i-80 Gold (TSX: IAU) has released the results of its preliminary economic assessment conducted on the Granite Open Pit Project, which follows yesterdays release of a PEA focused on the underground portion of the project.

The open pit portion of the project is estimated to have an after-tax net present value of $421 million and an IRR of 30%, which is based on $2,175 per ounce gold and a discount rate of 5%. At $2,900 gold, that NPV is said to jump to $866 million while the internal rate of return climbs to 50%.

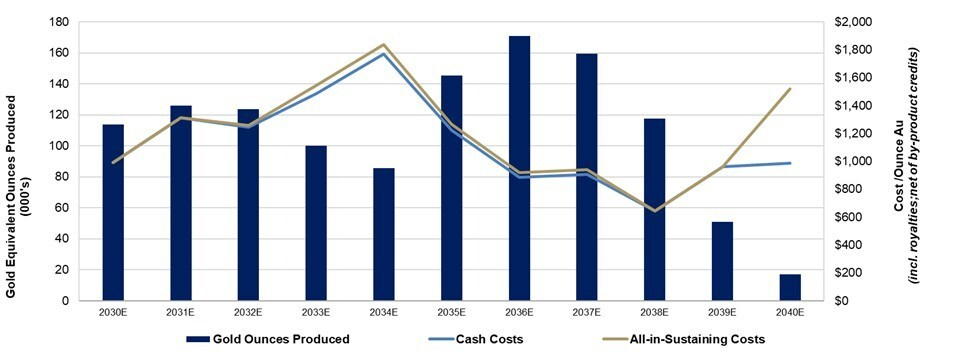

The estimate is based on a project that would see a ten year life of mine, producing on average 110,000 ounces of gold at a grade of 1.25 g/t. From a cost perspective, life of mine cash costs are projected as being $1,185 an ounce, while all-in sustaining costs are pegged at $1,225 per ounce.

Mine construction capital, including all pre-production facilities, are estimated at $200 million, with a further $33.9 million to be spent on pre-stripping. Total capital costs come in at $292.4 million, including sustaining capital and expected reclamation costs.

READ: i-80 Gold Outlines $155 Million After-Tax NPV For Granite Creek Underground In PEA

“This project on its own could be a company maker and it’s only one of five projects within the i-80 Gold portfolio. It’s a key component to growing our production profile towards mid-tier status, and our team is working vigorously to permit and move this project forward,” commented Richard Young, CEO of i-80 Gold.

The open pit project is estimated to have indicated gold resources of 1.44 million ounces at a grade of 1.18 g/t, alongside inferred resources of 0.08 million ounces at 1.09 g/t.

i-80 Gold last traded at $1.09 on the TSX.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.