It appears that a wrench has been thrown into the optimism of a V-shaped economic recovery, spoiling any hope of a smooth transition out of the coronavirus-induced economic mess.

Thus far, the US government, as well as many other governments around the world, have been meticulously propping up their stock markets via indulgent central bank spending sprees and tax-payer funded bailouts. However, kind of like a bad mullet hair cut, the front that is the US stock market appears composed and resilient to scrutiny, but the back that is the US economy is anything but a party. Millions of Americans still continue to be unemployed, consumer spending has not been rebounding at the rate that has been anticipated, and the US dollar is on the verge of tanking thanks to a never-ending supply of liquidity.

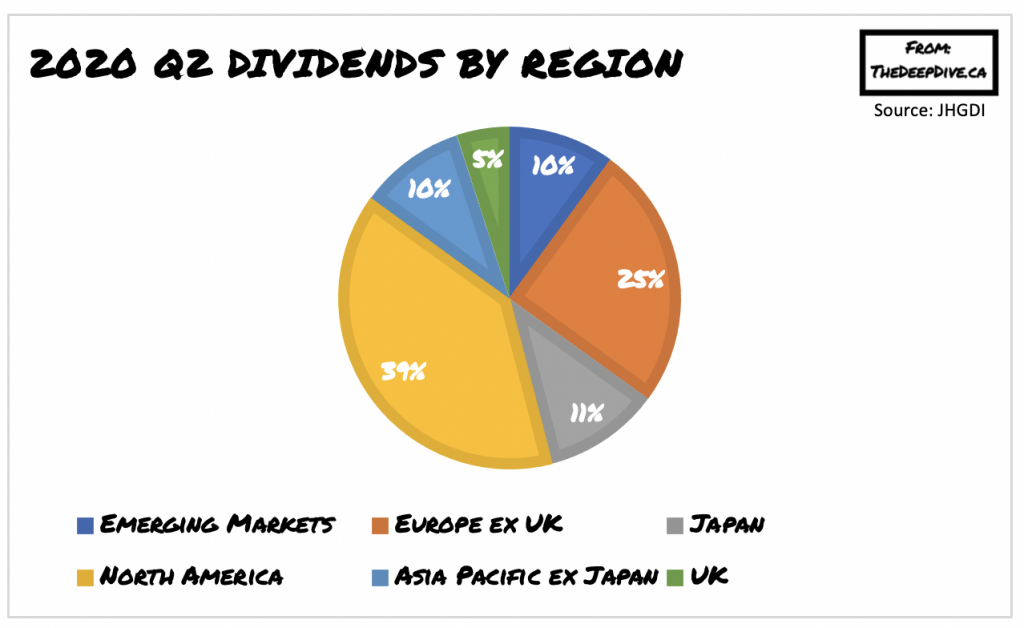

However, what was the stock market’s composed haircut in the beginning, is no longer immune to the financial storms that are about to ensue. It appears that the returns on investments have started to decline simultaneously with the intensification of the coronavirus pandemic, creating a worry-some headache for many folks. According to the Janus Henderson Global Dividend Index (JHGDI), which analyzes trends in global dividends, the second quarter of 2020 saw a 22% drop in dividend payouts around the world – the largest decline since the Financial Crisis of 2009.

The three months that ended in June saw global dividends fall by approximately $108.1 billion to a mere total of $382.2 billion. North America remained somewhat unchanged thanks to Canada’s relative resiliency to financial turmoils brought on by the coronavirus pandemic. The region that saw the largest declines in dividend payments was Europe and the UK, where most companies reduced their dividends by nearly two fifths.

The companies that were most affected by the pandemic, such as consumer -focused firms and energy and natural resource firms, were the subject of significant portion of the global dividend cuts. Conversely however, technology companies accounted for the largest increases in dividend payouts. Albeit the looming financial burdens that are continuing to pile up amid a pandemic that does not appear to be tapering off, many US companies have refrained from making any immediate changes to their payouts. Out of the total 335 US companies accounted for in the index, 296 have either kept their dividends unchanged or increased them.

The bold move to not issue dividend cuts amid a pandemic-induced financial crisis is certainly puzzling to the naked eye. However, given that the fourth quarter is when dividends are set for the following year, with payouts made each quarter, several months from now will most likely subside into chaos for more US firms. So far only 39 companies have either reduced or cancelled their payouts, costing investors a mere $6.5 billion. The Federal Reserve has recently issued a new dividend cover guidance, which has already caused Wells Fargo to lower its payouts by more than 80% in July. If more and more companies continue to follow suit, a bad haircut will be the least of worries come the fourth quarter.

Information for this briefing was found via the Janus Henderson Global Dividend Index. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.