On Monday, Hexo Corp (TSX: HEXO) (NYSE: HEXO) reported their fiscal third-quarter estimates which missed consensus estimates significantly. HEXO reported revenues of $22.7 million, a measly 2% increase year over year and a ~31% decrease quarter over quarter. Gross profit came in at $4.38 million, and had the same fate as revenue, cratering 61.3% quarter over quarter.

Many analysts have come out and lowered their targets and ratings on the company. ATB, Alliance, CIBC, Stifel-GMP, and Canaccord lowered their 12-month price targets bringing the consensus 12-month price target to C$8.43, down from C$9.47 from before the release. The company has 12 analysts covering the stock with three analysts having buy ratings, eight analysts have hold ratings and one analyst has a strong sell rating. The street high comes from Alliance Global with a C$12 price target while the lowest comes in at C$5.97.

In Canaccord’s note, they lowered their 12-month price target to C$7.00 from C$9.00 and reiterated their hold rating on the name. Matt Bottomley says that this quarter “represented a step back with respect to the company’s execution in its core legacy business,” even though the recent M&A puts the company in a top-three market share position.

For this quarter, the company reported revenues $10 million lower than Canaccord’s estimates. This is concerning to Bottomley due to the company seeing sales in its core market drop by $5.2 million and the company having issues with its production of hash products during the quarter. BUT the company boasted a leading market share of 46% in beverages!

Bottomley warns that the volatility in LP’s revenue might continue as “the saturated Canadian cannabis landscape continues to evolve,” and believes that this is a very high risk to the LP’s fundamentals.

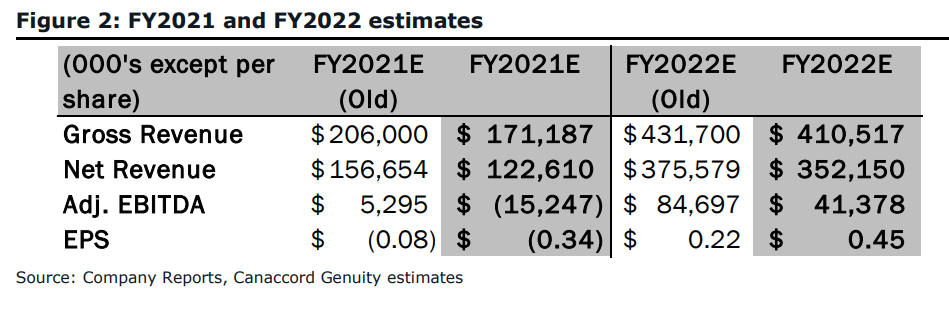

Below you can see Canaccord’s updated full-year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.