Earlier this month, Green Thumb Industries (CSE: GTII) reported its fourth quarter and full year financial results. The company saw its revenues grow 60.5% year over year to $893.6 million, while gross profits grew from $304 million to $492 million at the end of 2021. The company saw its full-year earnings per share almost 5x to $0.34 for a net income of $75.4 million. This is after paying $124.6 million in taxes for the year.

For the quarter, the company saw its growth slow this quarter, as revenue, gross profits, and income before taxes grow 4.2%, 1.8%, and -14.3% this quarter respectively. Compared to the 5.2%, 14.2%, and 10.5% growth it saw going from Q2 to Q3. The company reported revenues of $243.6 million and a gross profit of $128.64 million for the fourth quarter.

A number of analysts slashed their 12-month price target, bringing the average down from C$55.41 to C$49.42, which represents a 145% upside to the current stock price. Green Thumb currently has 17 analysts, with 5 having strong buy ratings and the other 12 having buy ratings. The street high sits at C$73, which represents a 262% upside.

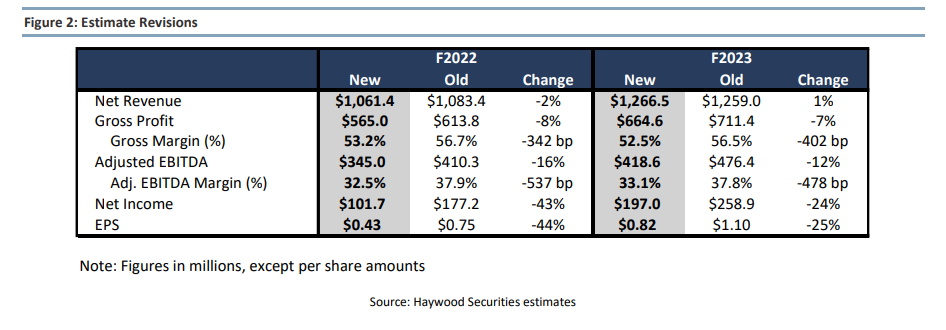

In Haywood Capital Markets’ fourth quarter review, they reiterate their buy rating but cut their 12-month price target from C$47 to C$40, saying that they are taking this time to reset their expectations for the company while saying, “We believe investors should have exposure to GTI given its strong track record in high growth markets across the U.S.”

For the results, Green Thumb missed both Haywood’s gross profit and adjusted EBITDA estimates. They expected Green Thumb to report gross profits of $134.9 million versus the $128.6 million reported and adjusted EBITDA of $83.9 million versus the actual $76 million. Haywood says that the company saw retail revenue increase roughly 8% thanks to an increase in foot traffic and new store openings, while same-store sales grew 6% year over year.

Lastly, Haywood says that they have reset their margin expectations given the company’s commentary on the call. They also expect delays in new markets, inflation, and supply costs to hurt the company’s margins.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.