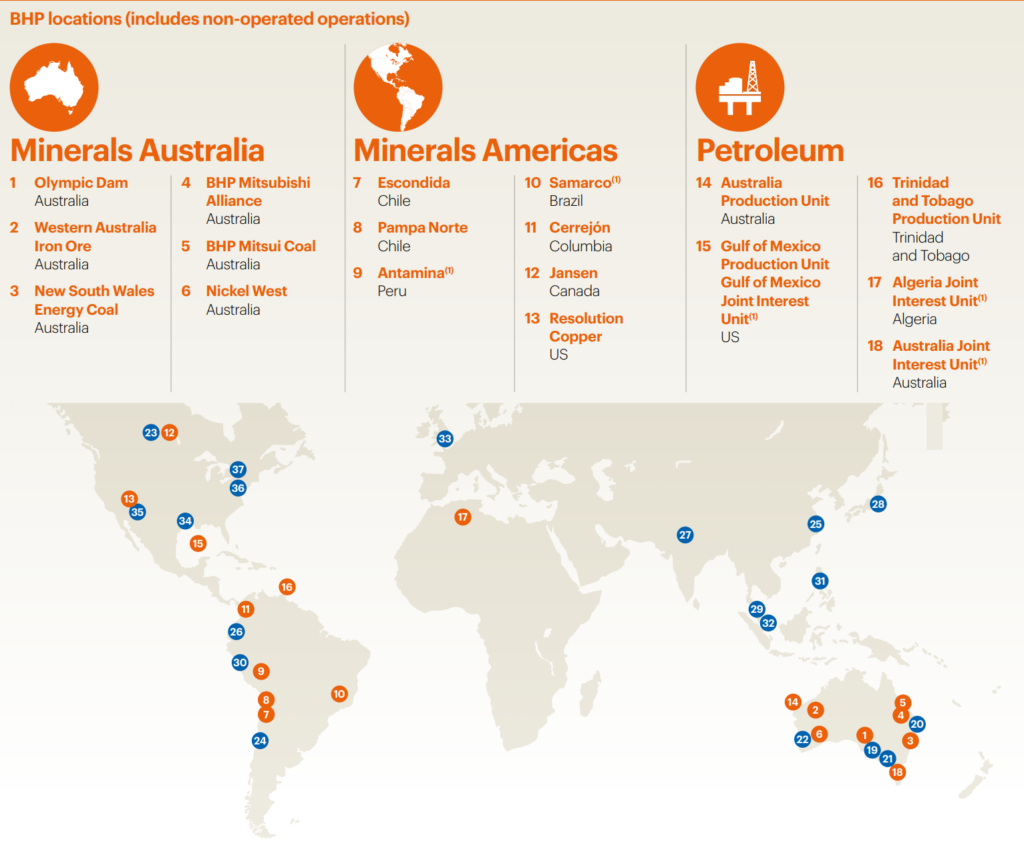

BHP Group (NYSE: BHP), formerly BHP Billiton, is the world’s largest extractive company. Its very large, very successful global footprint includes interests in petroleum, coal (both metallurgical and energy), nickel, copper, iron ore, and uranium.

It does business in the very epicenter of the industry that is going to be the most affected by climate change and, at a $160 billion market cap paying a dividend that yields 7%, and annual operating expenses in the tens of billions ($34.5 billion in 2021), it has considerable financial weight to throw around. As the economic landscape shifts, the way it chooses to throw that weight around is worth watching.

Map clipped from BHP 2021 annual report. Orange dots are active operations.

BHP does not try to minimize its role in carbon pollution, or sugar coat the effect a consistently warmer biosphere might have on its operations themselves or on the people who work in them. BHP is, after all, a mining company, and mining companies are full of engineers, and engineers are compulsive problem solvers.

