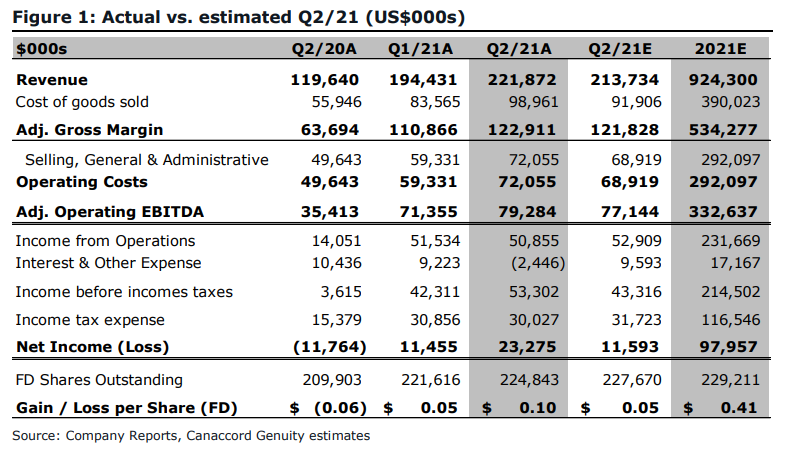

On August 11th, Green Thumb Industries Inc. (CSE: GTII) released its second quarter financial results. The company announced revenues of $221.9 million, up 14.1% sequentially. The company had adjusted EBITDA of $79.3 million and a net income of $22.1 million. The company had a gross profit of $122.9 million, up 10.9%.

Only one analyst raised their 12-month price target on the company, bringing the average consensus up to $59.03 from $57.92 last month. The company has 16 analysts covering the stock with 4 having strong buy ratings and the other 12 have buy ratings. The street high sits at $77 from BTIG while the lowest target comes in at $45.

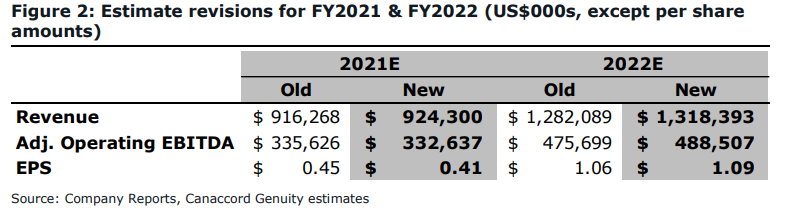

Canaccord Genuity was the only firm to raise their 12-month price target on Green Thumb, raising it to $56 from $54, while reiterating their buy rating on the stock saying that these results came in better than expected. They also add that three acquisitions that closed after the quarter ended will help Green Thumb going into the next quarter.

Green Thumb beat every one of Canaccord’s estimates. Canaccord estimated revenue to come in at $213.73 million, Gross margins of $121.82 million, adjusted EBITDA to be $77.14 million, and a net income of $11.59 million. The key drivers to the beat were Illinois and Pennsylvania sales coming in sequentially higher while same-store sales grew 7%. For the segments, CPG grew 13% while retail grew 15%.

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.