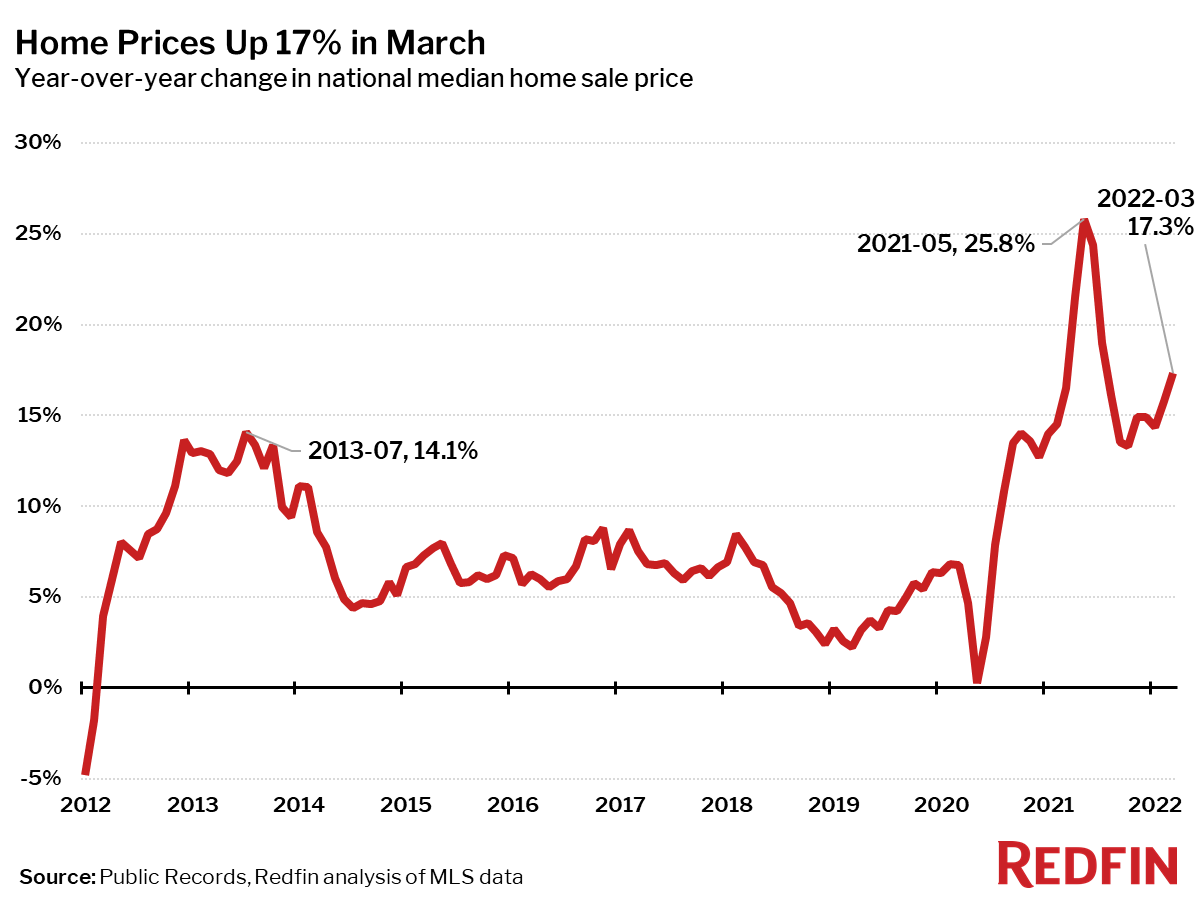

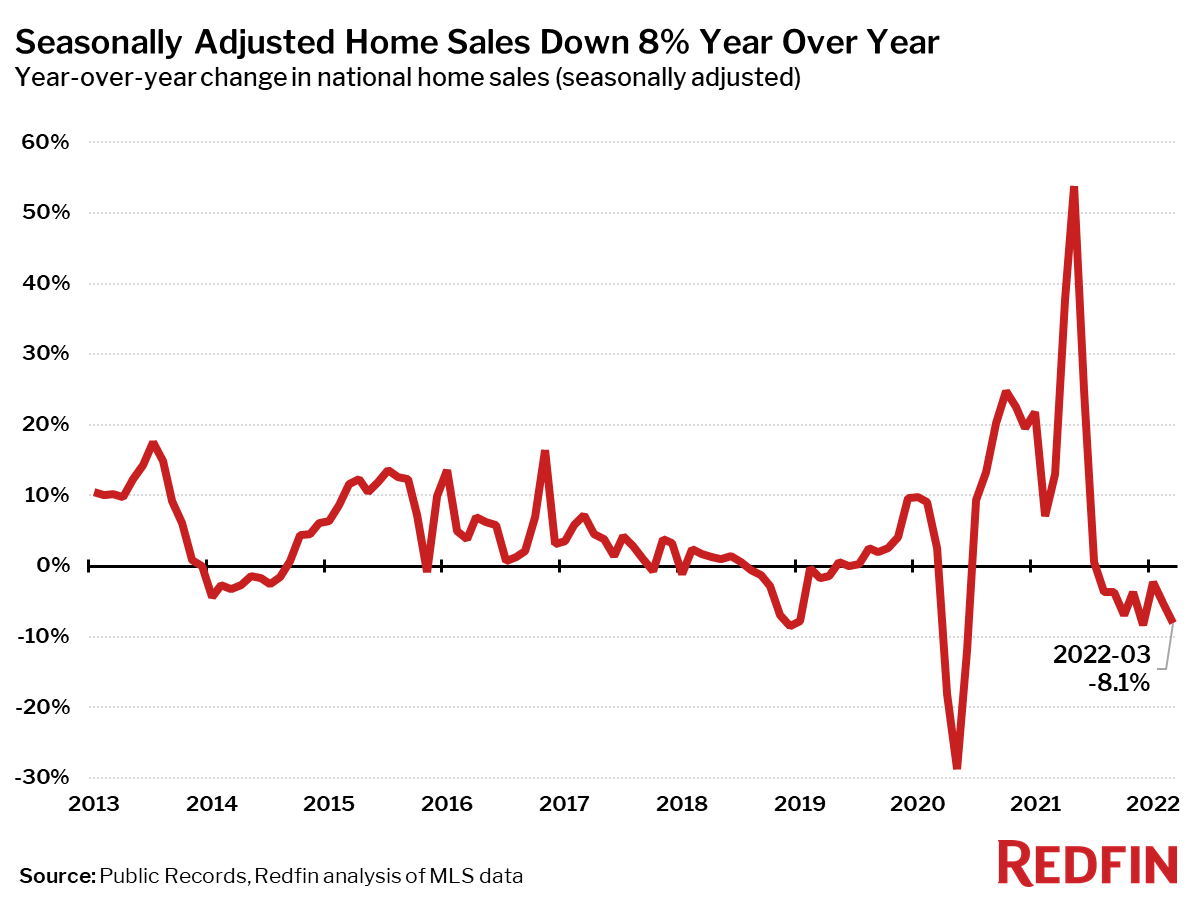

Homebuyers are seemingly backing out of the market as month-on-month home sales dropped by almost 4% in March 2022, according to a real estate brokerage.

Citing its own report, real estate company Redfin (NASDAQ: RDFN) said that they saw a 3.7% reduction in home sales compared to last month. One of the key reasons for this is the rising mortgage rates and prices, with median sale price jumping 6% over last month to an all-time high of US$412,700.

“We expect the combination of surging mortgage rates and record-high home prices to cause more homebuyers to drop out of the market,” said Redfin chief economist Daryl Fairweather. “Unfortunately, homeowners are turning their back on the market too. Instead of being motivated to list before prices weaken, potential home sellers may be choosing to wait-out the impending market cooldown.”

The firm also said that while the data shows “the hottest March market on record,” the market showed early signs of cooldown towards the end.

The highest price increases were reported in Tampa, Florida (+29%), Phoenix, Arizona (+27%), and McAllen, Texas (+27%).

