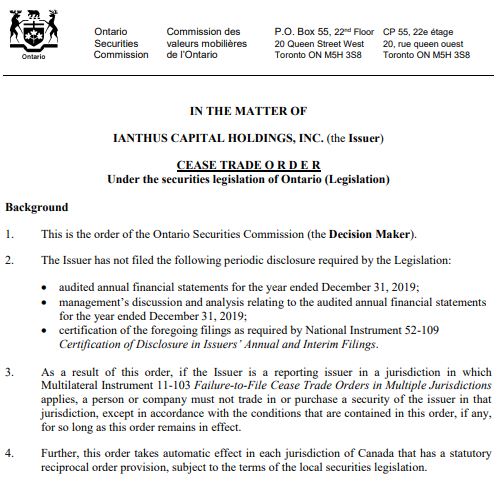

The inevitable has finally happened. This evening, iAnthus Capital Holdings (CSE: IAN) saw trading in its securities halted on the Canadian Securities Exchange via a cease trade order as a result of the firm failing to file its latest financial statements within the applicable timeframe. This failure is despite an extension granted by the Ontario Securities Commission due to the negative impact COVID-19 has had on capital markets.

The failure to file by the deadline is particularly comical for that of iAnthus, even if its investors don’t feel the same. The company initially announced on March 9 that the firm would file financials on April 6, 2020 after the close of market. However, when that date arrived, the company elected to note file.

Instead, they issued a press release identifying that financials would be delayed. Further, the company announced that they had defaulted on both senior secured and unsecured convertible debentures due to failing to make interest payments on March 31, 2020.

The decision to delay financials was so that the company could “incorporate subsequent event disclosures as they relate to the Company’s financial decision.”

As seen above, there is no mention of financials not being complete per se, but rather the company wanted to provide further disclosures as a result of the default of payment. With this in mind, it’s questionable why the company was not able to release financials within the two months since the initially scheduled release. Given that the company had originally scheduled to release the data early, its suspect that the financials were never actually filed due to “being incomplete.”

Now, the equity as a whole has been halted as the company continues to push through a strategic review of operations which as of yet has yielded little for investors. Potential arrangements on the table include a possible management buyout as we previously reported among other items.

iAnthus Capital last traded at $0.30 on the CSE, and now remains halted indefinitely until such time that the company files its year end financial results for FY2019.

For what its worth, the company recently stated the end of June as the current timeline for the release of financials, although they’ve already failed to meet numerous previous timeline estimates.

Information for this briefing was found via Sedar and iAnthus Capital Holdings Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.