i-80 Gold Corp (TSX: IAU) has released a preliminary economic assessment for its Mineral Point Project, which is part of the Ruby Hill Complex in Nevada. The estimate outlines a $614 million net present value with a 12% IRR on an after-tax basis, using a 5% discount rate.

That estimate is based on a gold price of $2,175 an ounce. At spot gold prices of $2,900 an ounce, the NPV is said to rise to $2.1 billion, while the IRR climbs to 27%, which again is on an after-tax basis using a 5% discount rate.

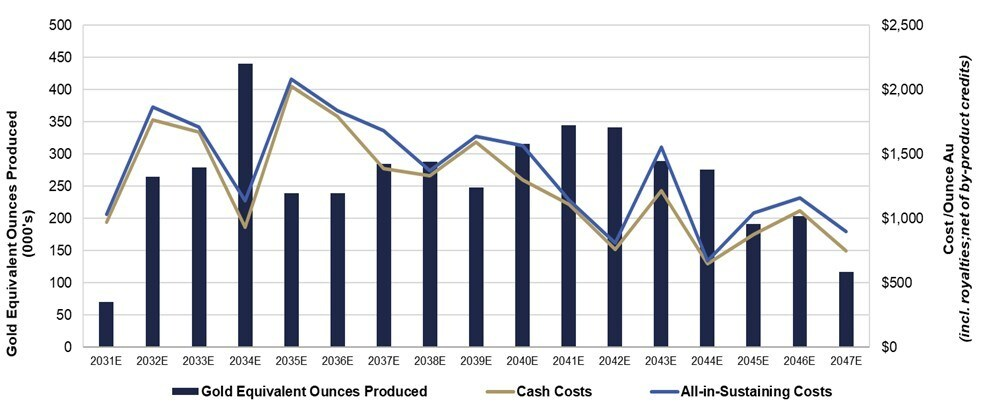

The study envisions an open pit heap leach mine, with a life of mine of 17 years. Annual gold equivalent production is estimated at 282,000 following production ramp up, while over the life of mine gold equivalent production is estimated at 268,000 ounces a year.

Average gold recoveries are estimated at 78% based on an expected grade of 0.39 g/t, while silver recoveries are estimated at a much lower 41% based on an average grade of 15.37 g/t, with 3.5 million ounces of gold and 72.0 million ounces of silver to be recovered over the life of mine.

Those ounces are expected to be recovered at a cash cost of $1,270 per gold equivalent ounce over the life of mine, while all in sustaining costs are estimated as $1,400 an ounce.

Initial capex is pegged at $708 million to get the project to a production-ready position, while a further $287 million needs to be spent in the first year of production on stripping in order to get to the mineralized body. Life of mine sustaining capital meanwhile is estimated at $388 million. Total capital costs are estimated at $1.45 billion.

READ: i-80 Gold Revised PEA Outlines $271 Million NPV For Cove Project

“A key driver of future growth, Mineral Point is the largest of our two planned oxide projects complementing our three high-grade underground mines in northern Nevada. With significant production scale, a long mine life, and low costs, Mineral Point is expected to be the flagship project within our portfolio,” commented Richard Young, CEO of i-80 Gold.

i-80 Gold last traded at $1.14 on the TSX.

Information for this story was found via the sources and the companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.