Last week, IAMGOLD Corp (TSX: IMG) reported its third quarter financial results. They reported $105.1 million in operating cash flows, $80 million in free cash flow, and production of 159,000 gold ounces. The company also announced that they are lowering their 2020 production estimates, raised 2020 cost guidance, and entirely withdrew from their 2021 guidance due to the challenges that arose at Westwood.

First, we look at what BMO had to say on IAMGOLD’s results. Jackie Przybylowski, BMO’s mining analyst, downgraded their 12-month price target to C$5.50 from C$6.00 and reiterated her market perform rating on the company.

She headlines “First Blush – Shaken Up by Seismic Activity,” while saying that the bottom line is negative. The main reason for the price target downgrades comes as “the impact of seismic activity on Westwood as reported on November 2, which we had previously not reflected in our estimates.”

Przybylowski says that the results were better than expected, partly driven by stronger than expected gold production and even better sales volume. Sadly, the strong results are being overshadowed by Westwood’s issues. She says that BMO has modeled that the mine will be closed for 20 days in the fourth quarter. Because of this, their estimates for 2020 full year production at Westwood have been lowered to be closer to 70-80 thousand ounces of gold production. Previously the estimate was 85-100 thousand ounces.

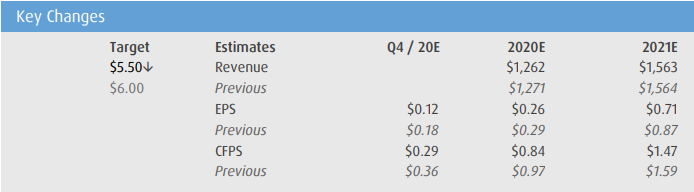

Below you can see BMO’s revised estimates for both 2020 and 2021.

Onto Canaccord’s note where they reiterated their C$6.50 price target and hold rating. Carey Macrury headlines, “Q3/20 first look: more headwinds from Westwood.”

IAMGOLD reported an adjusted EPS of $0.11 above the estimate of C$0.09, which MacRury comments on, stating, “we attribute the EPS beat largely to lower taxes and lower exploration expense.” He also calculates that third quarter adjusted EBITDA is $137 million, 2 million below their $139 million estimates. The miss is based mainly on higher cash costs.

IAMGOLD reported production of 159,000 ounces, which is in-line with Canaccord 158,000 ounce estimate. The total cash cost of $1,006/ounce was roughly 7% higher than their $943/ounce estimate and up ~8% quarter over quarter. This is mainly attributable to Westwood and Rosebel, where cash costs rose by 30% and 10% quarter over quarter, respectively.

MacRury says that IAMGOLD has a “strong liquidity position,” stating that IAMGOLD has a net cash position and has $500 million in a credit facility ready to be used.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.