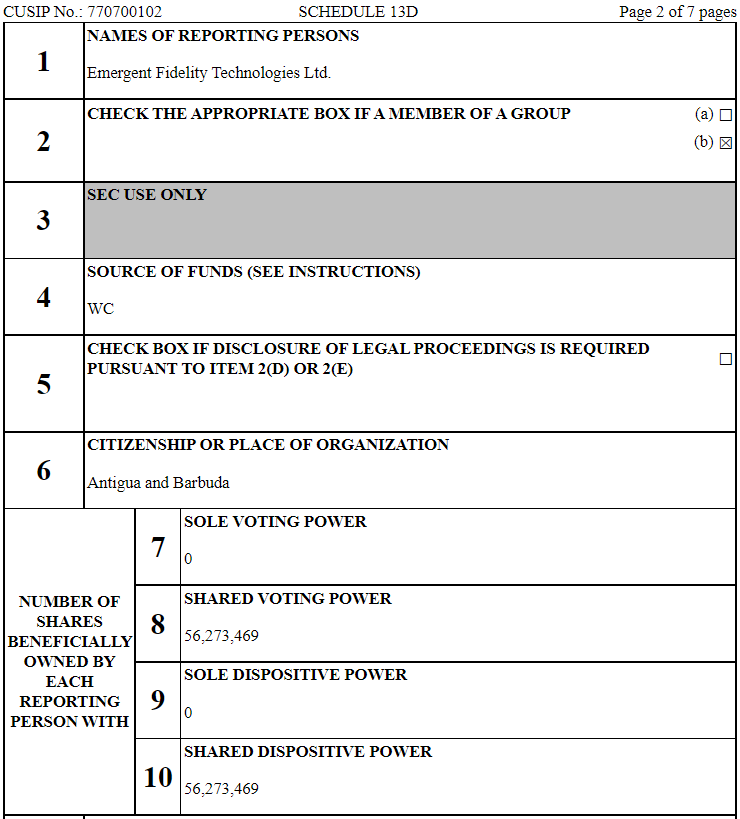

Bankman-Fried, whom is presumed to have assembled the balance sheet, is believed to have blurred the lines between personal and corporate ownership, whether intentional or not. The Robinhood shares in question are believed to be the shares purchased by Antigua and Barbuda-based Emergent Fidelity Technologies Ltd, as filed within a Schedule 13D with the Securities and Exchange Commission on May 2.

The investment by SBF at the time lead to several rumors of a potential acquisition of Robinhood by FTX, although the latter had indicated at the time that they were never in active talks to acquire Robinhood.

READ: Can FTX Even Afford To Buy Robinhood?

The entity, for which SBF was the sole director and majority owner as of the date of the filing, purchased a total of 56.3 million shares of Robinhood, equating to a 7.6% stake in the company, for a total figure of $648.3 million. No amendments have been made to the filing in the time since.

Within the filing, the only reference to FTX is that Bankman-Fried is co-founder of FTX Trading as well as of West Realm Shires Services Inc, whom is operating as FTX US.

Emergent Fidelity Technologies was not one of the 134 corporations listed as part of the bankruptcy filing made by the FTX Group – meaning that the shares themselves are still held by Bankman-Fried via beneficial ownership, and not by FTX or Alameda, as earlier reports suggested.

With a “liquid” valuation of $472.3 million on FTX’s balance sheet, Robinhood represents 52.4% of all assets within the category – and roughly 4.9% of the firms collective assets. Given that it can be easily proven that this asset doesn’t fall under the control of FTX, it leads to an even bigger question – how much of the balance sheet is real at all?

That question, of course, is pre- “hack” as well.

As for Robinhood, CEO Vlad Tenev said on Twitter this week that they have no direct exposure to the bankruptcy filing by FTX. The filing is said to have positively impacted the company however, with two days this week reportedly being the “biggest days of crypto inflows ever” for the trading platform.

Whether the event remains positive or not for Robinhood will ultimately depend on how and when SBF elects to dispose of the 56.3 million shares he currently holds.

Information for this briefing was found via the Financial Times, Edgar, Reuters, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.