Heliostar Metals (TSXV: HSTR) has released the results of a prefeasibility study conducted on their up and coming Cerro del Gallo project, found in Guanajuato, Mexico.

The study has outlined a net present value of US$424 million alongside an IRR of 33.1% and a payback period of 2.3 years at a gold price of US$2,300 an ounce. Closer to spot, at US$3,900 an ounce the NPV climbs to US$972 million and the IRR to 59.3%, while the payback period drops to 1.4 years.

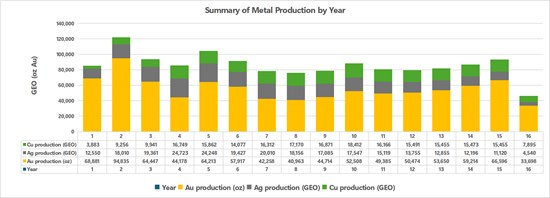

That estimate is based on an open pit operation that would produce 85,700 gold equivalent ounces per year over a 15.3 year life of mine, generating estimated annual average free cash flow of US$47.6 million. On the mining side, head grades are expected to average 0.73 g/t gold equivalent over the life of mine, while the strip ratio is pegged at just 0.3:1.

Heliostar is proposing Cerro del Gallo as a heap leach operation, with the flowsheet proposing the use of an adsorption, desorption, and recovery circuit for gold recovery to produce gold dore on site. Copper and silver meanwhile will be dissolved in solution will be recovered through a sulphidization, acidification, recycling and thickening circuit to be shipped to smelters. Average recoveries of 59.4% are expected for gold, along with 49.3% for silver and 61.8% for copper.

In terms of costing, initial capital costs are pegged at US$195.3 million, while sustaining costs are estimated at US$160.3 million, with total life of mine capital costs estimated at just US$355.6 million. On a per ounce basis, cash costs are estimated at US$1,252 an ounce, while AISC is estimated at US$1,390 an ounce.

“The Cerro del Gallo Prefeasibility Study demonstrates a mine that fits perfectly with Heliostar’s growth trajectory to larger, lower cost operations. The project has low CAPEX, shows strong free cash flow at a conservative gold price and significant resource upside,” commented Charles Funk, CEO of Heliostar.

“This study confirms Cerro del Gallo as an important development project in the Heliostar portfolio, and the Company plans to continue technical work, permitting and community engagement to advance the project to a feasibility level. Organic growth from Ana Paula first, and later from Cerro del Gallo, is planned to launch Heliostar to 300,000 ounces of annual gold equivalent production by the end of the decade.”

Heliostar Metals last traded at $2.53 on the TSX Venture.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.