“I fucked up and should have done better” – that’s the tweet just sent out from Sam Bankman-Fried, founder of FTX. In case you haven’t been watching financial media over the last week, the second-largest crypto exchange in the world has gone insolvent right before our eyes. This will have ripple effects throughout the crypto world and will likely force regulators to finally take real action.

The first we heard of FTX’s liquidity issues was on November 6th, when the founder of the exchange, Sam Bankman-Fried tweeted that they didn’t exist.

Filthy, fuddy rumors being spread by their enemies! Nothing to worry about.

Less than forty-eight hours later, the exchange had done an emergency “deal” with rival exchange Binance that aimed to keep it solvent while making it a wholly owned subsidiary of Binance for terms that they were going to work out later. Couldn’t have been much, right?

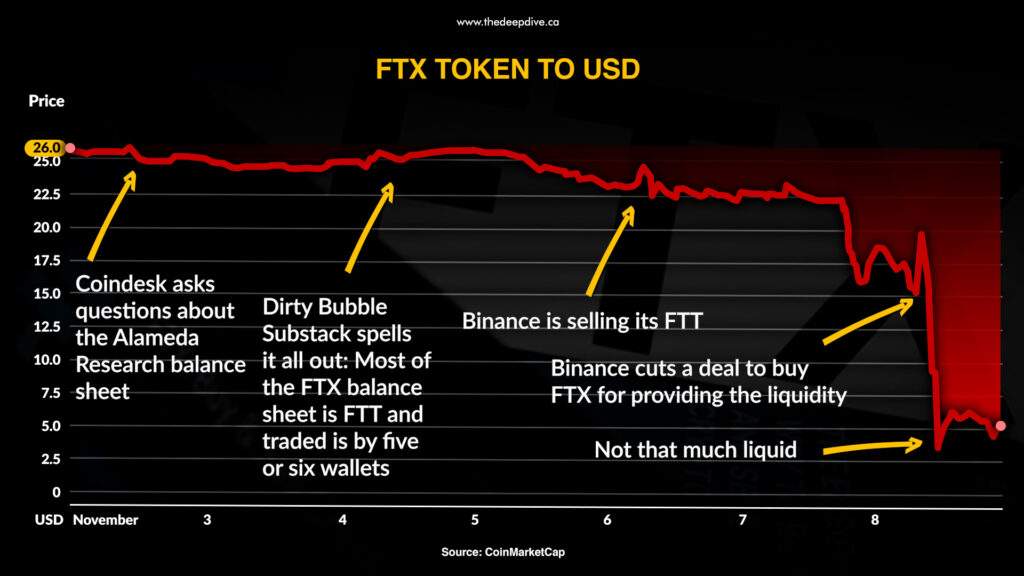

But if we roll back a few days, for people who were paying attention, on November 2nd, Coindesk was reporting that it had obtained a leaked balance sheet from FTX’s sister hedge fund and primary shareholder Alameda Research, and that the balance sheet was held together with FTT, the in-house coin that FTX uses to make its exchange run.

That Coindesk report turned out to be the FUD domino that started this slide, but it really got going when the Dirty Bubble substack posted about it November 4th.

It was a simple, compelling illustration of FTX as an impossible, self-propelled machine.

The real winners here might be the serial wise-asses on crypto twitter, who are still teeing off on The Bank Man getting Fried MEMEs.

But Binance, the number 1 crypto-exchange by volume, who nearly absorbed its main competitors’ entire user-base for virtually nothing, did alright, too.

Binance had already been operating for two years in 2019, when Bankman-Fried started FTX to take advantage of the growing interest in cryptocurrency markets. Back then, bitcoin was trading for around $10,000, and hedge fund trader types saw incredible potential in the emerging decentralized finance space. It was bound to occur to pretty much everyone, in short order, that nothing was stopping them from minting their very own tokens.

All those tokens were going to have to trade someplace, so exchanges were in a position to take the great financial decentralization, and centralize it. Around themselves.

