Global GDP levels are now forecast to exceed $100 trillion come next year, as economic effects stemming from the Covid-19 pandemic are expected to abate quicker than previously expected.

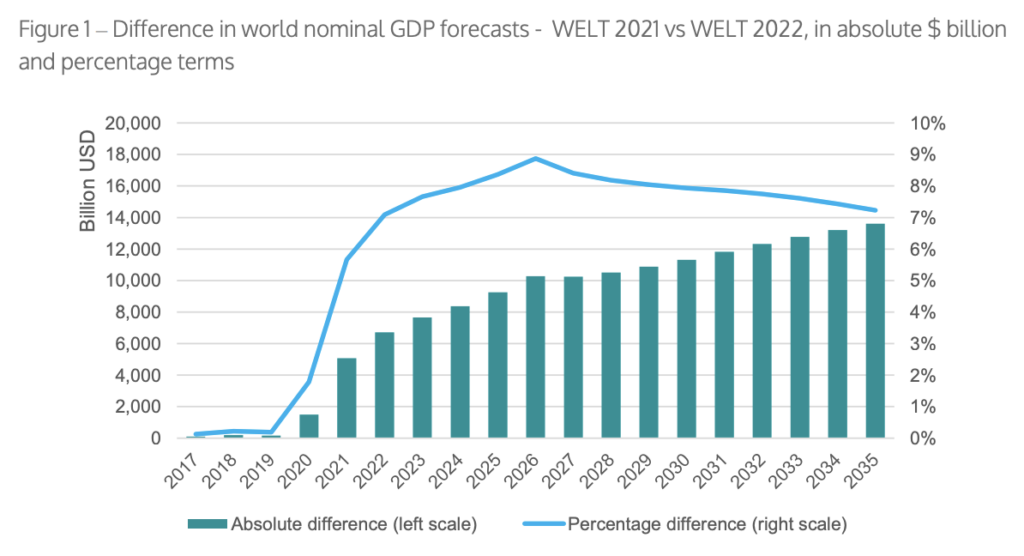

According to a new report from the Centre for Economics and Business Research (CEBR) published on Sunday, analysts have upgraded their growth forecasts for the global economy, which is now expected to reach $100 trillion in output for the first time in history come 2022, rather than in 2024 as previously anticipated.

The analysts cited a faster-than-expected improvement in the economic effects of the pandemic, while a “much improved immunity in many countries allows for less harsh restrictions, whilst greater economic adaptability means that renewed restrictions cause less of a blow than [previously].” However, the report highlighted the growing issue of inflation, which could become a forefront problem over the coming years.

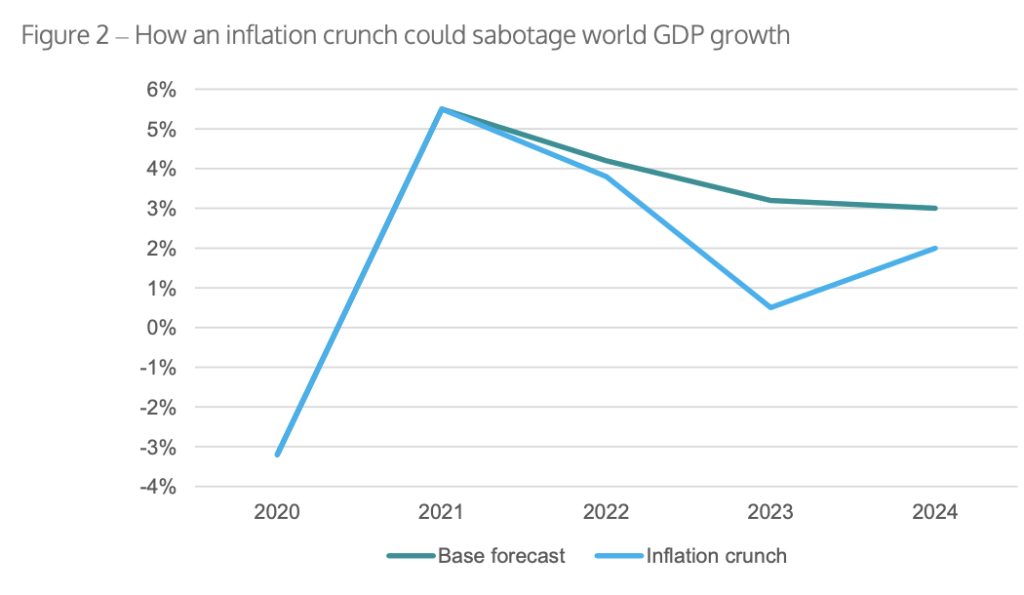

“The important issue for the 2020s is how the world economies cope with inflation, which has now reached 6.8% in the US,” said CEBR Deputy Chairman Douglas McWilliams, as cited by Reuters. The report also warned that if the non-transitory elements currently driving price pressures do not abate anytime soon, then the world could face a recession in 2023 and 2024.

Information for this briefing was found via CEBR. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

This is a lie. The economic output has in fact drastically diminished. The reason the numbers went up is due to the fiat currency based on NOTHING that is being printed by the trillions. This is all part of a plan to completely bankrupt the people of the planet by devaluing their holdings through massive massive inflation, nonstop taxation of things they already paid for, and seizure of assets when you can no longer pay their slave fees just to live on your own property.