On January 12th, IAMGOLD Corp (TSX: IMG) announced its preliminary 2021 operational results and 2022 guidance. IAMGOLD reported production of 601,000 ounces, reaching the high end of their 565,000 to 605,000 ounce guidance. The company produced 153,000 ounces in the fourth quarter.

For the 2022 guidance, IAMGOLD says that they will produce between 570,000 to 640,000 ounces with a cash cost between $1,100 and $1,150. The all-in sustaining cost is estimated to come in between $1,650 and $1,690.

IAMGOLD currently has 10 analysts covering the stock with an average 12-month price target of C$3.98, or a 10.5% upside to the current stock price. Out of the 10 analysts, 2 have buy ratings, 7 have holds and 1 analyst has a sell rating on IAMGOld. The street high sits at C$5 or a 39% upside to the current stock price. While the lowest price target comes in at C$3.13.

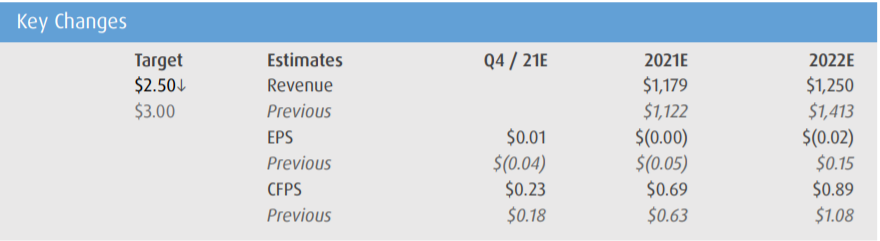

BMO Capital Markets reiterated their market perform rating while lowering their 12-month price target on IAMGOLD from C$3.00 to C$2.50, saying “Caution and Opportunity.”

For the results, it seems like they came slightly better than their estimates. Production of 601,000 ounces was better than their 583,000 ounce estimate, while cash and all-in sustaining costs came in the same range as BMO’s estimates.

For the 2022 guidance, BMO calls it disappointing. Mainly because of the company’s Rosebel/Saramacca production guidance of 155,000 to 180,000 ounces, which they had previously estimated at 317,000 ounces. This was the same for Westwood, where the company has guided for 55,000 to 75,000 ounces and BMO had 110,000 ounces as their estimates.

Below you can see BMO’s updated fourth quarter, full-year 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.