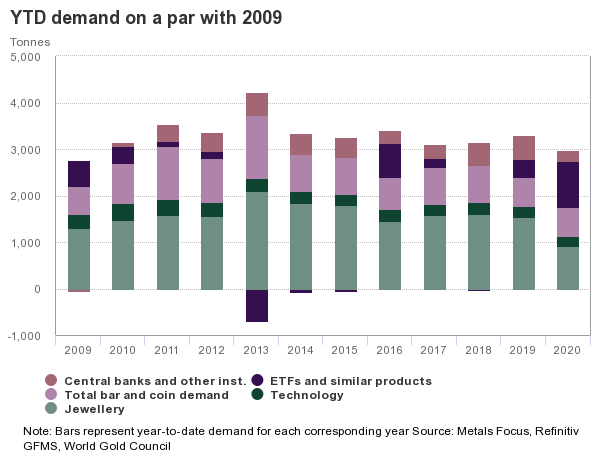

It appears that gold has lost its lustre for many central banks and investors, causing demand to drop by 10% in the third quarter as global interest in the precious metal slid under the weight of the pandemic.

According to the World Gold Council (WGC), third quarter gold demand slipped to 892.3t, the lowest level since 2009, as consumers and investors around the world were weighed down by the effects of the coronavirus pandemic. Conversely however, demand for coins and bars increased by 49% compared to the same time a year prior, as Western markets and Turkey looked to increase their safe haven assets via official coins. The third quarter also saw a steady stream of inflows into gold-backed ETFs, as investors around the world increased their holdings by 272.5t.

Meanwhile, some central banks have decided to sell a portion of their gold stockpiles, as governments looked to offset some of the financial damage from the pandemic. This is the first quarter since 2010 that generated net sales, which were predominantly driven by two central banks – Turkey and Uzbekistan. Nonetheless, the WGC anticipates that central banks will resume gold purchasing activity before the end of 2020, but at a slower pace compared to the previous two years.

Although the demand for gold experienced some levels of weakness amid the pandemic, the increased investment demand in western economies helped fuel gold prices to reach historically-high levels this year. Back in August, gold bullion rose above its record $2,075 per ounce, but some of the gains have been lost since then, falling below $1,900 per ounce as of current.

Information for this briefing was found via the WGC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.