Lithium, a key metal which is used in virtually all electric vehicle (EV) batteries, is a very unusual commodity. It is perhaps the only commodity where a combination of strong demand and a succession of supply-suppressing actions by country governments in key producing and reserve regions is boosting underlying prices both currently and likely over the long term.

The demand side is fairly straightforward: the global demand for EVs is growing at a rapid clip, and there appears to be no economically viable substitute for lithium in the cathode of the battery (at least given current technologies).

More specifically, China’s General Administration of Customs recently reported that in July China imported 9,639 tonnes of lithium carbonate, more than double the year-ago total. Furthermore, the average import price was US$62,500 per tonne, nearly ten times the July 2021 average import price.

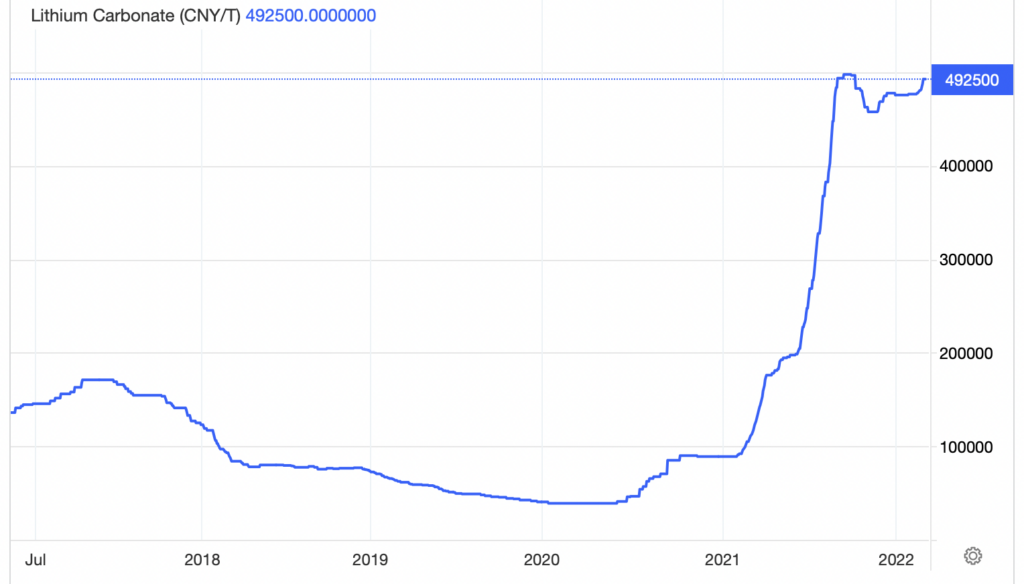

Lithium carbonate trades in the vicinity of 492,500 Chinese yuan per tonne (about US$71,300 per tonne), just off the March 2022 all-time high of 497,500 yuan per tonne.

On the supply side, some of the actions proposed and already put in place by governments may make sense from a populist point of view, but seem much less rational on an economic basis. For example, the new leftist government of Chile, the second largest lithium producing country in the world (to Australia), is proposing a new constitution that would likely decrease production of the silvery metal and make it more costly. On September 4, Chilean voters will decide, among other things, whether indigenous groups will have to consent to mining projects on or near to ancestral lands. The new constitution would also ban mining in glaciers and protected areas, and make gaining access to water rights more difficult.

Furthermore, in April 2022, Mexico’s Senate approved President Obrador’s mining reform plan which nationalized the country’s lithium industry. As a rule, nationalized industries are much less efficient than those with private sector participants.

Also, in January 2022, Serbia revoked Rio Tinto Group’s (NYSE: RIO) lithium exploration license for the Jadar lithium project because of protests by environmental groups. The US$2.4 billion project would have made Rio Tinto a top-ten global lithium producer.

Supply-demand dynamics for lithium may keep lithium prices high for quite some time. Lithium producers with operations and/or near-term development projects in areas outside of those countries which seem to be limiting domestic lithium mining potential should be particularly advantaged.

Information for this briefing was found via Trading Economics and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

“As a rule?”

Stat-owned Equinor ASA is among the largest oil companies in the world, and operates at an efficiency that provides Norwegians with free healthcare, university educations, and all kinds of other great stuff. They’re going to be pretty mad when they hear about the “rule.”