On September 25th, Gage Cannabis received qualification from the SEC, allowing Gage to offer 28,571,400 shares via a Tier 2 Regulation A+ offering. If filled, they would receive US$49,104,950 net of fees, with shares being issued at $1.75, roughly 17% higher than the strike prices of options that were issued only four months prior. The filing provided a glimpse into the finances of the currently private firm.

Looking at the balance sheet, the first item of note is that there is a going concern notice on Gage’s financial stability. The reason behind this is that as of June 30th, Gage only had $4.12 million in cash and short term investments, while current liabilities totaled $10.3 million. However, the going concern should only be present for this set of financials, as two sales leaseback agreements were signed totaling $6.2 million in addition to the current financing.

Total current assets currently sit at $12.89 million, with half of that value coming from inventory, which was $6.01 million. They have total assets of $63.45 million, with roughly $3.6 million of intangible and right-of-use assets.

Simultaneously, the company’s largest debt is the current accounts payable that has an outstanding balance of $6.9 million, which is almost half of their total liabilities balance of $13.9 million.

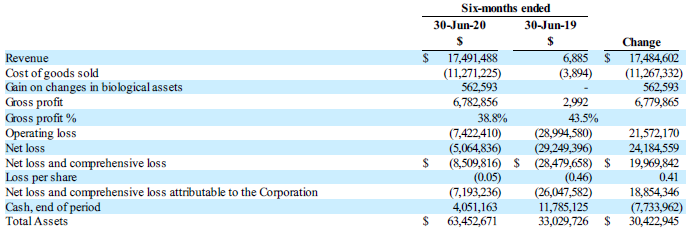

Gage does not include a three-month income statement but rather a six-month ending income statement. Essentially, the following data is for the first half of Gage’s fiscal year, rather than a single quarter.

Revenue was US$17.5 million for the period, while the cost of goods sold was $11.27 million, resulting in a gross profit before fair value adjustments of $6.22 million or 35.56%. They had total expenses of $14.2 million, of which selling, general and administrative expenses amounted to $9.5 million. The remainder of expenses was attributed to share-based payments.

A comprehensive loss of $8.5 million, or ($0.05) per share was posted for the six month period.

Looking at the share structure, Gage Cannabis currently has 106,622,799 shares outstanding, along 1,500,000 super voting shares and a number of convertible securities.

- 14,095,140 options are outstanding, with an average exercise price of US$0.69.

- 4,422,000 warrants are outstanding

- 1,500,000 exchangeable super-voting shares, convertible into 75 million voting shares. 900,000 are owned by a director in connection with the purchase of Terra Capital Holdings, and 600,000 are owned by a director in connection with the merger with Mayde Inc.

On a fully diluted basis, assuming the full subscription to the Tier 2 Regulation A+ offering, Gage is believed to have 228,711,339 subordinate voting shares outstanding, along with 1,500,000 super voting shares which we have been informed do not convert to subordinate shares. This is assuming all exchangeable units and super voting shares are converted to subordinate voting shares.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.