After sprinting to a fresh record around $81 per ounce, the silver market is now unwinding leverage and taking profit, pushing spot back toward the mid-$70s in a tape that is still up roughly 160% to 166% YTD.

The price action is internally consistent with a pullback, not a regime change. The silver is swinging hard around a mid-$70s handle after an $81 spike.

Wow! What a ride!

— TF Metals Report (@TFMetals) December 29, 2025

And Shanghai doesn't open for another 30 minutes… pic.twitter.com/Ft6r3cunNS

🚨 Silver Price just cut below $75/ounce spot. Nearly $9/ounce range in last 90-minutes!

— Peter Spina ⚒ GoldSeek | SilverSeek (@goldseek) December 29, 2025

Illiquidity = volatility.

China opens in 30 minutes. pic.twitter.com/bOIhvWFKVX

The first driver is simple: profit-taking after an end-of-year vertical move, with the Monday slide attributed to profit-taking following the record. In a market that had just delivered a one-way melt-up, even modest selling pressure can gap the tape lower.

This is insane.

— Subu Trade (@SubuTrade) December 26, 2025

At 3:52 pm today, someone bought $429 million of Silver Miners ETF $SILJ Calls, expiring January-February 2026

$429 million in Calls, betting on Silver Miners to rally 🤯 pic.twitter.com/8sBuHphLbc

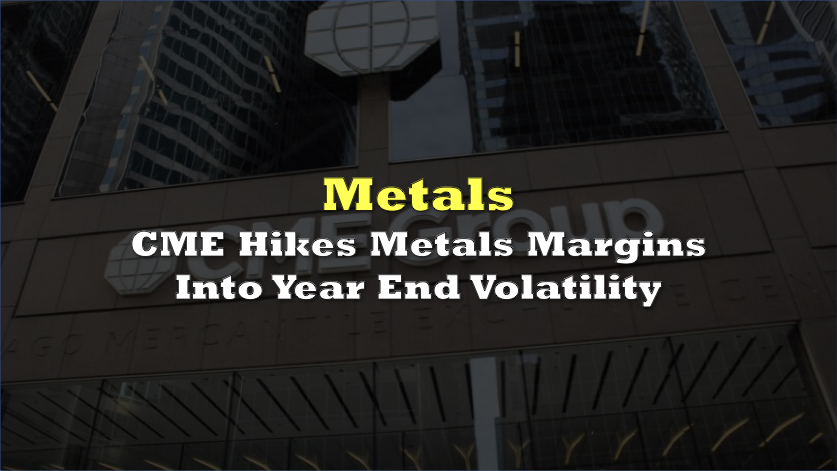

The second driver is leverage getting more expensive at the worst possible moment for crowded longs. A CME table shows higher minimum performance bond requirements for COMEX 5000 Silver Futures: Non-HRP initial and maintenance margins rose from $22,000 to $25,000, while HRP initial rose from $24,200 to $27,500 and HRP maintenance from $22,000 to $25,000. Higher margin requirements mechanically reduce buying power and can force position reductions if accounts are tight.

CME Margin requirements raised for commodities.

— Zoomer 🧢 (@zoomyzoomm) December 26, 2025

It’s over.

Short $gld $slv $pplt $pall pic.twitter.com/4IrMYbU13Y

🚨 THE CME GROUP JUST PULLED THE RUG ON #SILVER 🚨

— Terel Miles – Freedom Stocks (@FreedomStocks) December 26, 2025

If you watched the price action today, this is a MUST read.

Earlier today, December 26, 2025, the CME Group (COMEX) dropped a bombshell: Advisory #25-393.

Effective Monday, December 29, they are hiking silver margin… https://t.co/5KGItxThdg pic.twitter.com/ptUGCqahuc

300:1 paper to physical

— Roberto Rios (@peruvian_bull) December 26, 2025

remember that. sear it into your brain. https://t.co/xwjRkUVy3v

READ: CME Lifts Silver Futures Margins Across Front Months

The volatility itself is part of the explanation. An observer described the 10% silver price move as a “4–5 sigma event,” and another flagged nearly a $9 range in roughly 90 minutes, explicitly tying the chop to illiquidity.

Today’s 10% move in Silver is a 4-5 sigma event.

— Edward Dowd (@DowdEdward) December 26, 2025

A 3.8 sigma move is the chance that you personally get hit by lightning at least once in your lifetime…so not likely.

You are witnessing history today.

The third driver is “macro headline parsing” that matters mainly because it affects risk sentiment intraday. Investors were weighing geopolitics after President Donald Trump said peace talks with Ukrainian President Volodymyr Zelensky had made “a lot of progress,” while also saying a deal could take weeks, and adding he is open to addressing Ukraine’s parliament, trilateral talks with Zelensky and Russian President Vladimir Putin, and meeting European leaders in January.

READ: China Silver Benchmark Jumps As Physical Tightness Bites

Crucially, the pullback is happening inside a metals complex that is still extremely extended on the year. In the same snapshot, gold was $4,456.96 per ounce (+71.07% YTD) while silver showed +160.45% YTD. Platinum was $2,329.40 per ounce (+159.34% YTD).

So what’s going on is not one thing. It is a three-part unwind: a post-record profit-take, a leverage squeeze via higher margins, and a headline-sensitive risk tone, all playing out in a market that remains massively up on the year and structurally prone to whiplash.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.