In recent weeks, the world has witnessed a spike in the price of gold, catapulting the yellow metal to an all-time high. While much attention has been given to China’s voracious appetite for gold, there’s a significant factor flying under the radar: the substantial buying spree by central banks, largely unreported but undeniably impactful.

The surge in gold prices can be traced back to a series of events, notably China’s aggressive accumulation of gold reserves, which was first identified as far back as December 2022. However, it’s not just China’s demand that’s fueling the gold rush; central banks worldwide are increasingly turning to gold as a hedge against geopolitical and financial uncertainty.

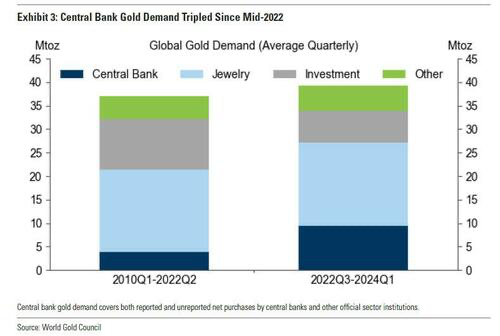

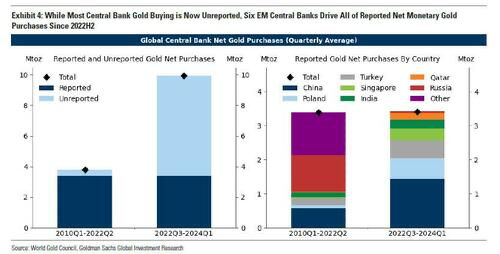

According to a note by Goldman Sachs, central banks, particularly those in emerging markets, have been the driving force behind the surge in gold demand since mid-2022, tripling their purchases since Russia’s invasion of Ukraine. What’s notable is that much of this buying goes unreported, with only a handful of countries disclosing their gold acquisitions.

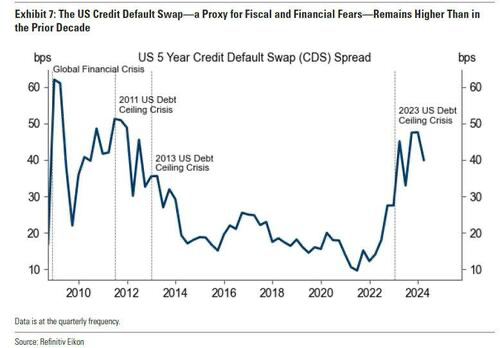

Goldman Sachs highlights that fears of geopolitical and financial shocks are compelling central banks to bolster their gold reserves. Historical data suggests that instances of sanctions and asset freezes coincide with spikes in gold prices, as seen in previous crises involving Iran, Libya, and Russia.

Moreover, the research firm has developed models linking global central bank gold purchases to measures of geopolitical tensions and financial instability.

Looking ahead, Goldman Sachs forecasts further upside to gold prices, driven by continued central bank buying and ongoing geopolitical uncertainties. In hypothetical scenarios involving heightened financial sanctions or increased market volatility, the bank predicts significant additional increases in gold prices.

While Goldman Sachs stops short of explicitly advising clients to shift their investments to gold, its acknowledgment of gold’s hedging value against systemic shocks marks a significant departure from past sentiments.

Information for this briefing was found via Zero Hedge and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.