Last night, GameStop Corp. (NYSE: GME) abruptly, and without stated reason, fired its CEO Matt Furlong and reported disappointing results for 1Q FY 2024 (the quarter ended April 29, 2023). In turn, the company added the CEO position to newly-appointed Chairman Ryan Cohen’s responsibilities.

This one-two punch (with the CEO firing news probably striking the harder blow) crushed the stock in after-hours trading, closing the extended session at $21.09, a 19% decline.

Such a steep fall is unusual for GameStop, a favorite among Reddit users. A factor which typically moderates a decline in the stock is the giant overall short position in the company’s shares. As of mid-May, 57.3 million shares were sold short, equal to about 21% of the float.

Two years ago (almost to the day), GameStop, with much fanfare, announced that Amazon.com, Inc. (NASDAQ: AMZN) veterans Mr. Furlong and Mike Recupero would take over its CEO and CFO positions, respectively. Mr. Recupero was similarly fired suddenly in July 2022. Holding on to a senior position at GameStop must be quite a difficult task.

GameStop’s revenue dropped just over 10% in 1Q FY 2024 to US$1.24 billion from US$1.38 billion in 1Q FY 2023. Hardware and accessories sales increased 8% versus the year-ago period, but software and collectibles (such as superhero toys) sales plummeted 30% and 22%, respectively, from 1Q FY 2023 levels.

Adjusted EBITDA fell sequentially to negative US$29 million from positive US$83 million in 4Q FY 2023 (quarter ended January 2023); however, EBITDA in the just-finished quarter was an improvement versus the US$126 million loss in 1Q FY 2023.

GAMESTOP CORP.

| (in millions of US dollars, except for shares outstanding) | Twelve Months Ended Apr. 29, 2023 | Apr. 2023 | Jan. 2023 | Oct. 2022 | Jul. 2022 |

| Revenue | $5,785.9 | $1,237.1 | $2,226.4 | $1,186.4 | $1,136.0 |

| Adjusted EBITDA | ($91.6) | ($29.4) | $82.5 | ($66.6) | ($78.1) |

| Adjusted Operating Income | ($206.2) | ($51.2) | $46.2 | ($95.0) | ($106.2) |

| Adjusted Diluted EPS | ($0.64) | ($0.14) | $0.16 | ($0.31) | ($0.35) |

| Operating Cash Flow | $309.4 | ($102.7) | $338.2 | $177.3 | ($103.4) |

| Cash – Period End | $1,057.0 | $1,057.0 | $1,139.0 | $1,042.1 | $908.9 |

| Debt – Period End | $650.5 | $650.5 | $616.6 | $574.5 | $602.4 |

| Fully Diluted Shares Outstanding (Millions) | 304.5 | 304.5 | 304.2 | 304.2 | 304.0 |

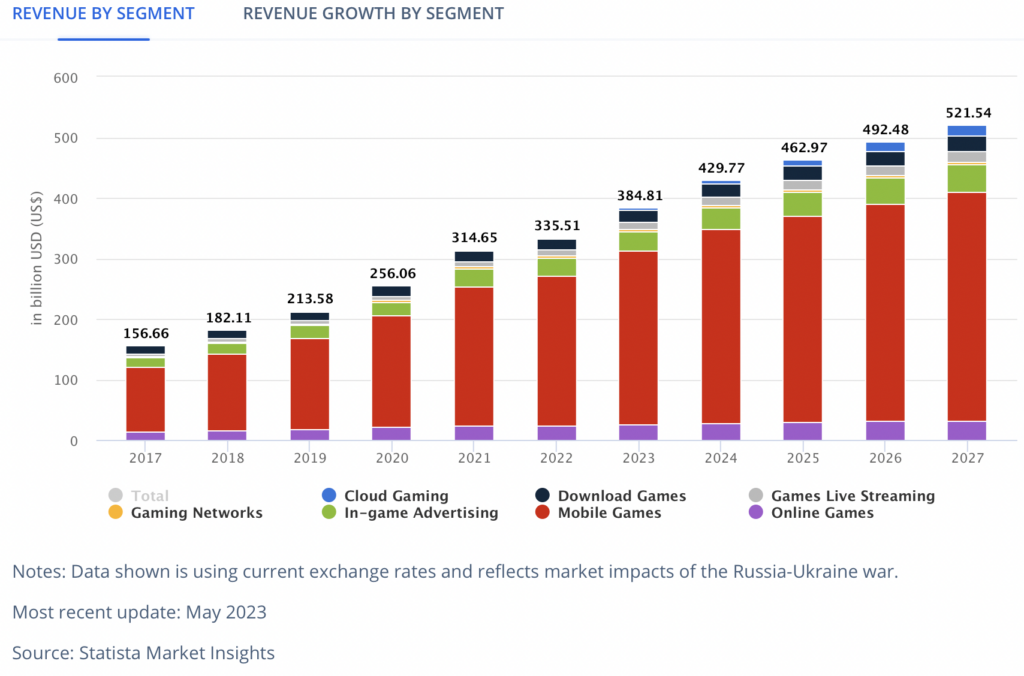

GameStop seems to be losing significant market share in video games, as Statista projects solid 10+% annual growth in global video game sales in 2024.

Even factoring in the sharp drop in its share price in after-hours trading, GameStop shares look very expensive. At a share price of around US$21, GameStop’s enterprise value is about US$6 billion. This giant valuation is hard to reconcile against declining revenue growth and adjusted EBITDA and adjusted operating income deficits of US$92 million and US$206 million, respectively, for the twelve months ended April 29, 2023.

GameStop Corp. last traded at US$26.11 during the regular session on the NYSE.

Information for this briefing was found via Edgar and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Market Manipulation: How It Works.

“Market manipulation?” You want market manipulation? I’ll give you market manipulation. There are two main...