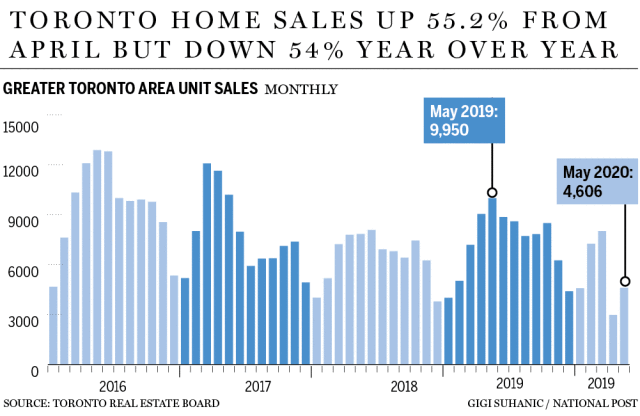

When the coronavirus pandemic made its way into Canada in February, a series of lockdown measures and stay-at-home orders were imposed, causing the housing market to become completely stagnant. By March, home sales in the Greater Toronto area were at a historical low, and both sellers and buyers exited the market for the time being. However, as the coronavirus storm is slowing beginning to subside, it appears that the housing market is on a path to recovery.

According to the Toronto Regional Real Estate Board (TRREB), the month of May has finally shown a small rebound in Canada’s largest real estate market. Housing sales have increased by 53.2% since April 2020, as some restrictions are being lifted and consumers are adjusting to the use of social distancing measures. However, activity is still far from reaching pre COVID-19 levels.

The average selling price for homes in the Greater Toronto Area in May was $863,599 – a figure that has remained relatively steady throughout the pandemic. The lack of change in housing prices is indicative of a decrease in home listings, which have dropped 42.8% year-over year. According to Jason Mercer, who is a chief market analyst at TRREB, the housing market will gradually continue on the path to pre-pandemic growth levels if there are no setbacks in the re-opening of Canada’s economy.

Information for this briefing was found via Bloomberg, National Post, and Toronto Real Estate Board. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.