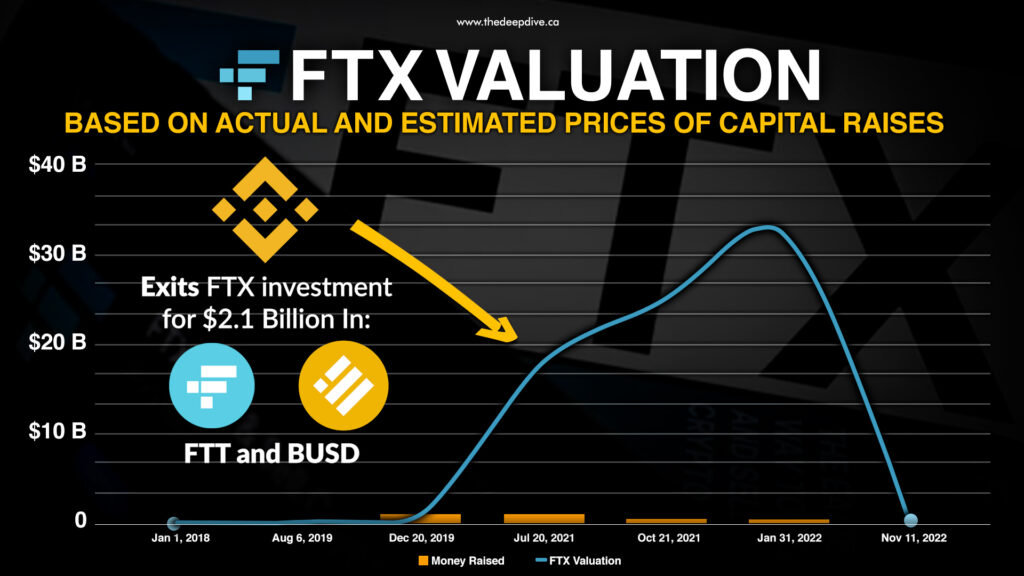

2020 and 2021 were banner years for crypto, and both exchanges’ volumes exploded. FTX did another capital raise in 2020 that valued it at eighteen billion dollars. Binance sold its equity interest in FTX in 2021, right around the time FTX moved its headquarters to the Bahamas.

When Binance exited its FTX position in July of 2021, their take was $2.1 billion worth of a combination of their own Binance stablecoin and the FTT coin. So it begs the question: if the proceeds of your investment exit are paid in a combination of your own in-house crypto, and crypto printed by the company you’re exiting… is it really an exit?

FTX immediately did a $900M equity raise that valued it at $18B, then did another $400M equity raise in January of 2022, which valued it at $32B. And celebrated with a Superbowl Ad.

"Don't be like Larry" pic.twitter.com/YgDxJNCOaN

— SmallCapSteve (@smallcapsteve) November 9, 2022

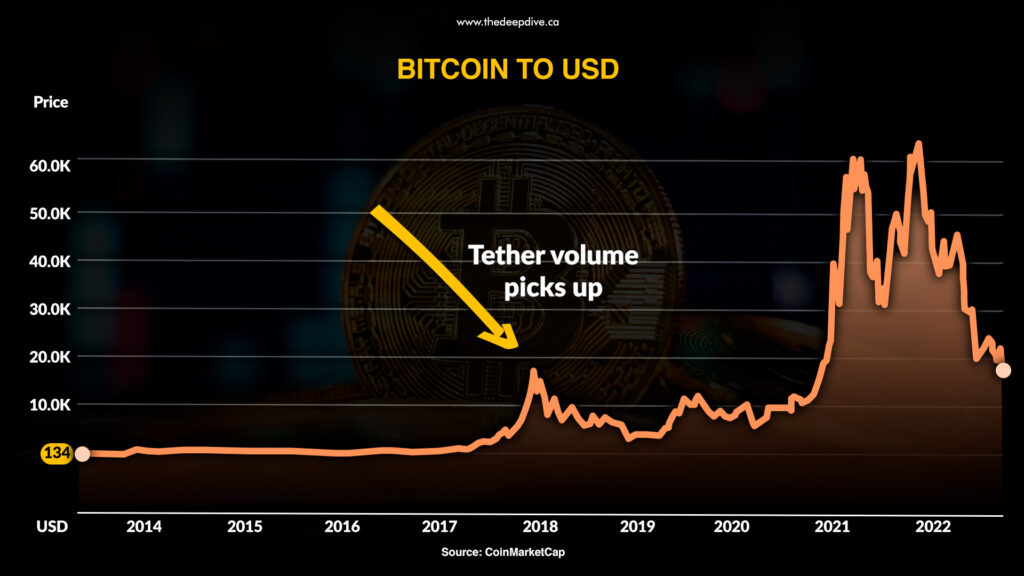

Hedge Fund Hustler types only moved on to running exchanges for coins that anyone could invent after they figured out what could be done with tokens they invented themselves. The first questionable crypto banking token was probably Tether; a token built to facilitate easy entry into the crypto world for any dollars whose owners were willing to accept the risk of owning the unaudited stablecoin. Tether is pegged to the US dollar, so a speculator can buy 10,000 Tether for US$10,000, then trade back the Tether on an exchange, when they want to cash out because for each Tether in circulation, Tether Inc. is supposed to have one US dollar in its reserves.

