After speculators spent all evening yesterday estimating the gain of Roaring Kitty’s portfolio on GameStop (NYSE: GME) due to strong after hours action, the equity is tumbling in early morning trade today following the filing of a prospectus supplement by the company.

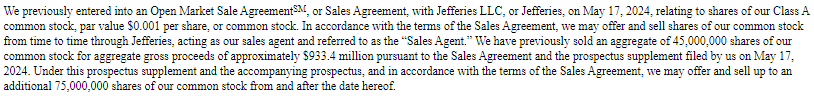

GameStop has filed to sell an additional 75 million shares under an at the market offering, which follows a prior at the market offering that saw 45 million shares sold for gross proceeds of $933.4 million. The latest offering is to be conducted through an open market sale agreement that is in place with Jefferies LLC.

The filing has seemingly resulted in a wake-up call for investors, whom last night bid the equity as high as $65.81 in after-market trading. Following the filing, the equity is down 17% to $38.50 in pre-market trading.

The sharp tumble follows speculation among market watchers last night that Keith Gill, whom is more commonly known as Roaring Kitty, had reached billionaire status if the price of the equity were to hold from after market trading.

BREAKING: "Roaring Kitty" is set to be a billionaire as GameStop stock, $GME, surges to $67.50/share in after hours trading.

— The Kobeissi Letter (@KobeissiLetter) June 6, 2024

If $GME opens at or above current levels tomorrow, his shares will be worth ~$325 million and options worth ~$700 million for a combined ~$1 billion.… pic.twitter.com/UqnUPoShnv

GameStop meanwhile reported its first quarter 2024 results this morning, posting net sales of $0.882 billion, from from $1.237 billion during the same period last year. Net loss for the period was $32.3 million, down from $50.5 million a year ago, while cash and cash equivalents totaled $1.083 billion.

READ: Roaring Kitty Returns With $180 Million GameStop Investment, Sends Stock Price Up By 70%

GameStop last traded at $46.55 on the NYSE.

Information for this story was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.