Horizons ETFs this morning announced that its BetaPro Crude Oil Daily Bull ETF (TSX: HOU) and BetaPro Crude Oil -1x Daily Bear ETF (TSX: HOD) will resume the acceptance of new subscriptions effective May 5, 2020, while warning investors to not invest in the ETF’s until such time.

Horizons originally suspended subscriptions to the ETF’s on April 21, following a tumultuous day for oil futures wherein the price of the front month contract entered negative territory for the first time in history. In an effort to reduce exposure to the volatility, the ETF manager halted new subscriptions for the funds. This effectively made both HOU and HOD closed-ended mutual funds, in that the ETF’s did not trade near parity with its net asset value as intended.

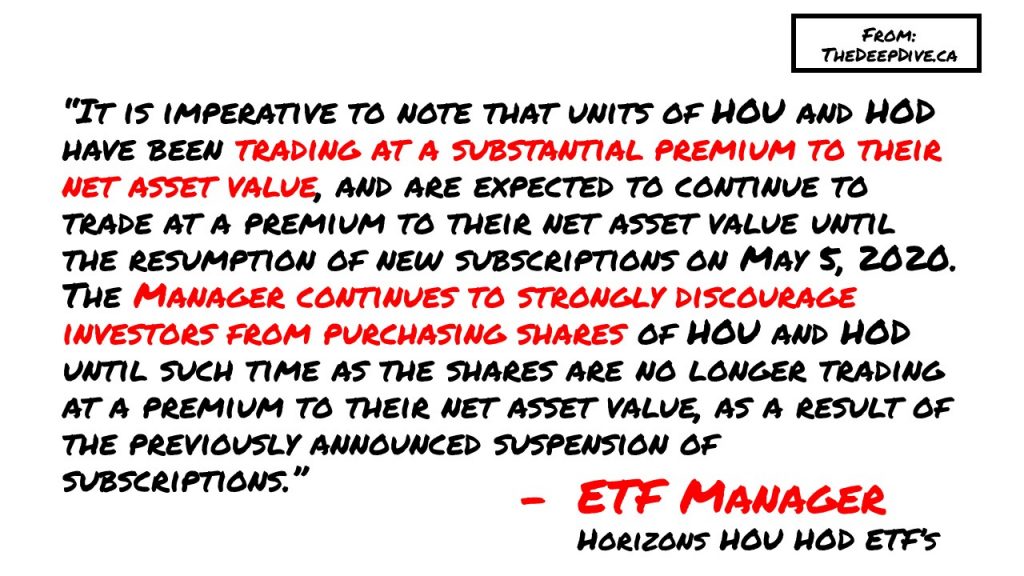

With both HOU and HOD now set to resume subscriptions as of 8:00 AM EST on May 25, with ETF manager has actually discouraged investors against trading in the shares of both ETF’s until after subscriptions have resumed. This is due to the fact that the net asset value, or NAV, of the funds has fallen far below the current price ascribed to the ETF’s, meaning that they are trading at a significant premium to their actual value.

HOU last traded at $16.26 on the TSX while having a net asset value of $9.42, representing a premium discount of 72.44%, while HOD last traded at $17.25 while having a NAV of $17.14, a premium discount of 0.60%.

It’s remains unclear on when both HOD and HOU are anticipated to return to 2x leverage.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

any advice to purchase HOU shares ? if i purchase shares am i going to have the chance to sell back the shares ? because it became confusing this stock .