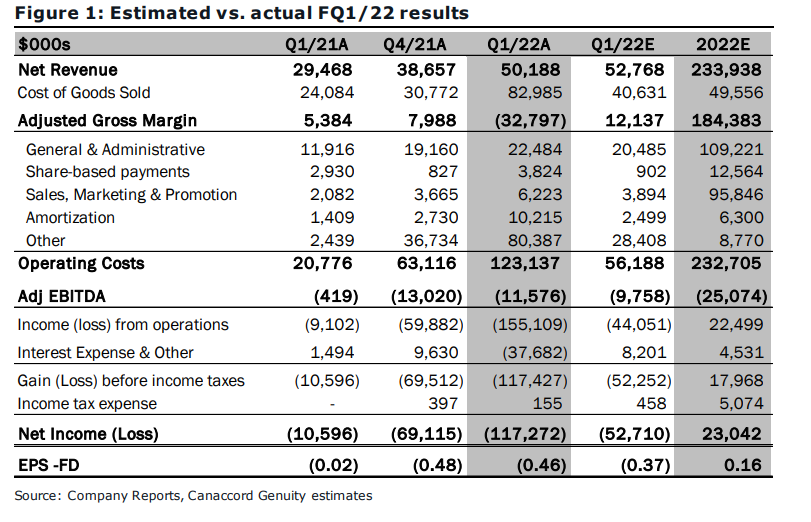

On December 14th, Hexo Corp (TSX: HEXO) reported its fiscal first quarter 2022 results. The company reported total net revenues of $50.2 million, an increase of 29% quarter over year. The company noted that Redecan and 48North contributed roughly $13.5 and $1.1 million to the companies total revenue for this quarter. Although, the company reported a gross loss of $32.8 million due to the company’s cost of goods sold being $83 million.

Additionally, the company announced that it expects to see $50 million in synergies from the acquisitions, a figure previously pegged at $35 million, and they are now forecasting positive cash flow within the next four quarters.

HEXO also reported during the quarter “transitory expenses” that come from a number of different impairments. The company reported a $23.8 million impairment of property, plant, and equipment and another $26.9 million investment impairment.

Subsequently, analysts lowered their 12-month price target on HEXO, bringing the 12-month average price target to C$2.27, or a 112% upside to the current stock price. There are 10 analysts covering the stock, with 1 analyst having a buy rating, 5 have hold ratings, 3 have sell ratings and 1 analyst has a strong sell rating. The street high sits at C$5.00 from Alliance Global Partners while the lowest comes in at $0.80.

In Canaccord’s fiscal first quarter review, they slash their 12-month price target in half, from C$2.00 to C$1.00, and reiterate their hold rating on the name, saying, “Declining organic growth, asset impairments, and an elevated debt burden point to a troubled start to FY22.”

Canaccord expects HEXO’s balance sheet to be an issue as the company ended the quarter with roughly C$56 million in unrestricted cash while the company had C$362 million of debt. Most notably, the company has a C$278 million senior convertible note outstanding. Canaccord says “if converted at current prices, would result in the issuance of >250M shares – a >70% increase from the company’s existing basic share count.”

For the results, the company missed every single one of Canaccord’s estimates, with the investment bank estimating revenue to be $53.77 million. While gross margins were expected to be $12.14 million and adjusted EBITDA was estimated at ($9.76) million.

Canaccord says that the HEXO saw an organic decline in revenue of roughly 10% and their sale data points to flat or negative growth for many of the company’s brands this year. Specifically, the company saw a >50% decrease reduction in Alberta due to “a significant reduction in its Original Stash value flower in the period.”

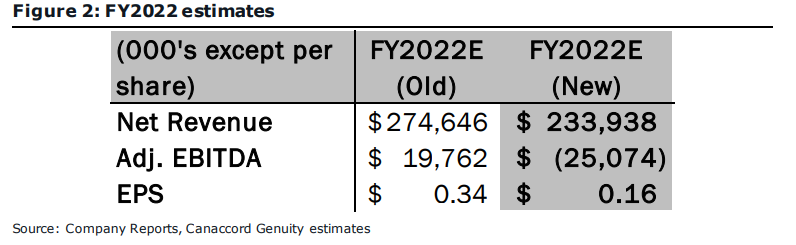

Below you can see Canaccord’s updated fiscal full-year 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.