Canada’s largest real estate market does not appear to be having an energetic summer this year.

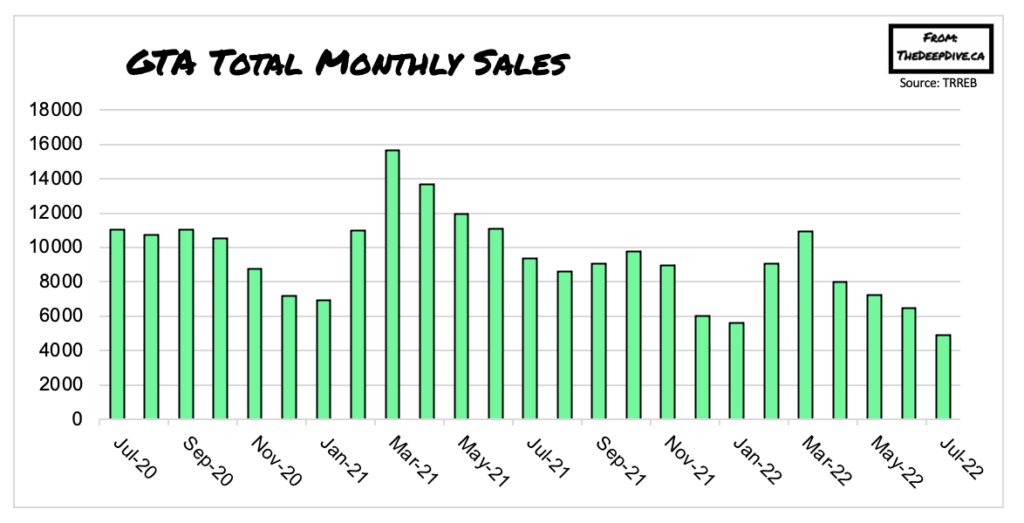

Latest data from the Toronto Real Estate Board (TRREB) shows that home sales plummeted 47.4% from July 2021, as sales activity fell 24.1% month-over-month. With the Bank of Canada aggressively raising interest rates, many potential homebuyers decided to remain on the sidelines over fears of affordability issues. “With significant increases to lending rates in a short period, there has been a shift in consumer sentiment, not market fundamentals,” said TRREB president Kevin Crigger.

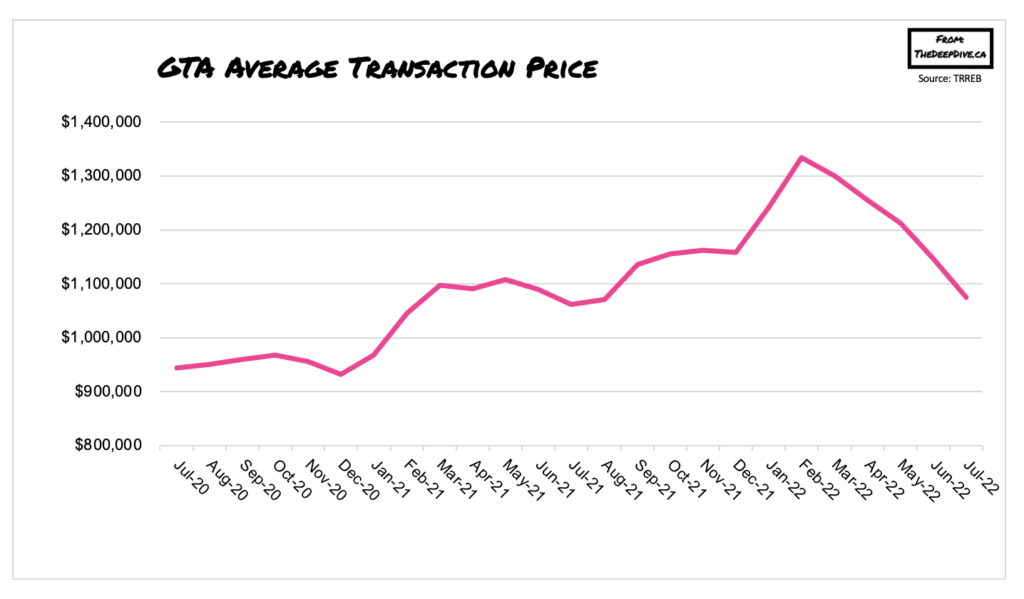

Following over a year of rapid price acceleration and strong demand for housing, Toronto’s real estate market is finally becoming more balanced this summer. With more choice available to buyers, the annual rate of price growth started to moderate, with the average selling price rising only 1.2% year-over-year to $1,074,754. “Despite more balanced market conditions resulting from rapidly increasing mortgage rates, policymakers must continue to take action to boost housing supply to account for long-term population growth,” said TRREB chief market analyst Jason Mercer.

Meanwhile, according to Crigger, the central bank acted too late in raising interest rates, and is now forced to play catch-up to curb the highest inflation in 40 years. “The federal government must enact measures which will assist buyers facing affordability challenges in an inflationary environment where costs are rising at the gas pumps, the grocery stores and everywhere in between.”

Information for this briefing was found via TRREB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.