The engineers at BHP have done the math, and know how much carbon the company’s operations contribute to global climate change down to the ton. They also do a much better job of calculating and reporting the (immediate) downstream emissions than many of their peers. Climate plans and goals take up a significant portion of BHP’s annual report, and are further laid out in a standalone climate strategy document. BHP is very frank about its role in global emissions and, while that may seem modern and noble, the truth is that it doesn’t have much of a choice.

Forward planning is in BHP’s corporate DNA. It’s nearly 140 years old with a diversified, relevant portfolio of very profitable assets that keep it consistently on top of its industry, and it didn’t get that way by just digging a hole as soon as it hit paydirt, then figuring out what to do next when the grade got too low. Every ton a mining company ships is one less that’s in the ground, so a company interested in its future is necessarily investing in or developing new reserves and diversifying into a product mix that is going to be sellable in the years ahead of it. BHP is on top of its present and future climate footprint, because it’s on top of the materials mix that the rest of the industrial world is going to need in the coming decades as it works to reduce emissions and adjust to a warmer earth with more people in it.

That’s how it earns. And that’s why it’s investing heavily in Canadian potash.

Meet George Jansen: Potash is BHP’s Future

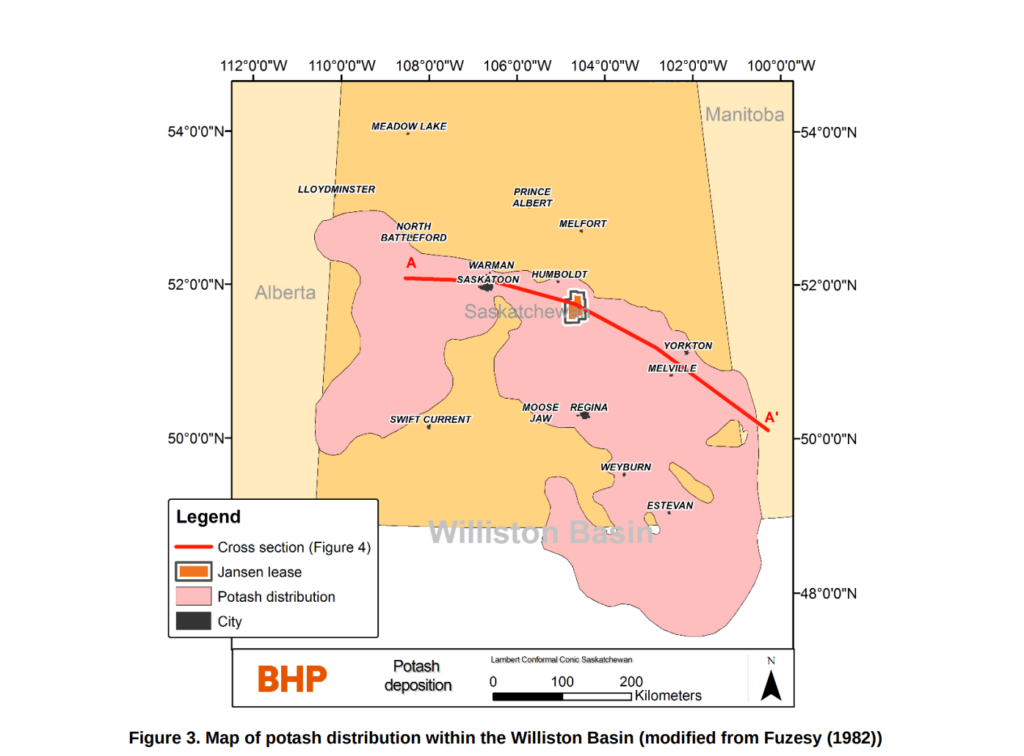

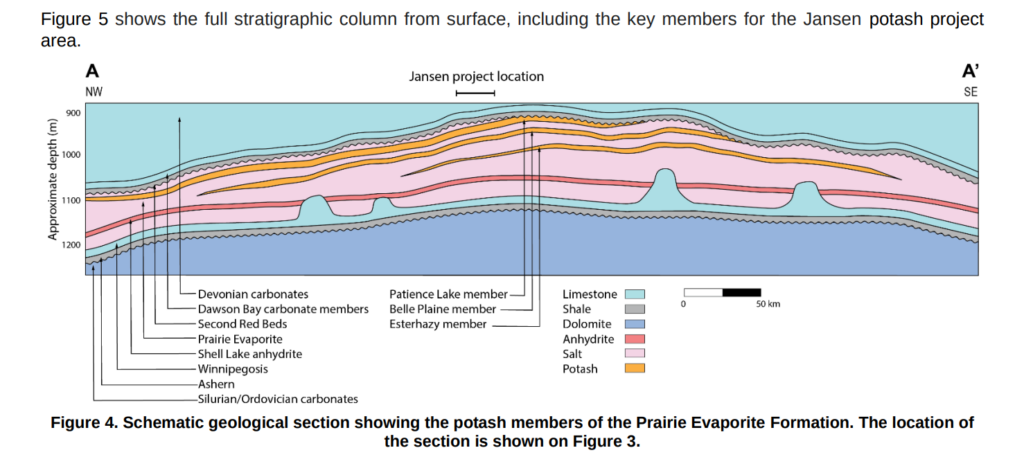

The Jansen potash deposit, 140 miles East of Saskatoon, Saskatchewan, is Canada’s largest undeveloped potash deposit. It’s a section of the Williston Basin, an extensive evaporite formation that starts about 900 – 1100 meters in depth, and is hundreds of thousands of square kilometers in size.

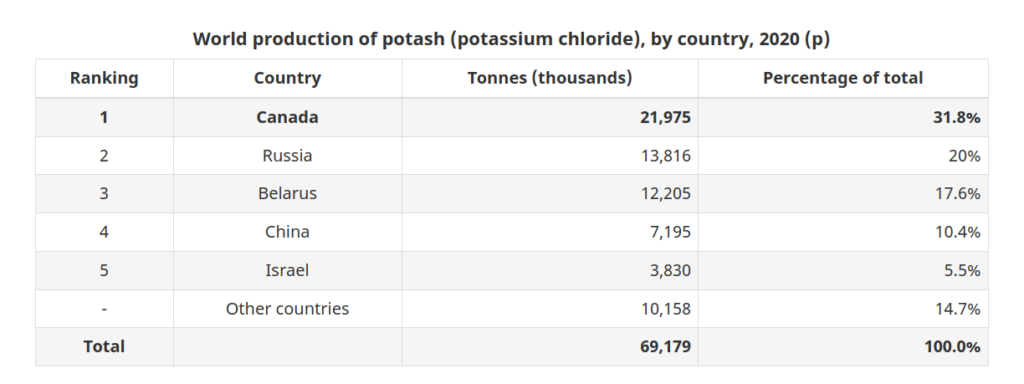

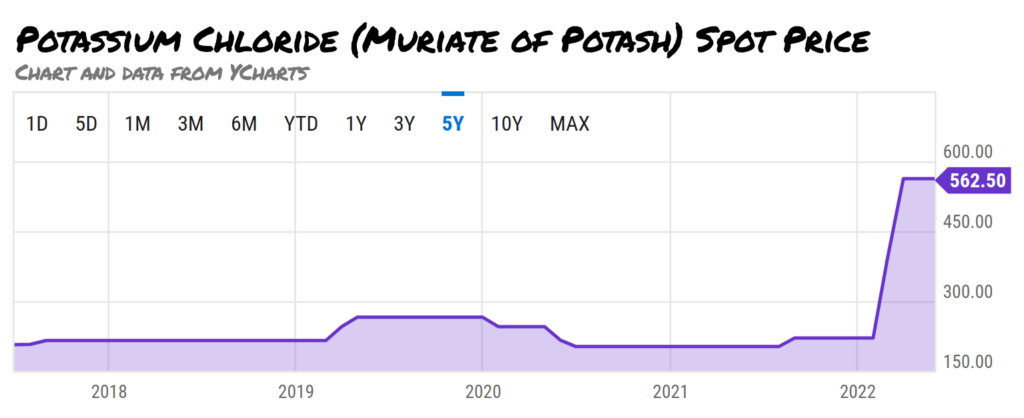

Potash is a key component of the high-grade fertilizer that is used in modern agriculture. Its price has been on the climb lately, because there is only so much of it, and a great deal of it comes from Russia.

