Despite many airlines eager to see air travel reinstated and quarantine rules eased, the continued rise in coronavirus cases and economic downturn casts doubts on a smooth rebound for the airline industry.

According to a recent report by Moody’s Investors Service, the sudden drop in demand for air travel at the onset of the pandemic may be here to stay much longer than anticipated. A recovery for the industry is heavily dependent on safety and health concerns, as well as the severity of restrictions imposed by governments to mitigate the spread of the virus. With an alarming resurgence in cases across much of the US, there is an increased likelihood that quarantine measures may be reinforced once again, thus further dampening passenger demand.

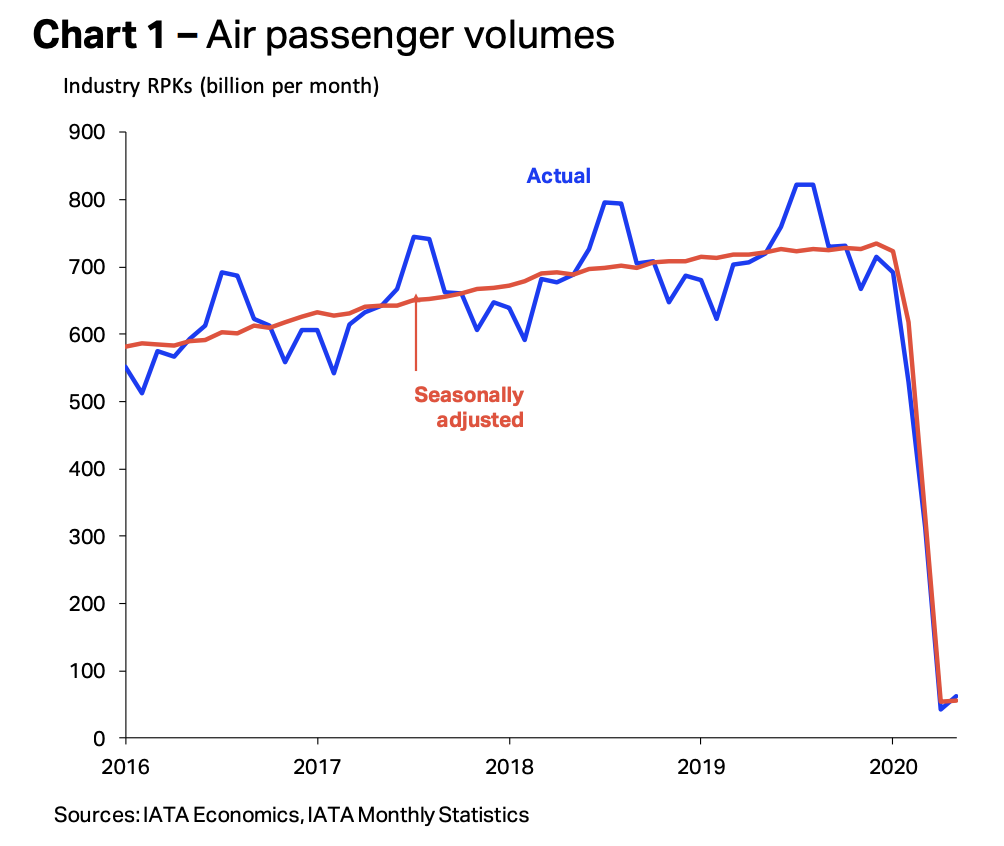

Shortly after coronavirus developed into a pandemic outbreak, the demand for air travel dropped by over 90%. As a result, not only were airlines significantly affected with plunging revenues, but so were their employees, who suddenly faced employment uncertainty. Moreover, the reduction in air travel has also been a contributing factor in the decline for fuel demand, which saw prices plunge to new lows.

Moody’s forecasts it may take up to three years for air travel to reach pre-pandemic levels, with the demand for key stakeholder’s services and products dropping anywhere between 40 to 50% for the remainder of the year. Although some countries have begun to reopen their air travel demand still remains significantly below previous year’s levels. The International Air Transportation Association estimates that the coronavirus pandemic will most likely cost airline providers approximately $314 billion in losses.

Information for this briefing was found via Moody’s Financial Services, RT News, and the International Air Transport Association. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.