On March 18th, Hexo Corp (TSX: HEXO) (NYSE: HEXO) reported their fiscal second quarter results. The company announced that it saw revenue grow 12% quarter over quarter to $32.8 million, alongside a positive adjusted EBITDA number of just $202. The company also announced that its non-beverage segment grew 72% and maintained its number one market share in Quebec.

Hexo currently has 13 analysts covering the company with a weighted 12-month price target of C$8.69. This is up from last month, which was C$6.94. Two analysts have buy ratings, while nine have hold ratings. One analyst has a strong sell rating and one analyst has a strong sell on the company. The street high comes from Alliance Global Partners who has a C$14 price target.

Below are the latest analyst changes:

- CIBC cuts target price to C$13.00 from C$13.50

- MKM Partners raises fair value to C$8.00 from C$1.30

- Canaccord Genuity raises target price to C$9.50 from $8.00

In Canaccord’s note, Matt Bottomley reiterates his hold rating while increasing his price target. He headlines, “FQ2/21 review: An in-line print while HEXO maintains a top-four market position in Canada.” Bottomley says that the reason he increased their price target is due to the incremental step up during this quarter as well as a strong balance sheet. He writes, “we believe HEXO is making strides to better right-size its operations with current market conditions.”

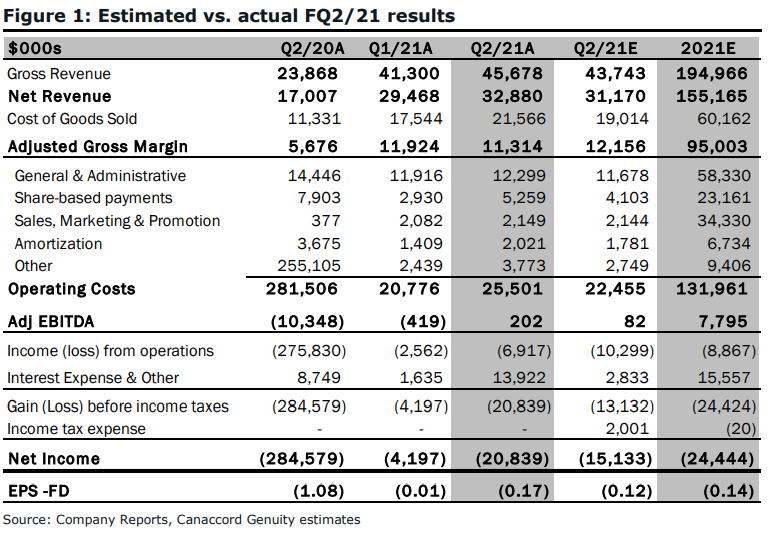

Hexo slightly fell below Canaccord’s estimates for this quarter on a handful of metrics, while beating revenue estimates. Most notably, Canaccord was forecasting $31.2 million for revenue, a gross margin of $12.2 million, and that net income would come in at -$15.1 million. Bottomley commends Hexo for retaining the number 1 position in Quebec and says that their growth was primarily due to higher adult-use penetration alongside a ~10% growth in its beverage products. Below you can see how Hexo’s numbers lined up with Canaccord’s estimates.

Bottomley adds additional commentary to why LP’s have not kept up with the overall growth in the market. He writes, “we believe the highly competitive landscape for producers has resulted in an oversupply of infrastructure and inventory while dispensary locations are still in the process of ramping up to critical mass.”

Bottomley touches on the acquisition of Zenabis by Hexo. To cut it short he summarizes his thoughts by writing this, “we believe HEXO is making strides to better right-size its operations with current market conditions.”

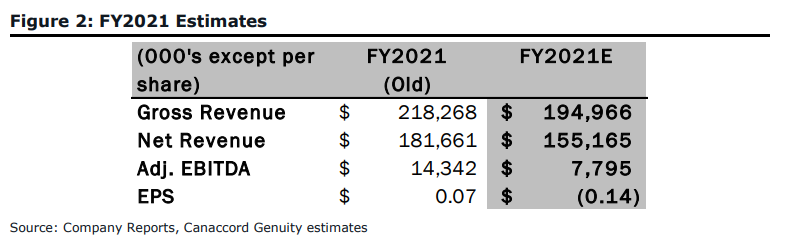

Below you can see Canaccord’s new estimates for fiscal 2021.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Hexo board of directors are way over compensated. This expense distortion are to the traceable income they have the ability to generate. Market share without income is easy to achieve.