At the start of the month Nevada Copper (TSX: NCU) provided investors with an operational and financial update. Within, the company indicated that it encountered an unidentified weak rock structure in the main ramp to the East South Zone at its Pumpkin Hollow project in Nevada. Since then the company has “taken steps to curtail operating activities while developing plans to address this issue.”

The company adds that it has continued its development of the priority heading through the dike structure and into the East North mining zone while warning that it may not be able to continue its work on the ramp due to liquidity issues.

Then on July 4, Nevada Copper said that it agreed to a debt extension for up to US$70 million, with US$30 million in additional funds made available for advance by the lenders and the other US$20 million available for a future draw by the company.

The company also announced that it “has not made payments that were due to certain creditors and vendors, including its mining contractor Redpath,” and that the company has been served a notice of default by Redpath. Though they note that both companies have reached an agreement to stop any mining work at the underground project.

There are currently 3 analysts covering Nevada Copper with an average 12-month price target of C$0.62, or an upside of roughly 170%. Out of the 3 analysts, 2 have hold ratings while 1 analyst has a sell rating on the stock. The street high price target sits at C$0.75 which represents an upside of about 225%.

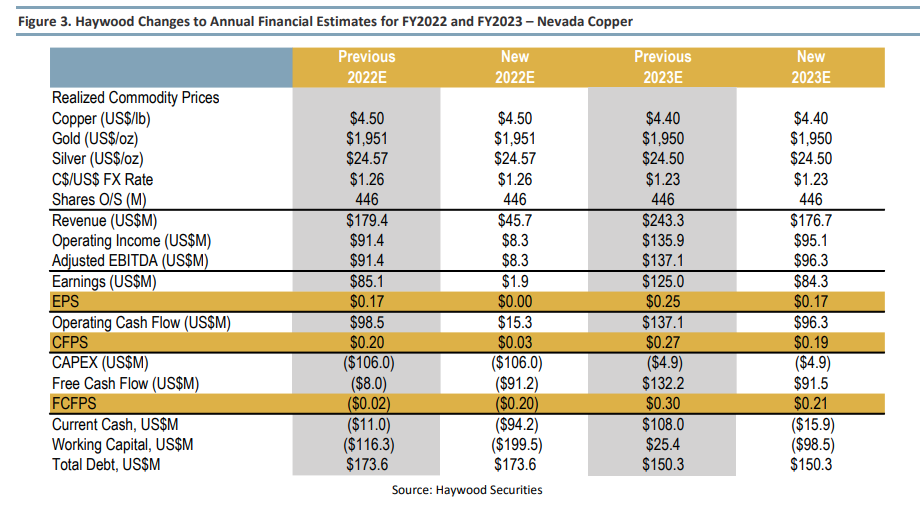

In Haywood Capital Markets’ note on the news, they reiterate their hold rating on the stock and slash their 12-month price target from C$0.60 to C$0.25, saying that while the new financing helps bring the company back from the brink, it is still not out and in the clear, as the company has close to $200 million in debt and a 38% equity ownership by Pala which will make obtaining new investment a challenge.

Haywood goes on to say that if the debt financing is implemented, it will help stabilize the company and allow them to maintain the assets at the Pumpkin Hollow mine, complete the required dike crossing and advance the open-pit mine feasibility study.

Lastly, Haywood expects that Nevada Copper will revise its production targets and guidance. They have elected to lower their estimates. Haywood now expects copper production will be 10 million pounds in 2022, down from 41 million previously expected. By 2023, they expect the company to produce 40 million pounds, down from 56 million.

Below you can see Haywood’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.