As international trade with Russia becomes more and more problematic, the next largest exporter outside of Canada is Belarus. Belaruskali, the state-run company responsible for potash production, is frequently besieged by labour unrest, and necessarily exists in the shadow of Russian influence. Canada is a safe bet that hosts enormous reserves and is the home of all the skilled labour that a mining company could ever need. BHP calculates total reserves at Jansen at 6.5 billion tonnes, at a grade of 25.6% K2O. At the rate the company plans to mine it and ship it, that’s 94 years worth of reserves. Conceivably, the project could still be expanded.

BHP has a 100% interest in Jansen, and is treating it as a definite and important part of the organization’s future. Its chosen narrative also puts its enormous nickel and copper operations in prime growth positions during this global shift towards renewables and mass electrification. It has taken steps to divest itself of its energy coal assets, and uses the word “transition” a lot when it describes its oil and gas assets, which are needed to “supply energy needed over the coming energy transition.” The oil and gas assets it owns and operates are very much value generators in the present, but potash is the future.

Starting in 2027, Jansen is expected to produce 4.35 million tonnes per year of potash. That would have accounted for just under 20% of the total Canadian volume in 2020. High potash prices figure to draw more tonnage out of existing producers between now and when Jansen starts shipping, but BHP isn’t worried about sustainability of price. Population growth and a finite amount of arable land, some of which may not be around for much longer on a warming planet, dictate that the most possible production has to be squeezed out of every available patch.

BHP has been very clear about its intention to develop this important legacy asset with a commitment to creating very low carbon emissions, which is consistent with its company-wide move into a low carbon future. But the real trick is the way they squeezed a hundred million dollars out of the Canadian government in the process.

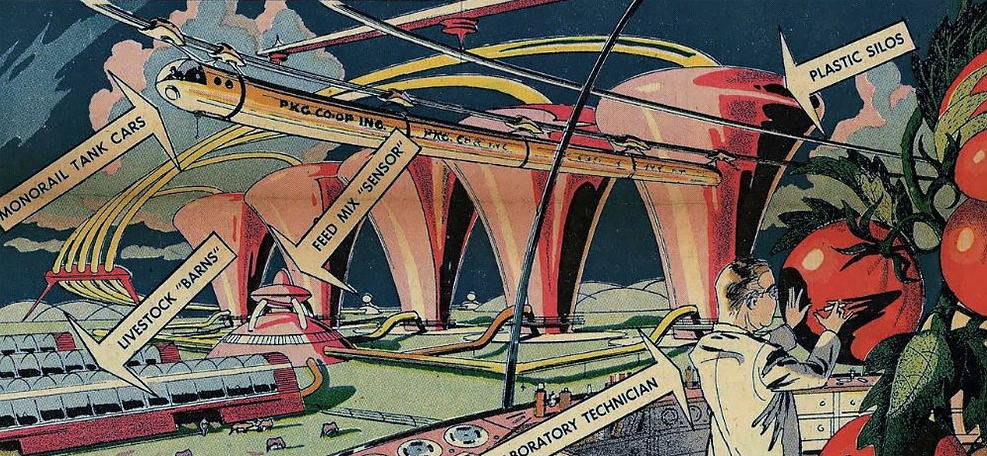

We’ll get Phase 2 of Sustain-O-Farm started for $50 million. Phase 1 was this drawing.

