On July 2, General Motors Company (NYSE: GM) reached an agreement with Controlled Thermal Resources (CTR), a private company. Under the arrangement, GM will invest in CTR and ultimately buy lithium that CTR hopes to produce from brine in the desolate Salton Sea area of the California desert.

Lithium is a key ingredient in virtually all current electric vehicle (EV) battery designs. In our view, this accord highlights the value of lithium, and those miners that have viable lithium projects in place, as CTR’s ability to economically produce sufficient lithium at its Hell’s Kitchen Lithium and Power project seems far from certain.

(Other energy companies have also expressed interest in the Salton Sea area. Occidental Petroleum’s TerraLithium subsidiary has expressed interest in the fields there.)

The Salton Sea region could be an enormous lithium resource. In a March 2020 report, the California Energy Commission estimated it could potentially produce 600,000 tons of lithium carbonate per year.

To put such a capacity level into perspective, consider the following. About 92 million motor vehicles are manufactured on a worldwide basis, according to Statista. If, as Elon Musk, CEO of Tesla, has theorized, 30% of those sales eventually transition to EVs powered by a lithium-ion battery, about 1.6 million tonnes of lithium carbonate must be mined each year, or more than five times the total lithium carbonate mined across the globe in 2019, per Morgan Stanley. (Lithium carbonate is also used in the manufacture of glass, cement, adhesives, and aluminum.)

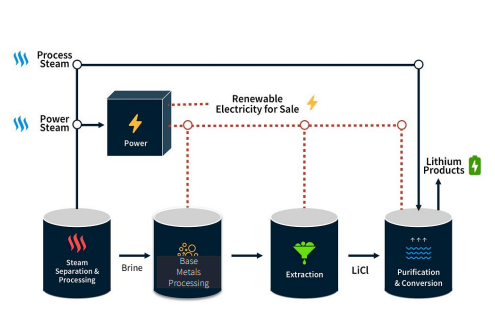

In the Salton Sea region, lithium is a byproduct of geothermal electricity production. Geothermal energy is a clean, renewable source of energy that provides about 6% of California’s electric power generation. In the process, a well brings underground reservoirs of hot water (around 400 degrees Fahrenheit, or just over 200 degrees Celsius) to the surface. The water which is brought to the surface is rich in lithium and other base metals.

CTR has developed a pretreatment process that selectively removes base metals dissolved in the geothermal brine, making lithium in the brine easier to extract. At the same time, Hell’s Kitchen would produce electricity, some of which will be used to provide power for its process. The balance will be renewable electricity which could be sold into the electric grid or to customers.

In the first stage of Hell’s Kitchen’s process, CTR hopes to produce on an annual basis 20,000 tonnes of lithium hydroxide and 50 megawatts (MW) of electrical power. Eventually, the company theorizes that 300,000 tonnes of lithium carbonate equivalent (LCE) can be produced, as well as 1,100 MW of power.

The Rub in All This

If achieved, the goals outlined above would represent tremendous levels of success. However, one of the longest-tenured participants in the region, the well-known conglomerate Berkshire Hathaway Energy, has much more modest aspirations.

According to E&E News, its demonstration plant in the Salton Sea area region is scheduled to be completed next year. It will produce only 200 tonnes of LCE annually. Berkshire Hathaway might start construction on a commercial-scale facility in 2024; it would produce just 10,000 tonnes of LCE annually. A Berkshire VP and chief lobbyist says the company is trying to determine whether it can economically capture the lithium from Salton Sea brine. “The technology to extract lithium from geothermal brine has not yet been proven on a commercial scale. It’s important to crawl before we walk, and walk before we run.”

Lithium Prices

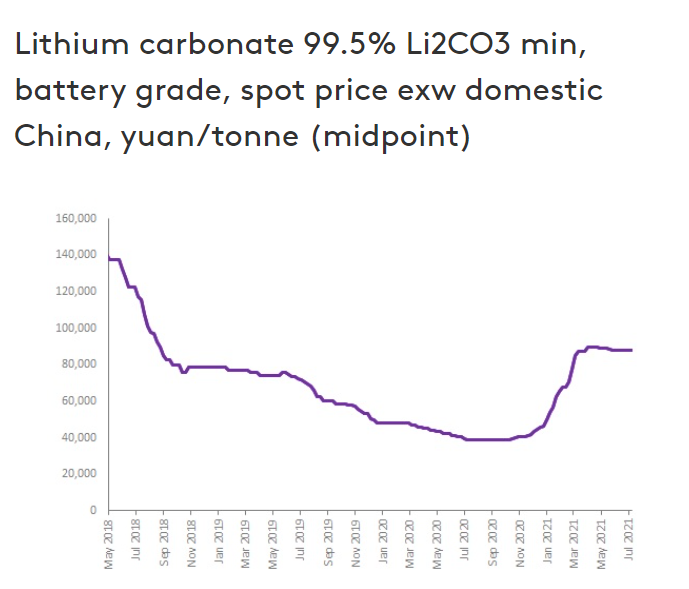

After doubling over the six-month period November 2020-April 2021, lithium prices have been about flat over the last couple months. They are still down about ~40% from a May 2018 peak.

GM’s decision to invest in what seems to be a risky lithium initiative underscores the value of well-defined lithium projects using traditional recovery methods, and which are likely to commence production in the near to intermediate term. Lithium Americas Corp. (TSX: LAC) and Sigma Lithium Resources Corporation (TSXV: SGMA) are two junior miners which each have projects scheduled to enter commercial production in 2022.

General Motors Company last traded at US$58.76 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.