GoldMining (TSX: GOLD) evidently wanted to draw little attention to the renewal of an at-the-market financing. The firm revealed the renewal in a news release simply titled “corporate update,” which it released at 2:36 AM on Saturday morning.

The financing will see the company sell up to US$50 million of its shares through a number of agents, including BMO Nesbitt Burns, Canaccord Genuity, Laurentian Bank, Roth Capital, and H.C. Wainwright, on the open markets. The financing is said to replace a currently ongoing at-the-market financing that is set to expire on November 27.

The new financing is set to run through to December 31, 2024, or until the full US$50 million in shares are sold on the open market, whichever occurs first. Proceeds from the financing are slated to be used for the development of mineral properties, to fund future acquisitions, and for working capital.

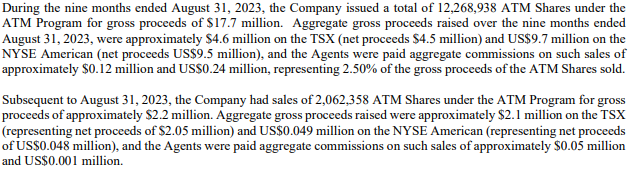

The current program has seen a total of 14.3 million shares sold as of October 13, 2023, raising gross proceeds of C$19.9 million, based on a filing made by GoldMining.

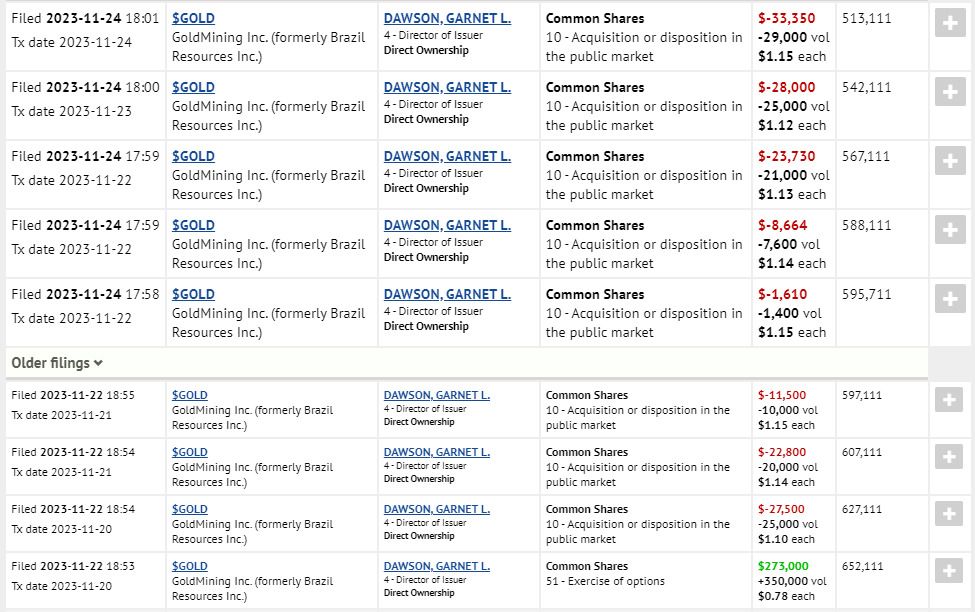

The filing follows the sale of 139,000 shares by director Garnet Dawson this past week, following an option exercise conducted at $0.78 per share.

GoldMining last traded at $1.19 on the TSX.

Information for this story was found via Sedar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.