Parent firm Digital Currency Group at insolvency risk; reportedly owes Genesis $1.1 billion.

Grayscale Bitcoin Trust (OTCQX: GBTC) categorically said in a statement that it won’t publish information on its proof of reserves for the world’s largest bitcoin fund.

“Due to security concerns, we do not make such on-chain wallet information and confirmation data publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure,” the firm said in its statement.

6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure.

— Grayscale (@Grayscale) November 18, 2022

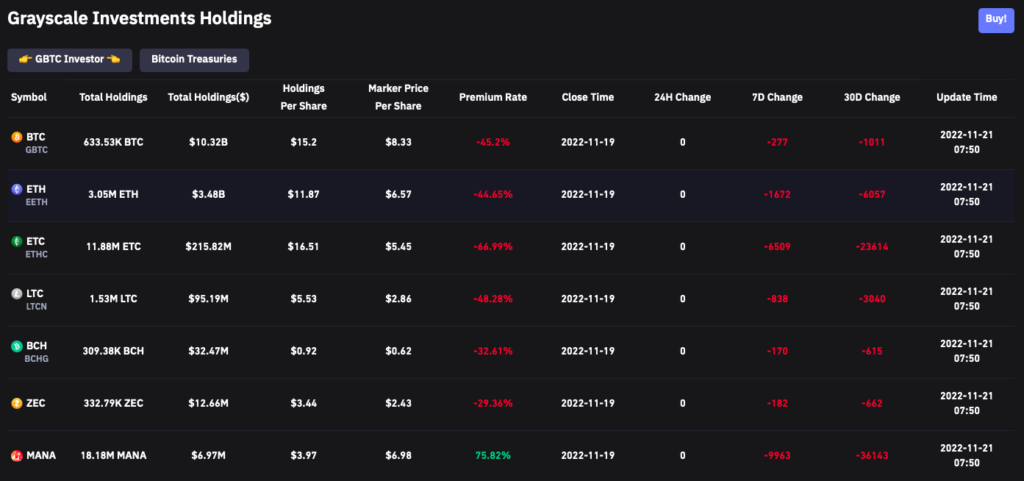

Grayscale’s holdings lost almost half of its value today, with bitcoin trading at around 45% discount.

The firm, however, reiterated that “the holdings of Grayscale’s digital asset products are safe and secure,” adding that balances are reflected in historical public filings and have been evaluated by third-party auditors.

“The organizational documents governing each of Grayscale’s digital asset products, as well as the custodian agreement with Coinbase Custody, prohibit the digital assets underlying the products from being lent, borrowed, or otherwise encumbered,” the crypto firm also noted.

Coinbase Custody also frequently performs on-chain validation as part of their custodian operations, said the firm. Coinbase now holds about 635,235 bitcoin on behalf of Grayscale, totaling $10.2 billion.

Coinbase affirms all the Grayscale assets are secure …should help sentiment a bit pic.twitter.com/sOjKZkcRxd

— FxMacro (@fxmacro) November 21, 2022

In a tweet, Grayscale acknowledged that neglecting to give proof of reserves would be a “disappointment to some,” but added that “panic sparked by others is not a good enough reason to circumvent complex security arrangements” that have kept its investors’ assets “safe for years.”

Grayscale and crypto investment bank Genesis Global Trading are both subsidiaries of Barry Silbert’s Digital Currency Group. Genesis’s lending arm Genesis Global Capital suspended new loan originations and redemptions last week.

Reportedly, Digital Currency Group owes Genesis around $1.1 billion “via a previously undisclosed promissory note that has been hidden from potential investors.” The crypto investment firm is believed to be at risk with this exposure as the debtor’s loan could possibly not be extended and will most likely be required to be returned sooner than expected.

To make the math simpler:

— Andrew (@AP_ArchPublic) November 20, 2022

If Genesis dies, so does DCG (DCG actually owes Genesis more than the $1.1B but have been asked not to disclose yet)

Two words I’ve heard today that I didn’t hear yesterday: lies and fraud.

Following FTX’s implosion and subsequent bankruptcy procedures, which revealed that customer assets were lent to sister hedge fund Alameda Research for investing in risky bets, numerous crypto exchanges have rushed to issue proof-of-reserve audits in order to allay investor fears about the safety of their funds.

READ: FTX Sinkhole: Is Silvergate Capital Next?

The SEC rejected in June Grayscale’s application to establish a spot Bitcoin ETF, highlighting concerns about market manipulation. It purported that the proposal lacks in ensuring protections for the investors.

GBTC last traded at US$7.73.

Information for this briefing was found via Coindesk and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.