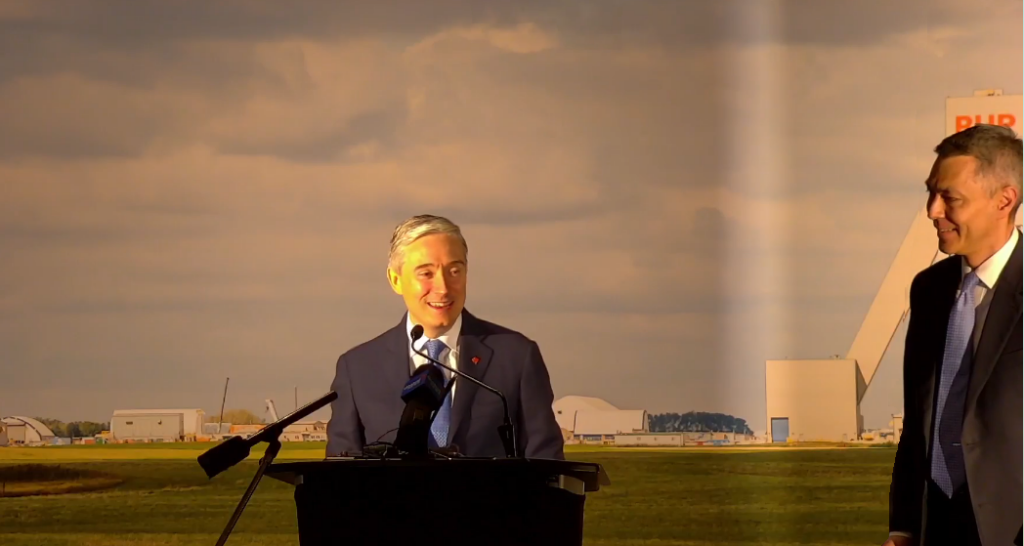

François-Philippe Champagne, the Liberal government’s Minister of Innovation, Science and Industry, stepped to the podium at a Monday press conference in Saskatoon positively delighted. He was standing up there with Mike Henry; the actual, real-life CEO of BHP, giving the country what it needed most. Jobs. Green jobs! The days where the Canadians who work in literal salt mines have to inhale diesel exhaust while they’re doing it will soon come to an end. Pretty soon. They haven’t said how soon, exactly, it’s all still development stage stuff, and there’s not much in terms of specifics or details, but that suits the “innovation” minister just fine.

Innovation is practically a fetish with this government, whose strategic innovation fund has contributed $5.2 billion so far to all sorts of fun “innovation ecosystems.” There isn’t any indication that the taxpayers get to share in any of the IP that comes out of that innovation, but so what? Spreading around a bit of R&D money keeps the plants blossoming locally, so that the country might be able to share in the bloom.

But it isn’t as though BHP is going to go and start a hundred year potash mine somewhere else instead. The resources are where they are, and BHP can’t move them like an NFL team who wants to leverage the city into building it a new stadium. If it were up to Champagne, he’d be building statues of the BHP board of directors for undertaking a $7.5 billion dollar build in Saskatchewan, as if they could have spent any less to get it done, and as if they were ever going to spend it anywhere else. BHP’s after-tax profit in 2021 alone was $13.4 billion, and the company has clearly calculated that its oil and coal projects’ days are numbered. The government doesn’t have to give BHP $100 million to cut its carbon emissions. It can just tell BHP to cut its carbon emissions, because it makes the rules. Nominally.

Monday’s dog and pony show made it seem like the money was beside the point. The event was practically an advertisement for BHP, who calls the shots, and plans to continue calling the shots for the next 94 years at least.

The ministry practically coughed up $100 million of taxpayer money just to be part of the action. Just so Champagne could stand up there next to BP and drink it all in. He wore the beaming, genuine smile that politicians get when they’re in the middle of a high-profile success. The BHP executives, by contrast, wore the subdued, satisfied grins of poker sharps who stumbled across a tourist who’s working his way through a roll of someone else’s money at a high-limit table, just to experience it.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.