FuboTV (NYSE: FUBO) has had a fantastic run from $26.59 to $62 since the start of December. The run officially started on December 15th when the company announced that they have partnered with VIDAA to bring sports and live TV streaming to every Hisense Smart TV, with fuboTV also being pre-installed in every model of the new Hisense 9602 smart TV. Since this news, the stock has rallied significantly.

In the last two months, seven analysts have initiated price targets on fuboTV with an average 12-month price target of U$41. Two analysts have strong buy ratings, and the other five have buy ratings.

Fast forward to today, BMO Capital Markets downgraded fuboTV to Market Perform from Outperform, but they did raise their 12-month price target from $33 to $50. On this news, the stock was down between 7-10% in pre-market trading.

Daniel Salmon, BMO Capital Market’s internet and media analyst, writes, “Our new target implies downside to shares, however this is more a reflection of recent volatility than an incrementally negative view,” and explains that their price target and rating are appropriate due to secular tailwinds and execution risks.

The main reason for the price target upgrade comes from “higher streaming comp set valuation and expanded distribution opportunities (e.g. partnership with Hisense and VIDAA) that add upside tension to subscriber estimates.” In his first bullet point, Salmon says that they believe fuboTV, “continues to offer a more promising path to profitability than most new investors expect.”

He then says that BMO believes that there is a tidal wave of momentum under sports betting and that they expect fuboTV to roll out free-to-play gaming in 2021. They also anticipate more gaming-related announcements in the coming months as he writes, “Management is taking a deliberate approach toward expansion and we view its multi-phase approach as prudent.”

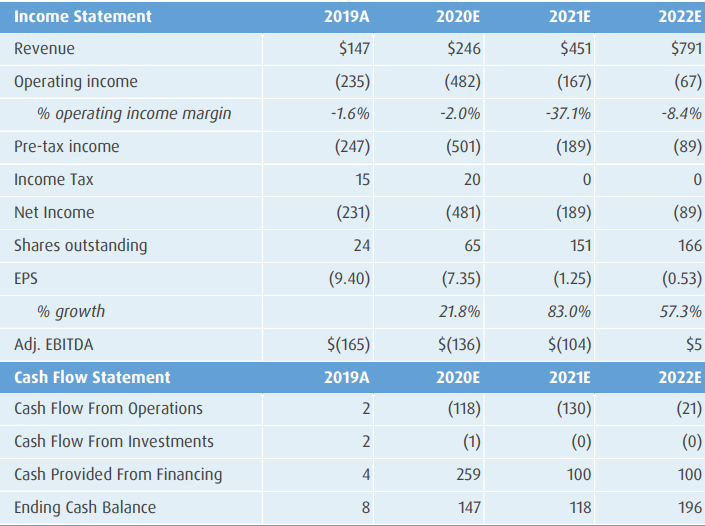

Salmon says, “$50 implies FUBO trades at a 10.3x 2022E EV/revenue and 38.1x 2022E EV/gross profit,” and below, you can see BMO’s 2020-2022 full-year estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.