The US economy is at a crucial crossroad right now, as coronavirus cases continue to rise out of control, while the topic of reintroducing economic lockdowns get more and more heated by the day. Nonetheless, the employment situation for many Americans remains fragile, and initial jobless claims have not been dwindling down at the rate that government officials had been desperately hoping for, now that it has been over eight months into the pandemic.

However, it appears that the pivoting situation is about to get even worse. Goldman Sachs strategists have been forecasting a cascade of mergers and acquisitions (M&A) across the economy, which will further add to the already-dire unemployment situation in the country. On Friday, Goldman Sachs president John Waldron pointed out that amid the shambles that is the US economy, there are big businesses that have been faring relatively well throughout the pandemic. These large cap companies will take advantage of weaknesses in the economy, and begin the wave of mergers and acquisitions of smaller companies that are not doing so well.

Goldman Sachs noted the surge in demand stemming from large corporations looking to either raise capital or reposition themselves. Likewise, the current record-low interest rates are also playing a significant role in the amplification of this scenario. The continuation of low rates provides an incentive for potential acquirers to borrow funds at historically low prices, which although from an economic standpoint seems like the right kind of tailwind for an economy that is attempting to emerge out of the rubble, it is certainly going to complicate a lot of other variables in the process.

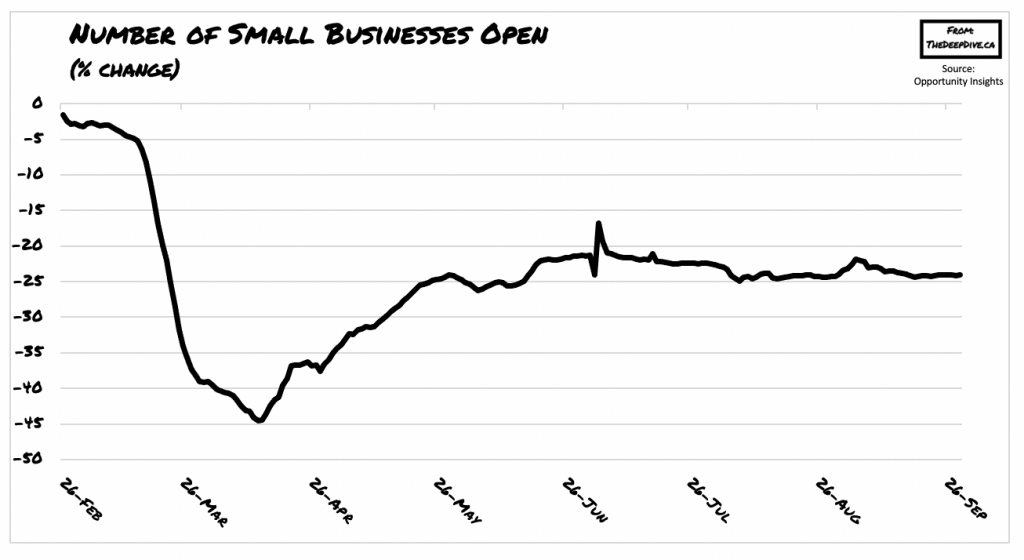

In the meantime, while many large corporations are doing relatively well financially, either via increased revenues as a result of the pandemic or on the receiving end of government bailouts, the number of small businesses across the US that are still able to remain open are dwindling down at an alarming rate. Although acquisitions such as the ones that Goldman Sachs warns about spur money borrowing in the economy, the negative effects at the lower tier are ultimately amplified.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.