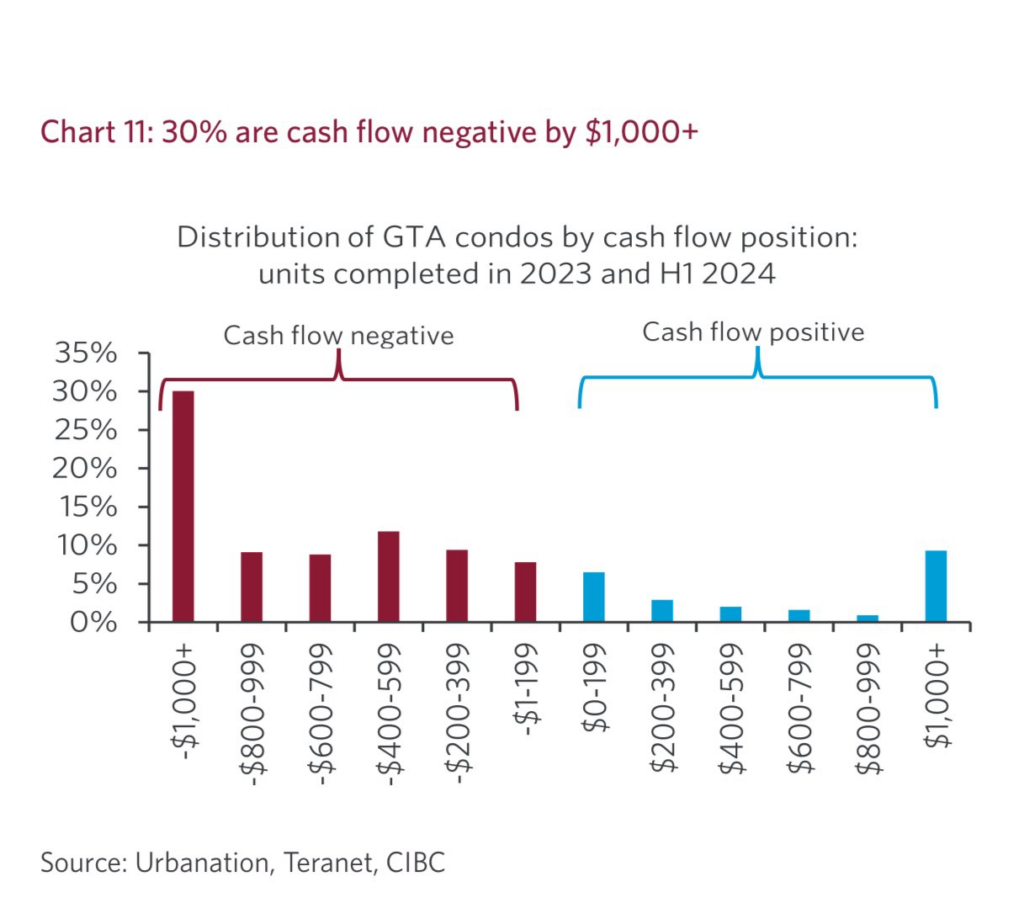

New data reveals significant financial distress in the Greater Toronto Area (GTA) condo market as Canada grapples with an escalating real estate crisis. Recent reports from Urbanation, Teranet, and CIBC paint a grim picture of the current state of the market, highlighting the potential for widespread economic repercussions if corrective measures are not taken swiftly.

One of the most alarming findings is that 30% of newly completed GTA condos in 2023 and the first half of 2024 are cash flow negative by over $1,000. This significant financial strain on property owners is depicted in a recent chart showing the distribution of GTA condos by cash flow position. The majority of these units are deeply in the red, indicating that many investors and homeowners are unable to cover their expenses through rental income.

Daniel Foch, a real estate expert, expressed his concerns on social media: “This is the biggest challenge facing Canada’s economy right now. There are BILLIONS of dollars in unrealized losses in the condo pipeline that will be absorbed by retail investors. Many buyers don’t want to take possession of the units they committed to purchasing. Just as many can’t afford to.”

The situation is exacerbated by plummeting condo sales. According to Urbanation and CIBC Capital Markets, new condominium sales have hit their lowest levels since the 1980s. A chart tracking GTA new condominium sales from Q1-87 to Q2-24 shows a sharp decline, with sales figures falling off a cliff in recent quarters. This downward trend underscores a significant lack of demand in the market, further straining developers and investors.

Compounding the problem is a steep decline in condo construction. The number of units and projects under construction has been dropping rapidly since early 2023. A chart illustrating GTA condos under construction from Q1-2014 to Q2-2024 highlights this dramatic downturn, indicating a potential future shortage in housing supply if the trend continues.

This is the biggest challenge facing Canada’s economy right now.

— Daniel Foch (@daniel_foch) July 25, 2024

It is one of the biggest challenges we've ever faced.

There are BILLIONS of dollars in unrealized losses in the condo pipeline that will be absorbed by retail investors.

Many buyers don't want to take possession… pic.twitter.com/Rf17apfyCS

Additionally, projects are struggling to secure financing, with many unable to qualify for construction loans. Another chart shows the percentage of preconstruction condos sold, which has plummeted from around 70% to below 50% between Q1-2004 and Q2-2024. This decline in pre-sales indicates a lack of confidence among buyers, which is critical for securing construction financing.

Experts and industry observers are calling for immediate government intervention to mitigate the crisis. Foch suggested, “The government would be very wise to get working on a CMHC or similar program to get unsold inventory product into the rental market, rather than sitting empty and bleeding out builders and developers, and causing a liquidity crisis for new owners.” This move, he argues, could alleviate some of the financial pressure on developers and help increase rental supply.

tldr; WE NEED TO BAILOUT THOSE THAT HAVE BENEFITTED MOST FROM AN OVERHEATED HOUSING MARKET

— The Deep Dive (@TheDeepDive_ca) July 27, 2024

Privatized gains, socialized losses is not something ANYONE should advocate for. That's not capitalism.

Money needs to move out of the real estate industry to actual productive industry. https://t.co/5mYQMBupLu

The potential economic fallout from this real estate crisis cannot be understated. With many condos sitting vacant and developers facing financial ruin, the ripple effects could extend to the broader economy. Banks are already taking significant risks and making serious compromises to keep the system moving, as highlighted by Foch’s comments.

Foch warns of the long-term impacts, emphasizing that “the second-order effects of this will last a decade.”

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.