But the British Virgin Island – incorporated Tether Inc. has never had its reserve base audited. If it were over-minting Tether in 2018 to juice the volume, then using it to buy bitcoin, and sending the bitcoin market on an all-time tear, nobody would ever know the difference.

If over-minted Tether was used to buy bitcoin, and that buying took BTC from $8,000 to $25,000, Tether Inc.’s newly valuable bitcoin position would be more than enough to back the over-minted Tether coins with US dollars.

Today, Tether is the stablecoin. It does more volume than bitcoin. The over-minting that put it where it is, real or imagined, was an inspiration to today’s masters-of-the-crypto-universe.

FTX made leveraged tokens for traders who wanted to get kinky about it. You know the types. Derivative freaks. Short sellers. Straddle crafters who get off on inverse puts. Double leverage. Triple leverage! Sick, nasty, freaky stuff that normally takes a margin loan, and explicit permission from the head of the compliance department. FTX just built the trades out of versions of its in-house token, and let those freaks go WILD!

Think bitcoin is going up? Want triple the exposure? There’s a coin for that.

Think bitcoin is going down? Want triple the exposure? There’s a coin for that, too.

FTX made a whole universe of kinky custom derivatives tokens.

Each exchange-traded coin held a mix of FTX “perpetual futures” contracts: futures contracts written on the coin that settle the long positions with the short positions every hour according to a formula that keeps the price stable, and the contracts open.

It sounds confusing because it is confusing. It’s the type of thing that’s bound to run into liquidity issues eventually, but FTX had an ace in the hole: its own, native, FTX token: FTT. Users who held FTT got significant commission discounts. That kept the token’s price up, and gave FTX a position to borrow against when it needed to make settlement.

By 2021, FTX was among the world’s top crypto exchanges in volume, consistently right behind Binance. Then SBF got aggressive. FTX took its talents to South Beach and bought the naming rights to FTX stadium, home of the Miami Heat. They bought endorsements from noted Shark Tank and Jeopardy Contestant Kevin O’Leary, and from the one and only Tom Brady!

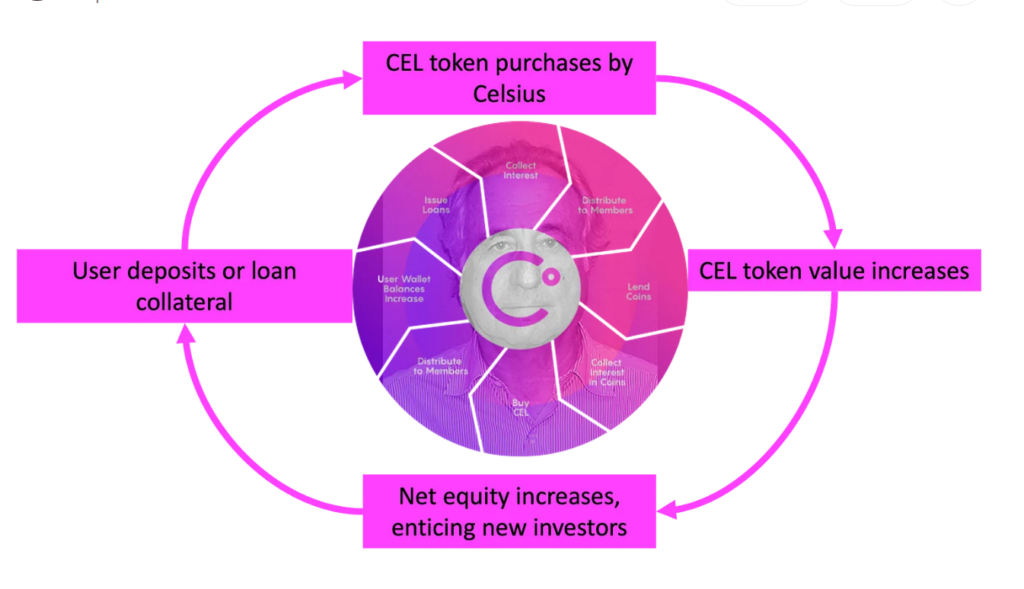

By June of 2022, the market was sophisticated enough to pick up on the self-minting snowjob. Off-brand stablecoin Terra, and its supporting coin Luna were the first to fall apart. That sent the market stumbling and set up the big swan-dive for Celsius.

