Over the last several months, gold prices have been rallying to record highs amid the increasing global economic volatility and uncertainty. Since the beginning of the year, spot gold prices have jumped over 32%, and according to analysts, prices are expected to continue climbing, making 2020 the most significant year for gold since 1979.

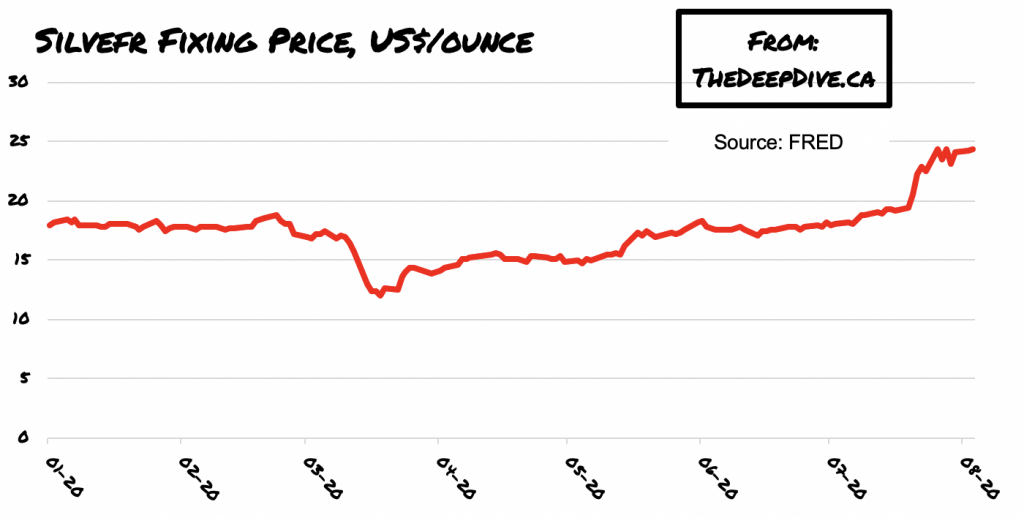

However, gold is not the only commodity outshining amidst all the turmoil; it appears that silver has been following suit, rising over 30% between January and to date. Today, silver prices rose to over $28.46 per ounce, while gold increased to a record-breaking $2,069. According to a note by Mizuho Bank which was witnessed by CNBC, the catastrophic Port of Beirut explosion most likely added to the sudden rally in gold prices overnight earlier this week.

According to Deutsche Bank commodities and foreign exchange strategist Michael Hsueh, once the world economy is able to recover from its disastrous coronavirus fallout, a demand increase for silver is to be anticipated; the long-run bounce back will cause industrial consumption to rise, thus expanding the use of silver in various industrial settings.

In the meantime, gold will most likely continue on its rising trajectory, since given that investors have recently been shying away from fiat currencies- the US dollar especially, according to Ned Naylor-Leyland, who is the precious metals fund manager at Jupiter Asset Management. Nonetheless however, both gold and silver prices are set to experiences increases.

Information for this briefing was found via CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Question Period With Riverside Resources’ John-Mark Staude

Recently, The Deep Dive had the pleasure of sitting down with John-Mark Staude, CEO and...