Imperial Helium (TSXV: IHC) is the latest issuer to hit the TSX Venture Exchange. The company is set to list its common shares under the symbol “IHC” effective this morning.

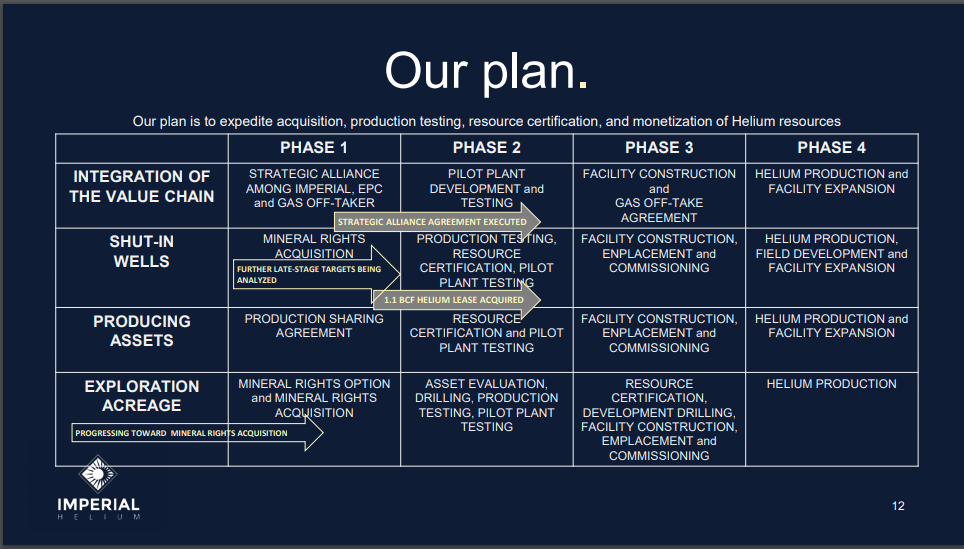

Focused on the growing helium space, the firm is a junior explorer with eyes on conducting its first production tests and well drilling in the second quarter of 2021. From here, the firm intends to spend the funds required to construct and evaluate a pilot plant, which is to be scaled up and commissioned later this year as per the firms latest investor presentation.

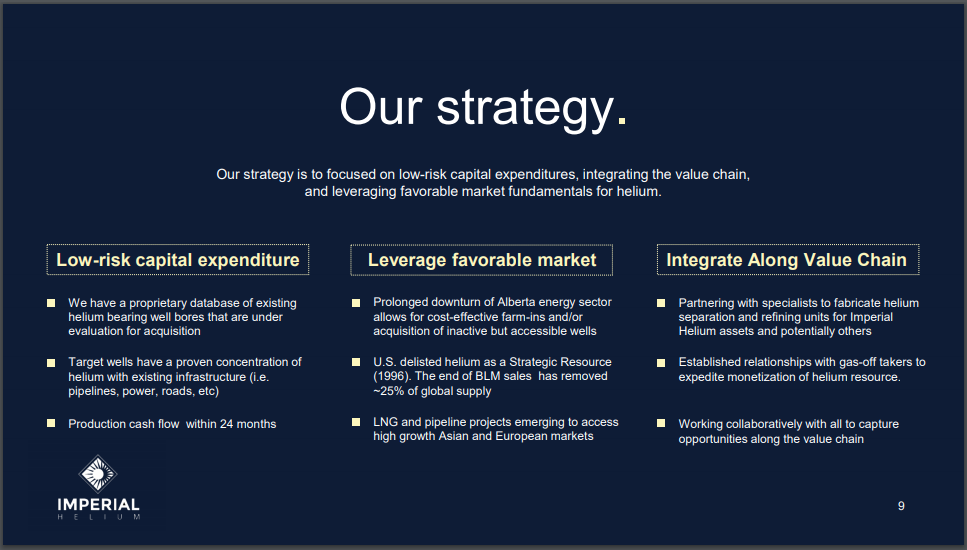

Based in Alberta, the company has been operating under the strategy of acquiring low-value natural gas assets throughout Alberta and British Columbia, from which it can exploit high-value helium content. The firm is currently focused on the Peace River Arch, which has shown to have an abundance of rich helium while featuring favourable source, reservoir and seal, as well as with Sweetgrass Arch which has proven helium production.

By targeting low-value natural gas assets, the company is able to target wells with proven concentrations of helium that also content existing infrastructure such as power, roads, and most notably, pipelines. The result is that the company can aim to be in a cash flow position within a relatively short amount of time.

The company deems its founding asset to be a historic discovery in Steveville, Southern Alberta, which contained overlooked helium. The property contains many re-enterable wellbores across a 24,500 hectare property, that contains 0.63% helium. The company currently estimates 1.1 BCF in recoverable helium from this single asset.

In terms of its operational plan, the company appears to be on the cusp of phase 2, with the aforementioned pilot plant set to be constructed in the current quarter at a cost of $0.15 million following a work program at Steveville for production testing and resource certification.

In terms of peers, the company is currently estimated to have an enterprise valuation of just $7.29 million, as compared to other publicly listed peers that contain a valuation in the range of $51.4 million to $207.5 million, with many peers still focused on exploration only and as a result no offtake arrangements in place.

In terms of share structure, the company has a total of 85.5 million common shares issued and outstanding, of which 20.6 million are currently subject to escrow restrictions or voluntary pooling restrictions. Approximately 13.9 million of such shares are subject to these voluntary restrictions, and are to be released six months after the listing date.

Imperial Helium is currently set to open the market at a price of $0.50 per share.

FULL DISCLOSURE: Imperial Helium is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Imperial Helium on The Deep Dive, with The Deep Dive having full editorial control. Additionally, the author personally holds shares of the company. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.