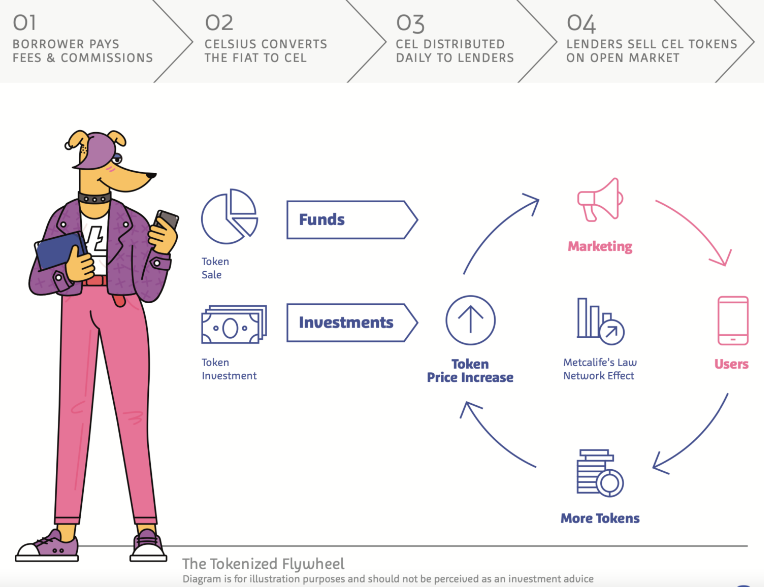

Celsius was more of a consumer banking entity than a crypto exchange. It gained users and their deposits by paying high-interest rates on coins that it printed itself. They then used deposits and borrowings to support the price of their self-minted token until there was so much of their own token on their own balance sheet that nobody could take it seriously anymore. Least of all its lenders.

The sudden bankruptcy of Celsius didn’t slow FTX down. It remained among the top crypto exchanges in terms of volume and emerged as the leading bidder for the assets of bankrupt crypto brokerage Voyager. FTX looked like an aggressive, international operator cleaning up on the carnage and getting ready for the next run until CoinDesk and the Dirty Bubble substack lit the fuse on a FUD BOMB!

FTX came apart all at once after that and on Tuesday, for an instant, at least in terms of a non-binding LOI, Chengpeng Zhao (CZ) owned it all. It turned out that FTT, the in-house token that FTX used to power its kinky derivative products, made up a good portion of the FTX balance sheet, and the balance sheet of Alameda Research, presumably its largest shareholder.

That wouldn’t be a problem, necessarily, even with all the FUD flying around, if FTT could maintain a stable price and steady volume. Unfortunately for FTX, a significant holder of FTT was in no mood to HODL.

Did CZ know what he was doing? He’d definitely never admit to it. As of time of publishing, Binance isn’t buying FTX, and neither is anyone else. Once the market came apart for the FTT token, there was no saving this pig.

But for a second there, Binance had worked out a deal that had it acquiring FTX, all its deposits, and all its users, for the price of providing enough liquidity to keep it open. Then they figured out how much that liquidity was going to cost.

If the rug pull-takeover maneuver had worked out, Binance would have taken over the benefit of all the expensive advertising and development FTX did over the past three years for nothing and made itself the #1 crypto exchange by an even wider margin.

Since CZ was already mounted up on his white horse anyhow, it would be a real shame to get off without taking a victory lap. He used his moment in the spotlight to tell everyone that he could never have orchestrated this.

He was as surprised as the rest of us! It’s not good for anyone! It’s sad! But… in the end… we all learned a couple of valuable lessons.

We expect the reigning champ to walk away from all this without a scratch, and he has every reason to re-assure everyone involved with Binance that they’re on solid ground.

But what did he think this industry was made of, exactly?

Celsius called it a “flywheel,” and basically spelled out what it was doing in the CEL white-paper.

FTX didn’t draw it out in a cartoon, but its white paper was just as explicit about what it was doing.

There’s no reason not to take CZ’s word for it when he says that Binance isn’t using its BNB coin as collateral. But it’s worth wondering how the coin’s stability, or lack of stability, might affect the exchange and its functioning.

This article was written in collaboration with Braden Maccke and Justin Thring.

Information for this briefing was found via the links provided within the article. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.