G Mining Ventures (TSX: GMIN) has completed a feasibility study for its Oko West Gold project, where early works construction efforts are already underway.

The project is said to have an after-tax net present value of $2.2 billion and an internal rate of return of 27%, alongside a payback period of 2.9 years under the base case scenario which uses gold pricing of $2,500 an ounce. At $3,000 an ounce gold, that after tax NPV is said to rise to $3.2 billion, while the IRR jumps to 35%.

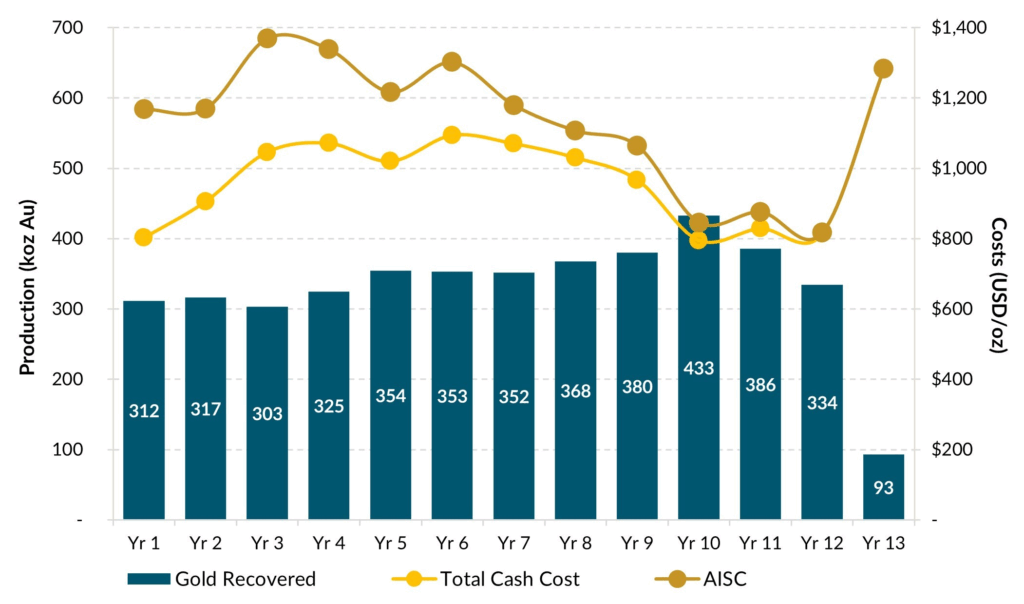

The study is based on a gold operation that would produce 350,000 ounces of gold a year over a 12.3 year mine life, with total gold production of 4.3 million ounces. The operation is expected to process 16,911 tonnes per day, with average gold grades of 1.89 across both the proposed open pit and underground operations.

Estimated mine life, as well as gold production, have fallen from a previously completed PEA. That estimate called for annual production of 353,000 ounces of gold over a 12.7 year mine life, with total production of 4.5 million ounces of gold over the life of mine.

Initial capital costs are estimated at $972 million, while life of mine sustaining capital is estimated at $650 million. After closure costs of $39 million, total capital costs over the life of the project are forecasted to be $1.7 billion. The prior PEA meanwhile had called for initial capital costs of $936 million, and total capital costs of $1.5 billion.

On a per ounce basis, Oko West is expected to produce gold at a cost of $1,123 per ounce, which is a 14% increase over the $986 an ounce estimate produced within that prior PEA.

“With Tocantinzinho nearing nameplate capacity and generating meaningful free cash flow, GMIN is well positioned to advance Oko West using the same experienced team and disciplined execution that delivered our first mine ahead of schedule and on budget,” commented Louis-Pierre Gignac, CEO of G Mining.

Final environmental permits for the Oko West project are expected in the second quarter of 2025, with an official construction decision expected to be made in the second half of this year.

G Mining Ventures last traded at $19.22 on the TSX.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.