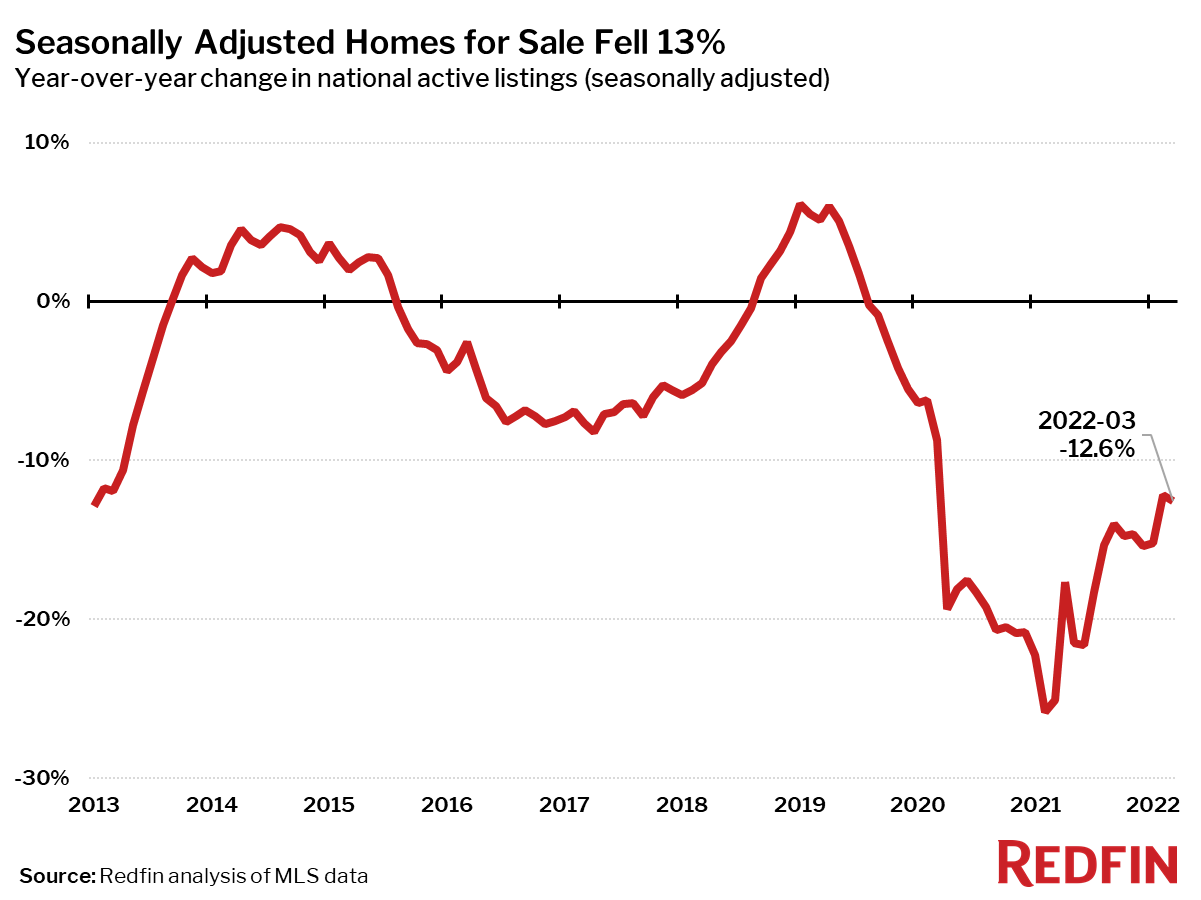

Homebuyers also had fewer options during the month as active listings declined by 12.6% year-on-year to an all-time low. The biggest declines were reported in Allentown, Pennsylvania (-47%), Greensboro, North Carolina (-41%), and Fort Lauderdale, Florida (-37%).

However, those who are able to buy real estate are seemingly willing to pay more than the listed price. Around 54% of the homes sold for the month were purchased above the listing and the average sale-to-list price ratio was 102.4%, both of which are all-time high records for this time of the year.

Redfin has been tracking the real estate market in 88 largest metro areas in the US.

Information for this briefing was found via Redfin. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.