On Monday, Galaxy Digital Holdings Ltd. (TSX: GLXY) reported its second quarter financial results. The company announced that its net comprehensive losses came in at $554.7 million for the quarter compared to a loss of $182.9 million last year during the same period. Galaxy said the elevated losses came from unrealized losses on their digital assets and investments in their Trading and Principal Investments businesses.

The company reported $10.9 million in revenue from its mining segment and ended the quarter with $1 billion in cash, and net digital assets were $474.3 million, which includes $256.2 million in “non-algorithmic stablecoins.” The company’s investments decreased by roughly 25% to $753.9 million.

Galaxy said that they had assets under management of roughly $1.7 billion, down 40% sequentially in their Galaxy Digital Asset Management segment. At the same time, they commented that the company has purchased 4,092,952 shares under its share repurchase program announced on May 16th, 2022.

Galaxy Digital has three analysts covering the stock with an average 12-month price target of C$18.67, or an upside of 150%. Out of the three analysts, one has a strong buy rating, one has a buy rating, and the last analyst has a hold rating on the stock. The street high price target sits at C$28, representing an upside of 275%.

In BMO Capital Markets’ note on the results, they reiterated their outperform rating and lowered their 12-month price target to $16 from $24, saying that the lowered price target now reflects the crypto correction. Though they write, “we believe Galaxy performed exceptionally well during this period, with only a 28% q/q drop in BVPS and one loan loss of a nominal $10mm.”

They believe this performance showcases management’s “disciplined approach to risk management” and believes that this is a great entry point for investors who are looking to get exposure to the digital asset space.

On the results, all metrics missed BMO’s estimates, but most notably, the company did outperform the crypto market as Galaxy’s book value declined 27% versus the 57% the broad crypto market was down. BMO adds that they calculate book value per share is now $5.57, down 19% sequentially.

BMO also provides their top takeaways from the earnings call, saying they think the crypto contagion from Terra-Luna is over, but the community needs a new narrative “to catalyze a recovery.” They add that they expect M&A to pick up in the sector as the sector starts to settle down; they note that during the first half of 2022, there were 190 transactions, while during the second half of the year, there have already been 90 transactions.

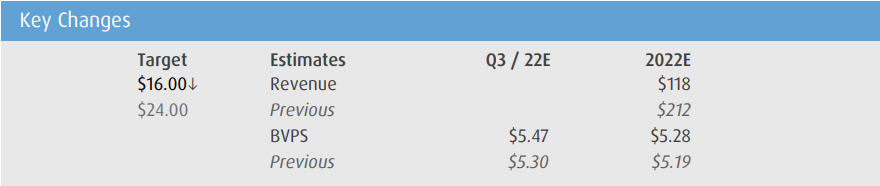

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.