As the White House proudly pats itself on the back as its sanction list against Russia grows exponentially by the day, the reality is, no one in Washington can think two moves ahead, let alone comprehend the grave implications of shutting Moscow out from the world’s reserve currency.

While the US runs out of creative ways to sanction the Russian economy, Moscow’s forex reserves are left sitting in limbo, forcing to country to devise creative ways of circumventing crippling restrictions. One of those clever ways is to force energy-dependent states to pay for Russian natural gas shipments with rubles instead of euros or US dollars. “If unfriendly countries do not pay in rubles starting from April 1, we will consider this a default on gas contracts, in which case the existing contracts will be scrapped,” said Russian President Vladimir Putin.

The deadline has left the EU in a disguised state of frantic: give in to Moscow’s demands and essentially make the West’s sanctions on Russian foreign currency reserves worthless, or join the US against itself and wait years for sleepy Joe Biden to reroute LNG exports. But, at the heart of the situation— and probably the most overlooked— is the US dollar’s deteriorating global dominance, as sanctions against Russia force countries to conduct transactions in alternative currencies.

US dollar is losing its trust as reserve currency: Vladimir Putin https://t.co/97xjegNd1j #Ukraine #UkraineRussiaWar #dollars

— Sir Buttinstein (@cryptobuttboy) March 30, 2022

“The dollar would remain the major global currency even in that landscape but fragmentation at a smaller level is certainly quite possible,” warned IMF deputy managing director Gita Gopinath as cited by the Financial Times. “We are already seeing that with some countries renegotiating the currency in which they get paid for trade.” Indeed, Russia and India are in the midst of devising a ruble-rupee payment mechanism to evade the US dollar.

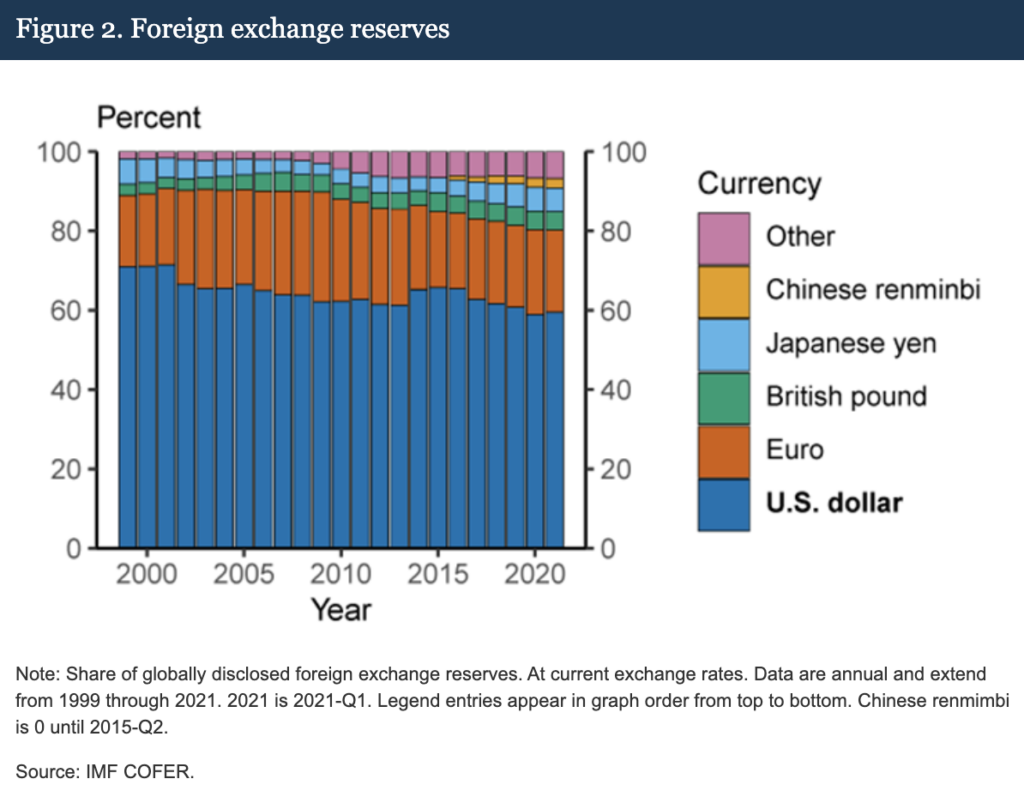

“Countries tend to accumulate reserves in the currencies with which they trade with the rest of the world, and in which they borrow from the rest of the world, so you might see some slow-moving trends towards other currencies playing a bigger role [in reserve assets],” she explained, adding that the dollar’s share of international reserves has slumped from 70% to 60% since 2000 amid an increased demand for other trading currencies.

For years, Russia prioritized slashing its dependence on the US dollar, accelerating the movement following the first round of western sanctions in response to the annexation of Crimea in 2014. Washington’s newest round of sanctions in response to Russia’s military operation in Ukraine are also sparking an accelerating movement towards digital finance, such as cryptocurrencies and stablecoins. “All of these will get even greater attention following the recent episodes, which draws us to the question of international regulation,” said Gopinath. “There is a gap to be filled there.”

Information for this briefing was found via the Financial Times and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.