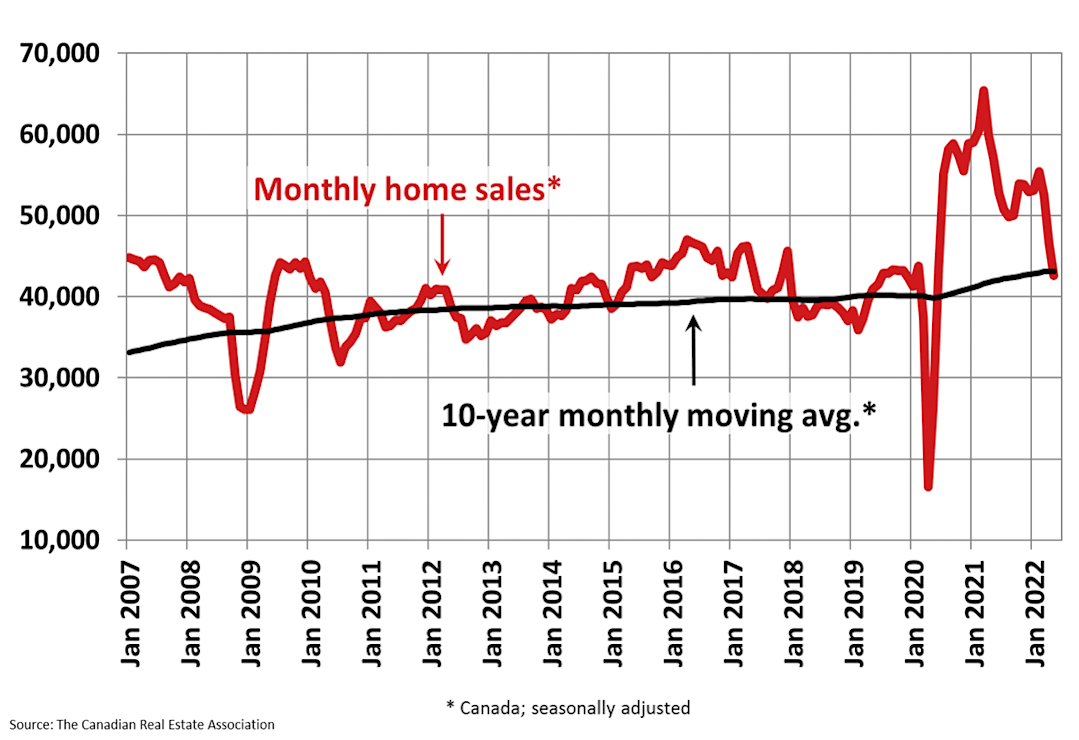

Latest statistics from the Canadian Real Estate Association (CREA) show home sales continuing the downward trend, falling 8.6% month-on-month in May. This brings the market activity closer to its pre-pandemic levels.

Non-seasonally adjusted home sales also fell 21.7% from the same period last year, selling 53,720 houses compared to 68,598 units in May 2021.

“May picked up where April left off, with sales activity continuing to slow and softening prices in many parts of the country,” said CREA Chair Jill Oudil.

The market is seeing a normalization of activity coming from the recent spike as Canada reels from the pandemic. The agency said “inventories are finally beginning to rebuild from record lows.”

“We are in a period of rapid change, but one that should settle to a more balanced housing market in time,” added Oudil.

But while the slowdown is expected, CREA’s Senior Economist Shaun Cathcart highlights “how fast we got here.”

“With the now very steep expected pace of Bank of Canada rate hikes, and fixed mortgage rates getting way out in front of those, instead of playing out steadily over two years, that cooling off of sales and prices seems to have mostly played out over the last two months,” Cathcart said.

Newly listed houses increased 4.5% on a month-to-month basis, putting the sales-to-new listings ratio down to 57.5%–its lowest level since April 2019.

Price point has also marginally declined by 0.8% from the previous month, with the national benchmark price ending at $822,900.

For 2022, the agency is estimating some 568,288 properties to trade hands, forecasting a 14.7% decline from 2021. Average home price is expected to increase by 10.8% from the previous year, pegged at $762,386.

Information for this briefing was found via Canadian Real Estate Association. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.