Yesterday, IAMGOLD Corp (TSX: IMG) released their preliminary operating results for the fourth quarter and year-end, while also providing guidance for 2021. Gold production came in at 653,000 ounces, while gold sales of 646,000 ounces were filed for the year. Total costs are expected to be between $980 – $1,010 per ounce, and all-in sustaining costs are between $1,240 – $1,270.

For 2021, IAMGOLD expects total production to be between 630,000 – 700,000 with an all-in sustaining cost between $1,230 – $1,280 per ounce.

IAMGOLD currently has ten analysts covering the company with a weighted 12-month price target of C$6.52. This is down from the average before the results, which was C$6.90. One analyst has a strong buy, while two analysts have buy ratings. The majority, six analysts, have hold ratings, and one analyst has a sell rating.

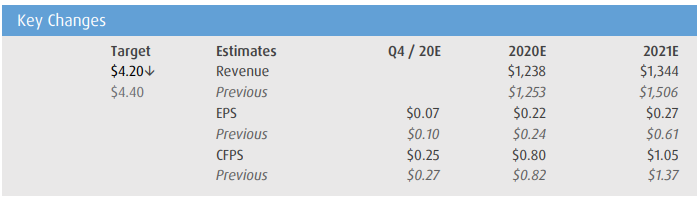

Following the results, a number of analysts cut their price targets, including:

- Credit Suisse cuts target price to $4 from $4.25

- Scotiabank cuts target price to $4 from $4.25

- BMO cuts target price to $4.20 from $4.40

BMO Capital Markets metals and mining analyst Jackie Przybylowski calls these results and guidance a small negative, writing “Production and Guidance Modestly Disappointing, Growth Options Intact.”

Fourth quarter numbers came short of the consensus expectations across all of IAMGOLD’s producing mines. Also, 2021 guidance was below what BMO was forecasting. Jackie comments, “On the positive, all-in sustaining costs are consistent with expectations. The company continues to move forward with growth projects, including spending on both Côté and Boto as well as exploration across both greenfield and brownfield targets.”

IAMGOLD’s 169,000 ounces of gold production was below BMO’s 170,000 forecast. Przybylowski says that this miss was primarily due to underperformance at Essakane and Rosebel, while Westwood performed slightly better than expected.

Onto the 2021 guidance, BMO’s production estimate is 713,000 ounces while the consensus was 807,000 ounces. The underperformance is expected to primarily be from shortfalls at Essakane, Rosebel, and Westwood.

Przybylowski is optimistic on the news that 2021 guidance includes production at Westwood, as the company had previously withdrawn its targets due to a November 4th seismic event. She writes, “We note that the guidance is now significantly lower than output previously envisioned (45-65koz, from 100-120koz in January 2020). We assume that operations continue to be affected in H1/21; production is weighted to H2.”

Below you can see the key changes in BMO’s estimates for IAMGOLD’s 2020/2021 results.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.